Hearsay Systems' 2024 Financial Services Social Selling Content Study Measures Impact of 13 Million Social Media Posts

Hearsay Systems' 2024 Financial Services Social Selling Content Study Measures Impact of 13 Million Social Media Posts

Over the last four years, video content published increased by 287%, but text-only posts still see the highest level of engagement

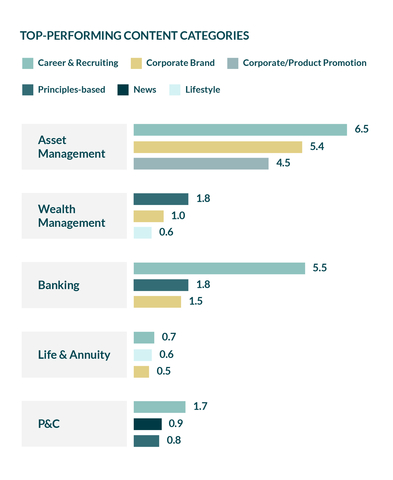

SAN FRANCISCO--(BUSINESS WIRE)--Hearsay Systems, the trusted global leader in digital client engagement for the financial services industry, today announced the findings of its 2024 Social Selling Content Study. Now in its seventh year, Hearsay’s 2024 Financial Services Social Selling Content Study aggregates data from over 100 leading global financial services firms—including Asset Management, Wealth Management, Property & Casualty insurance, Life & Annuities, and Banking—and their cumulative 260,000 agents and advisors who used the Hearsay platform during the calendar year 2023.

Our Social Selling Content Study is the most comprehensive of its kind, telling a story of what works best to drive engagement—and business—across financial services, both as a whole and by sector. —Leslie Leach, CMO, Hearsay Systems

Share

This year’s study analyzed more than 13 million published social media posts, which garnered more than 21 million engagements across Facebook, LinkedIn, X (formerly Twitter), and Instagram. This data was extracted from the Hearsay Systems platform to uncover insights into the behaviors of corporate social media program administrators, field publishers, and consumers.

“Our Social Selling Content Study is the most comprehensive of its kind, telling a story of what works best to drive engagement—and business—across financial services, both as a whole and by sector,” said Leslie Leach, Chief Marketing and Strategy Officer of Hearsay Systems. “Target audiences are consuming a high volume of financial content across more channels than ever before, yet engagement dropped this year. Our survey points out areas of weakness and opportunity so that firms can fine-tune their strategy and tactics to make the most of their social programs.”

2024 Social Selling Content Study Key Findings

- The number of engagements is down: The data shows that individuals are consuming more content across channels overall, but they’re opting to engage with it less often than last year.

- Instagram generated the most engagement: Instagram performed 3x better than Facebook and 14x better than X—but was also the least utilized social platform (again) this year.

- Original content generated 10x better engagement than unmodified content: Its performance is also remarkably consistent month-to-month. However, only 4.4% of all published content in 2023 was original.

- Firms make the jump to video: From 2019 through 2023, firms increased the amount of video content published by 287%. Still, text-only posts saw the greatest level of engagement.

Where Financial Services Firms Should Focus Their Social Efforts

Based on survey results, Instagram consistently generates the strongest engagement for banks, wealth managers, asset managers, and insurance companies—but is by far the least utilized platform for a multitude of reasons. Therefore, Instagram remains a missed opportunity for many firms.

LinkedIn can be an excellent network for social selling because it requires less 'creative overhead.' Financial services professionals can share every type of content without limitation, engagement is generally fairly strong, and since users don’t have to create visual assets for posts, they can lean into high-engagement, text-only posts. Asset Management professionals, in particular, have excelled on LinkedIn by sharing trusted, hard-hitting analysis with followers.

When it comes to Facebook, firms with already active followings can succeed by focusing there. Asset and Wealth Management firms lead the way here, enabling their wholesalers and financial advisors to build a strong personal brand.

To see all of the results, including specific line-of-business findings, download the 2024 Financial Services Social Selling Content Study or register for our webinar on May 15 at 11 am PT/2 pm ET.

Find out how Hearsay supports financial services organizations with their social programs by visiting www.hearsaysystems.com.

About Hearsay

As the trusted global leader in digital client engagement for financial services, Hearsay Systems empowers over 260,000 advisors and agents to proactively guide and capture the last mile of digital communications in a compliant manner. The world’s leading financial firms—including BlackRock, Charles Schwab, and New York Life—rely on Hearsay’s compliance-driven platform to scale their reach, optimize sales engagements, grow their business, and deliver exceptional client service. Hearsay is headquartered in San Francisco, with globally distributed teams in North America, Europe, and Asia.

Connect on Facebook, X, LinkedIn, and the Hearsay blog.

Contacts

Carmen Mantalas

carmen@gmkcommunications.com