Strategy Analytics: Ring, Nest, and Arlo Remain Among the Leaders in the Smart Home Camera Market

Strategy Analytics: Ring, Nest, and Arlo Remain Among the Leaders in the Smart Home Camera Market

Ring, Nest, and Arlo are the Catalysts Moving the Market towards Software

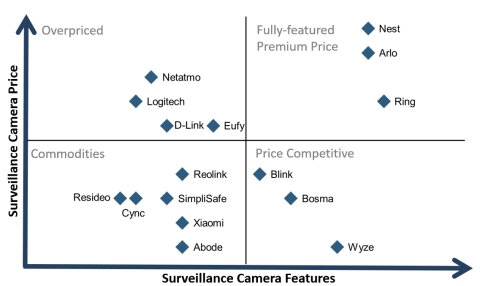

BOSTON--(BUSINESS WIRE)--Some of the largest smart home surveillance camera brands – Arlo, Blink, Nest, Ring, and Wyze – remain in control of the surveillance camera market, though a sea change is imminent, according to the latest research published in Strategy Analytics’ Smart Home Camera Market Analysis and Forecast - October 2021. As differentiators other than the lowest camera selling price begin to fade for most brands it is becoming clear that device-only business models will become unsustainable. The hardware-first business model that has spurred tremendous growth in this smart home device segment for brands such as Wyze, Xiaomi, Reolink, and Eufy, as well as dozens of Chinese companies over the last five years is showing signs of winding down. Companies already well down the path towards software, such as Amazon (Blink and Ring), Arlo, and Google (Nest), will further entrench themselves at the top of the market, as well as enjoy a head start on earning them new customers and protecting their installed bases. Cameras from brands that either cannot or choose not to enhance their software offerings will be viewed as commodities, at best relegating these brands to the sidelines, at worst knocking them out of the camera market altogether.

“In a few years or less, the leading consumer smart home surveillance camera brands will look more like software developers than device companies,” noted Jack Narcotta, Principal Industry Analyst, Smart Home Strategies. “A smart home business model built solely on devices is not sustainable as eventually cameras, and many other smart home devices, become commodities. With surveillance cameras, consumers evaluate a company’s offerings on how well they fit into how those consumers define ‘convenience’, and how easily cameras can be integrated into their daily routines. Consumers are more likely to consider how and why they might use a camera versus what features it has, and leading brands such as Arlo, Blink, Nest, and Ring have taken big steps forward to create features such as AI-powered video/image analytics, package detection, and trainable facial recognition that consumers find valuable.”

Bill Ablondi, Director, Smart Home Strategies, added, “Strategy Analytics’ research into the consumer smart home surveillance camera market shows specifications, such as 1080p or greater video resolution, advanced night vision capabilities, and integration with digital assistant ecosystems are still important to consumers, though to a much lesser degree than in the past. Competitors in the smart home camera arena know that leadership in this market will soon be based on software and services more advanced than simply enabling cloud storage or remote viewing. The challenge ahead for camera companies will be determining how to successfully transition from selling camera hardware to selling security, monitoring, and safety features.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Source: Strategy Analytics, Inc.

#SA_IntelligentHome

Contacts

Jack Narcotta, +1 617 614 0798, jnarcotta@strategyanalytics.com

Bill Ablondi, +1 617 614 0744, wablondi@strategyanalytics.com