Omdia: US PC Shipments See 1% Annual Drop for a Second Consecutive Quarter

Omdia: US PC Shipments See 1% Annual Drop for a Second Consecutive Quarter

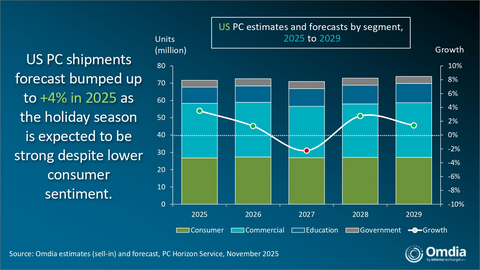

LONDON--(BUSINESS WIRE)--The latest research from Omdia shows that PC shipments (excluding tablets) to the United States fell 1% year-on-year in Q3 2025 to 17.7 million units, marking the second consecutive quarter of decline. Despite noticeable downward macroeconomic pressures, the consumer segment grew 8% in the quarter to 7.6 million units. The commercial segment was broadly stable, with shipments declining by just under 1%, while the education and government segments together saw a sharper 23% drop in Q3. Even with two consecutive quarters of overall decline, Omdia’s outlook for the holiday season remains positive and the US PC market is still expected to grow in 2025, with full-year shipments forecast to increase by 4%.

“The education and government segments have both moved into a pattern of continual decline after a strong start to the year in Q1,” said Greg Davis, Analyst at Omdia.

Share

“The education and government segments have both moved into a pattern of continual decline after a strong start to the year in Q1,” said Greg Davis, Analyst at Omdia. “There are a few drivers behind this. First, government funding for both schools and government agencies has been reduced. The United States has seen record layoffs in these areas in 2025, so it is not surprising that technology spending is also falling. Second, and less immediately visible, is the unwinding of elevated inventory levels that were built up earlier in the year to soften the impact of tariffs.” A recent Omdia quick poll indicates that commercial channel partners across all global regions now primarily expect inventory levels to decrease in Q4 2025.

Davis continued, “As these excess inventories are cleared, creating room for new shipments, we expect the rate of decline to begin to moderate, especially in the commercial segment where the contraction has been less severe. The ongoing transition from Windows 10 to Windows 11 should provide additional support to commercial demand and help this segment return to growth in Q4.

“The consumer segment has been a bright star for the US PC market in 2025, with growth recorded in each of the first three quarters,” Davis added. “Q3 delivered the strongest performance so far, with consumer shipments rising 8% year-on-year. However, recent reports show a sharp deterioration in US consumer sentiment. Tariffs and inflation continue to put upward pressure on prices, interest rates remain elevated, and unemployment, credit card debt, and loan delinquencies are all increasing.”

“In light of these macroeconomic trends, Omdia forecasts that the consumer PC segment will see an annual decline in Q4 2025. Even so, 2025 as a whole is still projected to be a growth year for the US PC market, and we expect it to finish the year in a stronger position than in the previous two quarters,” Davis concluded.

US desktop and notebook forecast Omdia PC Forecast: 2025 to 2027 |

|

|||||

Segment |

2025

|

2026

|

2027

|

2025

|

2026

|

2027

|

Consumer |

26,809 |

27,350 |

26,879 |

1.9% |

2.0% |

-1.7% |

Commercial |

31,545 |

31,570 |

29,771 |

7.1% |

0.1% |

-5.7% |

Government |

3,946 |

4,145 |

4,103 |

2.9% |

5.1% |

-1.0% |

Education |

9,362 |

9,530 |

10,217 |

-2.4% |

1.8% |

7.2% |

Total |

71,662 |

72,596 |

70,970 |

3.5% |

1.3% |

-2.2% |

|

|

|

|

|||

Note: Unit shipment in thousands. Totals may not add up due to rounding.

Source: Omdia PC Horizon Service (sell-in shipments), November 2025 |

|

|||||

US desktop and notebook shipments (market share and annual growth) Omdia PC Market Pulse: Q3 2025 |

|||||

Vendor |

Q3 2025

|

Q3 2025

|

Q3 2024

|

Q3 2024

|

Annual

|

HP |

4,326 |

24.4% |

4,336 |

24.2% |

-0.2% |

Dell |

3,990 |

22.5% |

3,996 |

22.3% |

-0.2% |

Lenovo |

3,205 |

18.1% |

3,089 |

17.2% |

3.7% |

Apple |

3,175 |

17.9% |

2,825 |

15.8% |

12.4% |

Acer |

820 |

4.6% |

782 |

4.4% |

4.9% |

Others |

2,226 |

12.5% |

2,885 |

16.1% |

-22.9% |

Total |

17,742 |

100.0% |

17,913 |

100.0% |

-1.0% |

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding.

Source: Omdia PC Horizon Service (sell-in shipments), November 2025 |

|||||

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan – fasiha.khan@omdia.com

Eric Thoo – eric.thoo@omdia.com