Omdia Forecasts Flat TV Shipments in 2025, but Mini LED Poised for Explosive Growth at 82.9%

Omdia Forecasts Flat TV Shipments in 2025, but Mini LED Poised for Explosive Growth at 82.9%

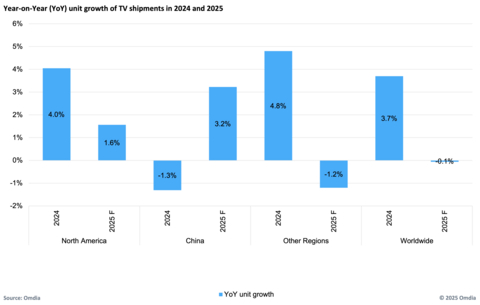

LONDON--(BUSINESS WIRE)--Omdia’s latest 1Q25 TV Sets Forecast reveals TV shipments are expected to remain nearly flat in 2025, totaling 208.7 million units (-0.1% year-on-year). Despite overall modest demand, Mini LED, and extra-large screen sizes are set to grow quickly, driven by retailers and brands focusing on premium features.

Omdia’s latest TV sets analysis highlights two key regions expected to buck the global trend and deliver shipment growth in 2025:

- North America – forecasted to hit 49.9 million units (+1.6% year-on-year) thanks to competitive pricing strategies from channel brands, ample inventory, and a diverse range of technologies (LCD, OLED) and features (QD, Mini LED, smart OS).

- China – forecasted to reach 38.3 million units (+3.2% year-on-year) boosted significantly by ongoing consumer electronics subsidies and rising demand for larger screens.

“Although overall shipment growth remains flat, key technologies and larger screen sizes will see significantly higher growth rates. These differentiators will be crucial for both emerging Chinese brands and established players aiming to capture and defend market share,” explains Hisakazu Torii, Chief Analyst, TV Sets, Omdia.

Top 5 positive YoY unit growth of TV technology, size, and features for 2025:

- Mini LED: 82.9%

- 90-inch +: 57.4%

- QD LCD: 36.0%

- 80 – 89-inch: 26.5%

- 75 – 79-inch: 12.3%

Despite headwinds from US tariffs, North American shipments are expected to grow due to sufficient inventory built up since last year and aggressive pricing strategies from Chinese and channel brands. Overall shipments in North America will reach 49.9 million units in 2025, a 1.6% year-on-year unit growth. Consumers in this region benefit from a broad range of screen technologies, features, and brands offered at competitive prices. This diversity ensures a stable, accessible market environment, though it could become vulnerable if inventory tightens or prices rise significantly during the year.

In China, shipments will reach 38.3 million units in 2025, a YoY growth rate of 3.2%, thanks to consumer electronics (CE) subsidies launched in August last year. While demand for larger screens (75-inch and above) continues to surge at 24.2% YoY, shipments for smaller screens (65-inch and below) are expected to decline 6.0% YoY.

Strategic demand pull-in to drive inventory adjustments in Latin America

TV shipments in Latin America experienced significant growth starting 4Q24 (15.2% YoY) and continuing into 1Q25 (9.2% YoY), prior to the announcement of US tariffs. The region had already enjoyed positive shipment momentum in the previous two years (2023-2024), supported by favorable currencies, stable inflation rates, strong economies, and lower unemployment rates.

“The recent spike in shipments, however, reflects growing concerns regarding potential negative impact of US tariffs. Retailers and brands have strategically accelerated shipments into the Latin America aiming to secure inventory earlier and at lower cost, particularly with the FIFA World Cup 2026 approaching next year,” said Torii.

In the other regions (excluding North America, China and Latin America), shipments are expected to decline by -1.2% YoY in 2025. These markets lack strong promotional factors (such as major sporting events), face less aggressive pricing strategies, and continue to deal with inflation and currency volatility, and increased costs.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Media Contact: Fasiha Khan

fasiha.khan@omdia.com