Omdia: Display Panel Makers Forecast 3- Point Drop in 2Q25 Fab Utilization Amid Weak LCD TV Panel Demand

Omdia: Display Panel Makers Forecast 3- Point Drop in 2Q25 Fab Utilization Amid Weak LCD TV Panel Demand

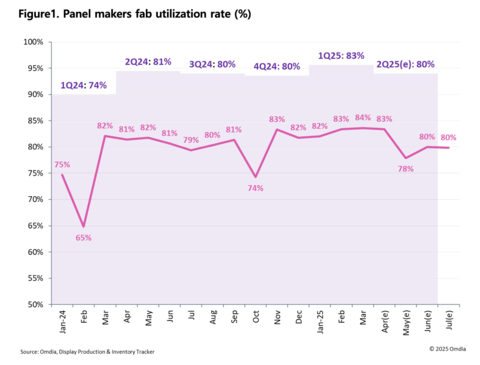

LONDON--(BUSINESS WIRE)--The latest analysis from Omdia reveals that display panel makers are forecasting a 3-percentage point decline in fab utilization rates in Q2 2025, following a period of stability that began mid-Q4 2024. This planned reduction is driven by anticipated cuts in LCD TV panel orders from major TV brands. Chinese manufacturers are expected to scale back orders starting in May, after building inventory for the 618 mid-year sales promotion, while Korean TV brands are also expected to reduce procurement once they reach sufficient stock levels.

Top Chinese panel makers BOE, China Star, and HKC Display, which collectively account for 60% of global display manufacturing capacity (by area), are projected to lower their monthly average fab utilization by 6-9 percentage points in May. This drop is also influenced by extended factory holidays around China’s Labor Day period according to Omdia’s latest Display production & Inventory Tracker – April 2025.

It is unusual for panel makers' 2Q fab utilization rate to be lower than in 1Q as set makers typically increase panel purchases to prepare for end-market demands in the second half of the year. In both 2023 and 2024, panel makers' quarterly fab utilization in 2Q was 12 percentage points and 7 percentage points higher than in 1Q, respectively.

In 2024, Chinese panel makers limited LCD TV panel production by taking extra holidays around the Lunar New Year to prevent panel price reductions. However, they did not adopt the same strategy in 2025. Instead, Chinese TV makers increased demand for LCD TV panels in an effort to capture a larger market share, driven by the Chinese government’s “swap old for new” subsidy program.

Additionally, March 2025 saw a surge in LCD TV panel orders from TV makers with factories in Mexico, following the temporary suspension of US import tariffs on Mexican goods, further boosting 1Q 2025 fab utilization rates.

"The uncertainty surrounding end market demand in 2H2025 has led panel makers to adopt a more conservative approach to panel production volume in 2Q25,” said Alex Kang, Principal Analyst of Omdia. “The impact of the Chinese government's subsidy program is expected to diminish in the second half of the year, and set makers are unlikely to aggressively pursue year-end promotions in US market due to ongoing tariff issues.

“Panel makers are prioritizing panel price protection and are expected to maintain a ‘production-to-order’ strategy carefully managing inventory levels in 2H2025. As a result, panel makers’ 2H 2025 fab utilization is not expected to see a significant increase,” concluded Kang.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Media Contact

Fasiha Khan: fasiha.khan@omdia.com