dunnhumby RPI Ranks H-E-B as Top U.S. Grocer, Hardened Consumers Turn Away from Retailers Not Offering Savings

dunnhumby RPI Ranks H-E-B as Top U.S. Grocer, Hardened Consumers Turn Away from Retailers Not Offering Savings

A new price-conscious consumer mindset solidified in 2024, as customers pay closer attention to grocery prices than ever

CINCINNATI--(BUSINESS WIRE)--dunnhumby, the global leader in customer data science, today released the eighth annual dunnhumby Retailer Preference Index (RPI), a comprehensive, nationwide study that examines the approximately $1 trillion U.S. grocery market. The annual study, that includes a survey of 11,000 U.S. consumers, found that “saving customers money” – through price, promotions, and rewards – is the most important predictor for retailers to have stronger, long-term market success in the United States. This pillar has been increasing in importance over the last eight years, with 38% of a retailer’s long-term success now based on their price, promotions, and rewards proposition, the highest percentage in the history of the RPI.

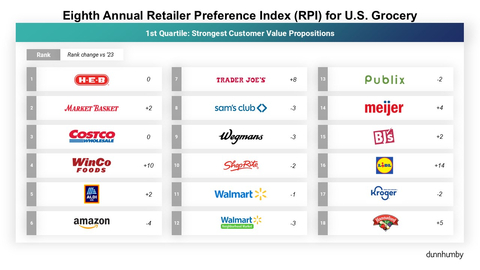

The dunnhumby RPI also found that H-E-B is the top U.S. Grocery Retailer for the fourth time in eight years. The Texas-based regional supermarket format has dominated the RPI’s top spot three of the last four years, thanks to its long-term customer value proposition. Market Basket (2), Costco (3), WinCo Foods (4), and Aldi (5) round out the top five retailers.

“Since releasing the first U.S. Grocery RPI eight years ago, retailers and shoppers have weathered Covid, supply chain disruptions, agricultural shortages due to climate impacts, and a prolonged period of high food inflation that have reshaped shopping behavior and how Americans perceive the grocery retail environment,” said Matt O’Grady, dunnhumby's President of the Americas. “Clients across the grocery retail sector understand that market success is dependent upon saving shoppers money and implementing innovative pricing technologies to maintain their customer base.”

Key findings from the study:

- Three of the top four retailers (H-E-B, Market Basket, and WinCo) are regional supermarkets, with the 15 additional retailers in the first quartile made up of a cross-section of non-traditional, national banners in club, discount, online, and superstore formats.

- Retailers with stronger customer value propositions – indicated by higher RPI rankings – grew up to 2.5 times faster over five years than retailers with lower RPI rankings.

- The battle for first place that raged from 2017-2022, has now turned into a battle for second. In the last three years, H-E-B has separated itself from the rest of the top five due to their superior ability to deliver a combination of better savings, quality, shopping experience and assortment.

- Kroger and Albertson’s banners suffered ranking declines, with particularly steep declines in states where there were ongoing, high-profile court cases regarding their proposed merger. Both King Soopers (Kroger banner) and Albertson’s declined in many areas of the value proposition, which may be a sign of the negative halo cast by the merger news headlines.

- Amazon, the top U.S. Grocery Retailer in 2021 and 2022, fell out of the top three for the first time in eight years, landing in the sixth spot. Part of this drop in rankings is due to the digital pillar having its first retreat in importance. Digital, the third most important pillar, fell from its high in 2023 of 18.5% to 16% in 2024.

- Lidl and Trader Joe’s made significant gains in rankings in 2024. Lidl ascended 14 spots to move up to the top quartile for the first time, taking the 17th position. Lidl saw modest improvements in a few areas: prices, digital, and operations. This, coupled with the uptick in importance of savings (their strength) and downtick in importance of quality (their weakness), explained their jump. Trader Joe’s, a former top U.S. Grocery Retailer in the RPI, stopped its slide and improved its ranking from the 15th position to the eighth position by being ahead of the market on quality while being about average at savings. Trader Joe’s, the second highest ranked retailer for quality, leads other quality-first retailers in savings perceptions.

“This year’s RPI shows that the fundamentals still apply as H-E-B has proven year over year. Any format can win,” said O’Grady. “The first step is to understand your customers and how customers perceive you. Secondly, prioritize efforts to save your customers money that is consistent with your positioning. And finally, use the RPI as a framework to help you determine where you should invest and where you should make tradeoffs.”

Methodology

The dunnhumby RPI is the only approach to ranking grocers that combines financial results with customer perception. It includes the largest 72 retailers in the industry that sell everyday food and non-food household items. The financial data used in the dunnhumby model comes from Flywheel, and the customer perception data is sourced from dunnhumby’s annual survey of more than 11,000 American grocery shoppers. The five drivers of the customer value proposition are in order: 1) Price, Promotions, and Rewards, 2) Quality, 3) Digital, 4) Operations, and 5) Speed and Convenience.

The RPI can be accessed today. Retailers included in the RPI that are interested in receiving their individual banner profiles can speak with their dunnhumby account executive or contact dunnhumby at: https://www.dunnhumby.com/us-retailer-preference-index-reports/. dunnhumby will also be attending and exhibiting at NRF 2025 in booth #6305.

About dunnhumby

dunnhumby is the global leader in Customer Data Science, empowering businesses everywhere to compete and thrive in the modern data-driven economy. We always put the Customer First. Our mission: to enable businesses to grow and reimagine themselves by becoming advocates and champions for their Customers. With deep heritage and expertise in retail – one of the world’s most competitive markets, with a deluge of multi-dimensional data – dunnhumby today enables businesses all over the world, across industries, to be Customer First.

The dunnhumby Customer Data Science Platform is our unique mix of technology, software, and consulting, enabling businesses to increase revenue and profits by delivering exceptional experiences for their Customers – in-store, offline and online. dunnhumby employs over 2,500 experts in offices throughout Europe, Asia, Africa, and the Americas working for transformative, iconic brands such as Tesco, Coca-Cola, Meijer, and Procter & Gamble.

Contacts

Theresa Smith, dunnhumby, 1 8186816456, tls@pathwaypr.com