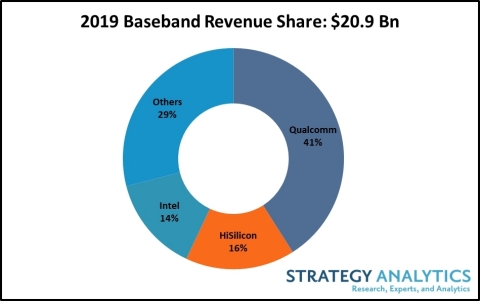

BOSTON--(BUSINESS WIRE)--The global cellular baseband processor market declined 3 percent year-over-year to reach $20.9 billion in 2019, according to Strategy Analytics Handset Component Technologies service report, “Baseband Market Share Tracker Q4 2019: 5G Basebands Capture Double-digit Revenue Share.”

According to this Strategy Analytics research Qualcomm, HiSilicon, Intel, MediaTek, and Samsung LSI captured the top-five revenue share rankings in the global cellular baseband processor market in 2019. Qualcomm led the baseband market with 41 percent revenue share in 2019 followed by HiSilicon with 16 percent and Intel with 14 percent.

- 5G baseband shipments saw a significant traction in the first year and accounted for almost 2 percent of total baseband shipments while capturing 8 percent revenue share, thanks to high average selling prices (ASPs).

- HiSilicon, Qualcomm and Samsung LSI were the key 5G baseband vendors in 2019 with significant design-wins.

- Strategy Analytics believes that 5G will be a bright spot in the COVID-19 world and will likely defy the downward trend as handset OEMs prioritize 5G over 4G for their new launches.

- 4G LTE baseband shipments declined year-over-year for the first time in 2019. Except for Intel and Unisoc, all other major baseband vendors saw their LTE shipments decline in 2019.

Sravan Kundojjala, Associate Director, commented, “The first year of 5G baseband market saw three different market leaders before Qualcomm widened its lead by late 2019. Strategy Analytics estimates that Qualcomm captured 53 percent unit share in the 5G baseband market in 2019. Qualcomm’s market-leading X50 family of 5G chips, RF front-end know-how, wide customer base and early pioneering work all contributed to its 5G baseband market leadership. Qualcomm is well situated to grab further 5G share in 2020, driven by both the upcoming iPhone 5G design-win and proliferation of mid-range Android 5G in China and elsewhere.”

According to Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies service, “MediaTek showed signs of recovery and improved its LTE baseband share through 2019. MediaTek captured multiple high volume LTE design-wins at Oppo, Vivo and Xiaomi with its new Helio P chips. Despite its missteps in 4G LTE, surprisingly MediaTek looks well prepared for 5G with Dimensity-branded 5G SoCs. Unisoc, the world’s third largest baseband vendor in terms of unit shipments, continued its recovery and registered a strong growth in its 2G and 4G baseband shipments in 2019. Unisoc is well positioned to capture long-tail 4G LTE demand as the market leaders shift their focus to 5G.”

Christopher Taylor, Director of the Strategy Analytics RF & Wireless Components service, added, “Intel saw its LTE shipments jump 74 percent in 2019, driven by Apple design-wins. Apple, which closed the acquisition of Intel’s 5G smartphone baseband business in late 2019, now joins vertical baseband vendors HiSilicon (Huawei) and Samsung LSI. Both HiSilicon and Samsung LSI performed strongly in the 5G baseband market in 2019. However, it is likely that Apple could wait for another three to four years before deploying its own 5G baseband in an iPhone. It is possible that Apple could experiment with non-iPhone 5G devices in the next two years.”

#SA_Components

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com