The Value in Machine Learning Alternative Data for Investment Managers

The Value in Machine Learning Alternative Data for Investment Managers

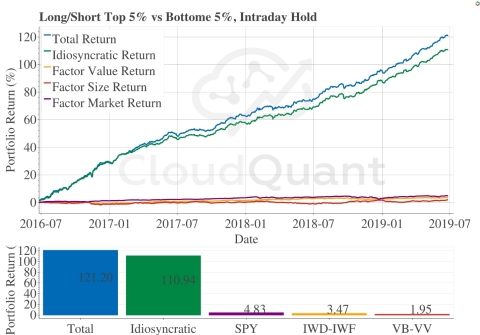

CHICAGO--(BUSINESS WIRE)--CloudQuant LLC has proven the value in the Precision Alpha Machine Learning Signals (PA Signals) alternative data set. Its detailed data science study shows a long-short portfolio outperforms the equal-weight S&P 500 ETF by an average of 37.9% per year after transaction costs. CloudQuant found that over 91.5% of the total return is pure alpha. The results of the study are significant to the 99th percent level.

Cutting-edge machine learning is transforming quantitative analysis for portfolio managers and traders. PA Identifies structural breaks and exposes investment signals that market participants are currently unable to see. The PA Signal offers a favorable risk-adjusted return that can be used to create large-scale investment algorithms.

“Backtesting on CloudQuant’s Mariner™ showed that a long top 5%-short bottom 5% quantile intraday strategy achieved overall Sharpe Ratio1 of 5.36 and a very low CAPM beta,” said Morgan Slade, Chief Executive Officer of CloudQuant.

The growing quality and quantity of Alternative Data Sets have created a dilemma for many investment managers. Profitable information is contained in new data but most investors lack the resources to onboard and then research the data. CloudQuant’s quantamental researchers have studied the PA Signals and provide a detailed white paper, and backtesting algorithm with source code (free upon qualified request) that allows any portfolio manager to replicate the research and immediately begin to reproduce the results.

“With CloudQuant investment professionals can jumpstart their research without incurring the cost of dataset ingress and curation. They are able to see the value in the data,” says Mark Temple-Raston, Ph.D. and Chief Data Scientist of Precision Alpha.

About CloudQuant

CloudQuant provides quantamental data showcasing services to alternative data providers including bespoke AI, Machine Learning, and data science services. Fundamental and quantitative investors utilize the cloud-based institutional-grade analytics technology and detailed backtests to quickly research alternative datasets in a unique “try-before-you-buy” data shopping experience.

Twitter: @CloudQuant

About Precision Alpha

Precision Alpha uses probabilistic mathematics, information theory and machine learning to expose alpha for investors. They calculate a set of exact, unbiased, equity measurements that reveal market price moves before they occur for every security on 85+ global financial exchanges. Precision Alpha’s proprietary technology leverages machine learning to generate accurate, predictive Alpha for Investment Funds, Family Offices, Traders and professional investors.

Twitter: @PrecisionAlpha

1 ASharpe Ratio is the performance of an investment by adjusting for risk. This ratio is commonly used to judge the performance of an investment strategy.

Contacts

For Media Inquiries Please Contact:

J. Tayloe Draughon, Senior Product Manager

tdraughon@CloudQuant.com

+ 1 512.439.8152