Rapyd’s 2026 State of Stablecoins: Businesses Move En Masse as Stablecoins Go Mainstream

Rapyd’s 2026 State of Stablecoins: Businesses Move En Masse as Stablecoins Go Mainstream

Rapyd’s 2026 State of Stablecoins Report shows 64% of businesses surveyed already use stablecoins or plan to within three years, with speed, easier cross-border transactions, and cost savings driving adoption

LONDON--(BUSINESS WIRE)--Rapyd, a leading global fintech company, released its 2026 State of Stablecoins Report, revealing that stablecoins have reached a tipping point and are becoming a foundational component of global commerce rather than a niche digital asset.

The report shows the market has moved decisively into active, real-world use. Today, nearly one in five businesses already consider stablecoins a mainstream financial tool. Looking ahead, a much larger majority (76%) believe stablecoins are either already mainstream or will become mainstream within the next five years.

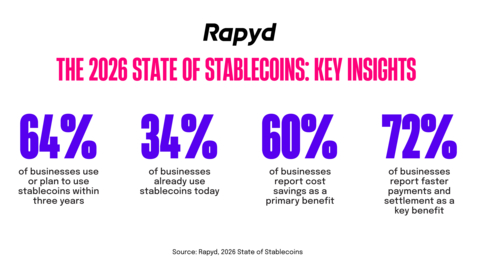

This shift in perception is translating into action: 64% of businesses surveyed either use stablecoins today or plan to adopt them within the next three years, signaling a move from crypto curiosity to institutional-grade execution.

The findings, drawing on a global survey of business decision-makers across multiple industries in APAC, the Americas, and EMEA, highlight how stablecoins are increasingly used to improve operational speed, reduce costs, and simplify cross-border payments and treasury operations.

Key findings from the State of Stablecoins Report include:

- Mainstream momentum is accelerating: Stablecoin utilization among businesses has reached 34%, with a strong adoption pipeline with 48% of organizations planning to adopt stablecoins within the next 12 months.

- Cross-border commerce is the primary use case: 72% of businesses rank faster payments and settlements as a key benefit, while 62% cite easier cross-border transactions.

- Stablecoins are delivering measurable financial impact: 60% of organizations report cost savings as a primary benefit, demonstrating that stablecoins are now a profitability driver rather than a technology experiment.

- Trust is high, but regulation remains the main concern: Over 83% of businesses rate their trust in stablecoins as moderate to high, while regulatory uncertainty remains the top barrier to adoption.

- Smaller businesses are leading the way: Companies with 51–100 employees show the highest current usage at 50%, while larger enterprises remain more cautious.

Treasury moves to the center of stablecoin adoption

The report points to a shift in how businesses approach treasury operations. Based on Rapyd’s research findings, faster settlements and cross-border payments consistently emerge as the primary drivers of stablecoin adoption, underscoring the importance of speed and efficiency in global money movement. From Rapyd’s perspective, stablecoins play a growing role in enabling funds to move more quickly across entities and geographies, helping businesses operate with greater flexibility and less friction.

Taken together, these findings highlight a broader move from experimentation toward execution in how businesses approach global payments and treasury infrastructure.

“Stablecoins have crossed a threshold where the conversation is no longer about potential, but about execution,” said Arik Shtilman, CEO and Co-Founder of Rapyd. “Our research shows businesses are using stablecoins to move money faster, lower costs, and operate more efficiently internationally. This is not about speculation. It is about building modern financial infrastructure that works at global scale.”

For CFOs and corporate treasuries, the report underscores a clear shift in perception. Stablecoins are no longer viewed as alternative assets, but as liquidity tools. Businesses are using stablecoins to accelerate payments, reduce FX and banking fees, and enable just-in-time funding across regions to free up capital.

“Treasury teams are under increasing pressure to manage liquidity in real time across multiple markets,” said Kristin Reischel, Senior Director of Solutions and Partner Marketing at Rapyd. “What we are seeing in this research is a practical shift. Stablecoins allow businesses to deploy capital globally without the friction of traditional banking structures. That flexibility is becoming essential for companies operating across borders.”

While regulatory uncertainty remains the leading concern for businesses exploring stablecoins, the report finds that trust in the technology itself is already well established. This gap between confidence and adoption highlights the importance of compliant infrastructure and operational expertise to support enterprise use at scale.

Rapyd’s 2026 State of Stablecoins Report is available now and provides a detailed analysis of adoption trends, use cases, and implications for global payments and treasury operations.

Download the full report here.

About Rapyd

Rapyd lets you build bold. Liberate global commerce with all the tools your business needs to create payment, payout and fintech experiences everywhere. From Fortune 500s to ambitious business and technology upstarts, our payments network and powerful fintech platform make it easy to pay suppliers and get paid by customers—locally or internationally.

With offices worldwide, including London, Tel Aviv, Dubai, Iceland, Amsterdam, Miami, Hong Kong and Singapore, we know what it takes to make cross-border commerce as easy as being next door. Rapyd simplifies payments so you can focus on building your business.

Get the tools to grow globally and learn about our products, solutions and partner programmes at www.rapyd.net. Follow: Blog, Insta, LinkedIn, Twitter.

Contacts

Media Contact: press@rapyd.net