Omdia: Global PC Shipments Grew 9% in 2025 but Memory and Storage Supply Issues Threaten 2026 Outlook

Omdia: Global PC Shipments Grew 9% in 2025 but Memory and Storage Supply Issues Threaten 2026 Outlook

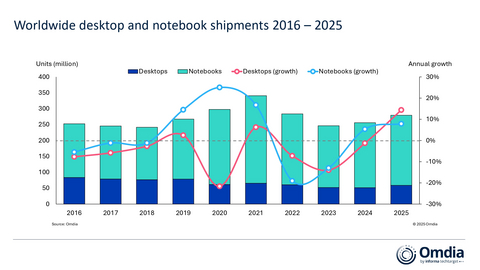

LONDON--(BUSINESS WIRE)--The latest research from Omdia reveals that total shipments of desktops, notebooks and workstations in Q4 2025 grew 10.1% to 75 million units. This brought full-year 2025 PC shipments to 279.5 million units, a 9.2% increase over 2024 volumes. Notebook (including mobile workstation) shipments reached 58.6 million units in Q4 and 220.4 million units in the full year, achieving 8% growth in 2025. Desktop (including desktop workstation) shipments in Q4 landed at 16.2 million units, bringing the total 2025 volume to 59 million units, a 14.4% increase over the previous year.

“Between Q1 to Q4 2025, mainstream PC memory and storage costs rose by 40% to 70%, resulting in cost increases being passed through to customers,” said Ben Yeh, Principal Analyst at Omdia.

Share

Although overall PC market performance in 2025 was healthy, memory and storage supply tightened, and the associated upward price pressure emerged from the middle of the year. In December 2025, PC vendors began signaling their expectations of price increases. Coupled with the inability to secure sufficient supply, this has already dampened forecasted shipment expectations for 2026. “Between Q1 to Q4 2025, mainstream PC memory and storage costs rose by 40% to 70%, resulting in cost increases being passed through to customers,” said Ben Yeh, Principal Analyst at Omdia. “Given tight 2026 supply, the industry is emphasizing high-end SKUs and leaner mid to low-tier configurations to protect margins.”

“In 2026, with device replacement demand not yet fully abated, supply-side pressures will be more pronounced and supply will not fully meet demand,” added Yeh. “Actual shipment performance will hinge on vendors’ memory and storage procurement and negotiating leverage; beyond scale, their track records and credibility with suppliers will be a decisive factor in determining their success in navigating this period of complexity.” A November 2025 Omdia poll of B2B channel partners that asked “How do you expect your PC business to perform in 2026 compared to 2025” revealed that 57% forecast growth in 2026, indicating that a healthy demand environment will provide strong opportunities for vendors that are best able to manage their supply.

Worldwide desktop and notebook shipments (market share and annual growth) Omdia PC Market Pulse: Q4 2025 |

|||||

Vendor |

Q4 2025

|

Q4 2025

|

Q4 2024

|

Q4 2024

|

Annual

|

Lenovo |

19,313 |

25.8% |

16,880 |

24.9% |

14.4% |

HP |

15,387 |

20.6% |

13,724 |

20.2% |

12.1% |

Dell |

12,468 |

16.7% |

9,898 |

14.6% |

26.0% |

Apple |

7,023 |

9.4% |

6,893 |

10.2% |

1.9% |

Asus |

5,307 |

7.1% |

4,972 |

7.3% |

6.7% |

Others |

15,285 |

20.4% |

15,526 |

22.9% |

-1.5% |

Total |

74,783 |

100.0% |

67,893 |

100.0% |

10.1% |

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|||||

Source: Omdia PC Horizon Service (sell-in shipments), January 2026 |

|

||||

Worldwide desktop and notebook shipments (market share and annual growth) Omdia PC Market Pulse: 2025 |

|||||

Vendor |

2025

|

2025

|

2024

|

2024

|

Annual

|

Lenovo |

70,851 |

25.4% |

61,841 |

24.2% |

14.6% |

HP |

57,440 |

20.6% |

52,992 |

20.7% |

8.4% |

Dell |

41,894 |

15.0% |

39,096 |

15.3% |

7.2% |

Apple |

27,674 |

9.9% |

23,779 |

9.3% |

16.4% |

Asus |

20,067 |

7.2% |

18,329 |

7.2% |

9.5% |

Others |

61,526 |

22.0% |

59,910 |

23.4% |

2.7% |

Total |

279,452 |

100.0% |

255,947 |

100.0% |

9.2% |

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|||||

Source: Omdia PC Horizon Service (sell-in shipments), January 2026 |

|

||||

Lenovo led the PC market both sequentially and for the full year, delivering double-digit growth of 14.4% in Q4 2025 and closing the year with shipments of 71 million units, up 14.6% year on year. HP ranked second, shipping 15.4 million PCs in Q4 2025 and recording growth on both a sequential and annual basis during the quarter. Dell posted its strongest quarterly performance of 2025, achieving a robust 26% year-on-year increase in Q4. Full-year shipments reached 42 million units, representing a 7% increase compared with 2024, while Dell also expanded its market share by two percentage points year on year in the quarter. Apple retained fourth place and stood out as the fastest-growing vendor for the full year. The company recorded 16.4% growth for the full year, with full-year shipments reaching 28 million units. Asus rounded out the top five in both quarterly and full-year rankings, shipping 5.3 million units in Q4 and 20 million units for the year, supported by 7% growth during the holiday quarter.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan – fasiha.khan@omdia.com