Omdia: Sovereign verticals set to spend $15 billion on low-earth orbit economy connectivity by 2030

Omdia: Sovereign verticals set to spend $15 billion on low-earth orbit economy connectivity by 2030

3.5 million broadband connections will drive 94% of LEO enterprise revenues; Transportation, Energy, Government and Defense industries among main buyers

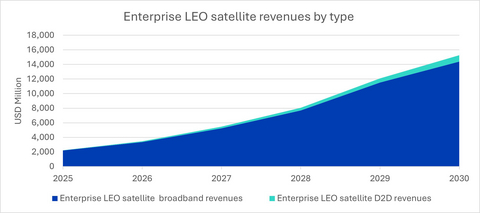

LONDON--(BUSINESS WIRE)--Enterprises with fail-safe, mission-critical connectivity needs will spend $15.3 billion on low-earth orbit (LEO) satellite connectivity by 2030, according to Omdia’s Enterprise LEO Forecast 2025-30. Broadband connectivity will account for 94% of LEO enterprise revenues, with direct-to-device (D2D) subscriptions making up the remaining 6%.

“The heartland of LEO opportunity lies among public and private enterprises with isolated operations and high-performance requirements spanning network security and data sovereignty,” said Pablo Tomasi, Principal Analyst, Future Wireless, at Omdia.

Share

“The heartland of LEO opportunity lies among public and private enterprises with isolated operations and high-performance requirements spanning network security and data sovereignty,” said Pablo Tomasi, Principal Analyst, Future Wireless, at Omdia. “Using satellite to bridge the digital divide will not pay all the bills.”

Key report findings include:

- The enterprise target market is growing: “Sovereign verticals” is Omdia’s term for enterprises with geographically vast, high-dependency networks. This includes critical industries like public safety and defense, as well as transportation and energy.

- Satellite is now a make-or-break service for telcos: Enterprises want convergent ‘anywhere’ connectivity – dependable service irrespective of technology. This is forcing telecom operators to sell on a promised service experience using multiple connectivity types.

- North America dominates: The region, led by the United States, will remain the largest enterprise satellite market through 2030, representing 37% of the market opportunity. Oceania, Eastern and Southeastern Asia, led by China, will grow from 9% of revenue share in 2025 to 33% by 2030.

- LEO D2D will struggle to grow revenues. Direct to device services do not match the experience of cellular, and unique use cases are limited. Most D2D will be bundled with premium offerings, and therefore not directly monetized.

Omdia’s Space To Grow: Enterprise LEO Forecast: 2025-30 report provides a comprehensive analysis of the LEO market, including detailed revenue forecasts, regional breakdowns, and insights into key enterprise use cases.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan: fasiha.khan@omdia.com