85% of CFOs Would Switch Banks for a Direct Connection to Their ERP System, Ninth Wave Survey Finds

85% of CFOs Would Switch Banks for a Direct Connection to Their ERP System, Ninth Wave Survey Finds

Six-hour weekly time savings and near-universal loyalty gains await banks that deliver direct ERP connections

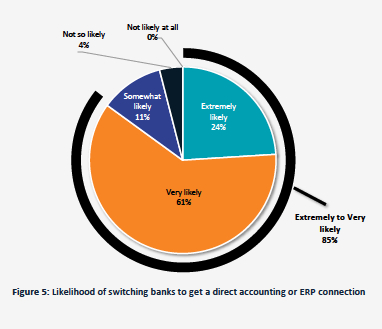

NEW YORK--(BUSINESS WIRE)--A new survey from Ninth Wave, a provider of enterprise Open Finance solutions, found that 85% of finance professionals who lack a direct connection between their bank and ERP/finance systems would switch banks to get this capability.

85% of CFOs Would Switch Banks for a Direct Connection to Their ERP System, Ninth Wave Survey Finds.

Share

The research comes as banks face increasing pressure from fintech competitors across all sectors. Corporate banking is undergoing disruption as businesses increasingly expect their corporate systems to be connected to their entire business ecosystem.

The report, “CFOs Speak: The Influence of Direct Bank Connections for Enterprise Open Finance,” surveyed 200 senior finance leaders at companies with $50 million or more in annual revenue. The findings reveal a significant gap between what corporate customers want and what most banks currently offer.

Key Findings:

- Significant time savings: Finance teams with a direct bank-to-ERP connection save nearly six hours per week on average, with larger firms reporting even greater time savings.

- Stronger unmet demand: 88% of respondents without a connection believe it would be “extremely” or “very” beneficial to have one, with support reaching 95% among C-level executives and vice presidents.

- Increased loyalty and service adoption: Nearly all finance leaders said a direct connection would increase their loyalty with 38% saying it would significantly increase the number of products used from the bank.

- Broader operational benefits: In addition to time savings, users of a direct connection reported improved money management (54%), stronger security (53%), and fewer errors (43%) as key results.

“CFOs and treasurers are sending banks a clear message: direct connections are no longer optional," said George Anderson, Founder and CEO of Ninth Wave, Inc. "Our open finance platform enables banks to deliver the real-time ERP integration that 85% of finance leaders say they'll switch providers to get. The technology exists today—banks just need to implement it.”

The Stakes for Banks

The survey's results have significant implications for banking relationships. With 85% of finance professionals willing to switch banks for direct integration features, banks face considerable risk. Yet, the opportunity is equally clear: 99% of respondents said that such connections would increase their loyalty.

"What stands out is that this isn't about price or rates—it's about fundamental operational efficiency," Anderson added. "Finance teams are overwhelmed with manual processes that need to be automated to keep pace."

The findings emphasize the urgent need for financial institutions to modernize their digital services. Direct connections not only improve customer experience but also foster loyalty, encourage service adoption, and increase profitability.

The study, “CFOs Speak: The Influence of Direct Bank Connections for Enterprise Open Finance,” was conducted by Global Surveyz, an independent research company specializing in market and industry studies, on behalf of Ninth Wave among 200 senior finance leaders at companies with $50 million or more in annual revenue.

About Ninth Wave

Ninth Wave is the leading provider of secure data connectivity between financial institutions and third-party applications such as aggregators, fintechs, accounting solutions, ERP systems, and other business tools. The company's platform allows direct connections for more than 2,000 institutions and 120 million accounts, including seven of the top 10 U.S. banks and eight of the top 10 U.S. wealth managers. Founded in 2018, Ninth Wave is privately owned and based in New York City. For more information, visit ninth-wave.com.

Contacts

Media Contact:

Steve Jensen

Surge PR

801-362-2793