Omdia: Global TV Shipments Fell 2.1% in 2Q25 as Key Markets Decline

Omdia: Global TV Shipments Fell 2.1% in 2Q25 as Key Markets Decline

LONDON--(BUSINESS WIRE)--Global TV shipments experienced a 2.1% year-on-year decline in the second quarter of 2025, according to new analysis from Omdia’s quarterly TV Sets Market Tracker. The drop comes as brands realign inventory and shift focus to new target markets amid volatile tariffs.

The poor second quarter performance in Europe and North America were a direct result of inventory rebalancing,” said Matthew Rubin, Principal Analyst, TV Set Research, Omdia.

Share

According to Omdia’s latest TV Sets (Emerging Technologies) Market Tracker: History – 2Q25, global TV shipments fell to 47.1 million units in Q2 2025, down from 48.1 million in the same period last year. The decline in volume is the first year-on-year fall since Q1 2024.

The decline was driven by key mature markets, with shipments to Western Europe, North America, and Japan falling by 9.7%, 7.4%, and 4.5% respectively.

“The poor second quarter performance in Europe and North America were a direct result of inventory rebalancing,” said Matthew Rubin, Principal Analyst, TV Set Research, Omdia. “Brands have sent extra shipments into both markets since the second half of last year to get ahead of higher US tariffs, and we are now seeing the effect of that strategic shift.”

The slowdown in growth for TCL and Hisense, whose combined growth was up 4.8% year-on-year (their lowest rate of growth since 2023), highlights the global challenges being faced. The US market faces growing trade barriers, resulting in both brands making strategic shifts to other markets, such as Europe. However, intense price competition across Europe has not been able to stimulate consumer demand, which is unsurprising in a year without a major sporting event like the FIFA World Cup to drive sales. Heavy discounting of TVs has nonetheless suppressed selling prices and created difficult trading conditions for all non-Chinese incumbent brands.

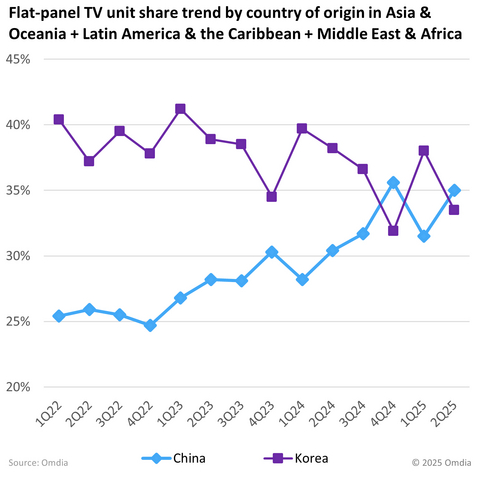

Strong second quarter shipment growth in the Middle East & Africa (up 8.7% year-on-year) and Asia & Oceania (up 6.4%) indicates that brands are targeting less-mature markets. This shift is being driven increasingly by Chinese brands, often at the expense of their Korean counterparts. Mexican factories have ramped up production but are having to look toward other Latin American markets due to reduced inventory requirements in the US. Similarly, Asian TV production, which had to divert shipments away from the US due to tariffs, was expected to shift to Europe, but this market has also slowed. The potential consequence of these shifts is that if local demand is unable to keep up in these less-mature markets, it will likely add further volatility to shipments throughout the rest of the year.

“Fortunately for incumbent non-Chinese brands, the local TV market in China continues to grow, with shipments up 1.6%. If local demand in China falls, significant volume will likely be pushed into other international markets, adding to competition and volatility. Indeed, this should be expected next year, when this temporary, government-funded stimulus ends,” said Rubin.

The OLED market, which was seen as a safe haven for key brands, also dipped in the second quarter of 2025, down 1.8%. However, this is mostly caused by heavy discounting of old 2024 OLED models, slowing the adoption of newer 2025 models that carry much higher prices.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Media Contact: Eric Thoo

eric.thoo@omdia.com