Omdia: Nintendo Switch 2 to Drive Gaming Console Display Shipments up 200% in 2025 Sparking Innovation in Panel Technologies

Omdia: Nintendo Switch 2 to Drive Gaming Console Display Shipments up 200% in 2025 Sparking Innovation in Panel Technologies

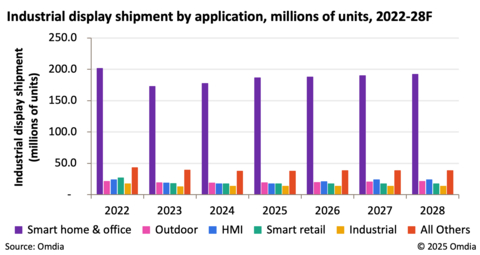

LONDON--(BUSINESS WIRE)--According to Omdia's Industrial and Public Display & OEM Intelligence Service, global industrial display panel shipments reached 281.1 million units in 2024 and are expected to grow 3.4% year-on-year (YoY) to 290.6 million units in 2025. This growth is primarily attributed to the “smart home and office” segment, which accounts for 64% of total shipments this year. A major factor behind this surge is the recent launch of the Nintendo Switch 2 featuring a 7.9-inch LTPS gaming console display. Omdia estimates gaming console display shipments will surpass 15 million units or more in 2025, representing an increase of 200% YoY.

Historically, demand in the industrial display market has remained stable due to its niche characteristics,” said Omdia Principal Analyst TzuYu Huang. “However, tariff uncertainties in recent years prompted TV, IT and some industrial display supply chain participants to shift demand forward into the first half of 2025.”

While this pulled-forward demand may result in softer or uncertain demand in Q3, the successful launch of the Nintendo Switch 2 earlier this year is helping to sustain robust momentum in the smart home and office sector throughout 2025.

To achieve their 2025 industrial display shipment targets in 2025, panel makers are driving growth through innovation and emerging technologies. AUO Display Plus is focusing on indoor signage using EPD solution, outdoor signage and transportation applications with ChLCD, as well as open-frame and integrated display solutions for retail signage, 2D/3D medical displays, human-machine interface (HMI) devices, panel PCs, interactive white boards (IWBs), and slot machines.

BOE has achieved breakthroughs in diagnostic displays and has introduced AMOLED displays into industrial applications such as body cameras and 3.5- and 3.2-inch digital still cameras. Additionally, BOE has developed RGBW technology for electric vehicle (EV) chargers and signage applications.

Innolux is concentrating on mini LED displays with direct or local dimming backlight technology. Their product lineup 3.5- and 5-inch displays for digital still cameras, 7- and 11-inch displays for drones, 17.3- and 23.8-inch displays for marine applications, and 13.3- and 17.3-inch displays for in-flight entertainment. Innolux continues to prioritize meeting strong demand from key customers in the gaming console market this year.

Tianma has expanded into the public display market by ramping up production at their TM19 Gen 8.6 Fab, targeting key applications, such as 50-inch 4K displays for signage and 27-inch displays for the signage, kiosk, slot machines, and digitizer markets. Tianma also maintains a strategic focus on the two-wheeled EV sector, supplying 4.2-, 5-, and 7-inch displays in specific regions. Furthermore, Tianma is investing in mini LED backlight technology for its for larger display panels (13.3-, 15.6-, 17.3-, 23.8-, and 27-inch displays), specifically serving marine and aviation sectors.

Truly is emphasizing small-sized AMOLED displays, including less than 1-inch AMOLED screens for tobacco heat-not-burn products and AMOLED panels smaller than 3 inches for applications in body cameras and e-bikes.

“Game consoles such as Nintendo Switch 2 will continue to drive growth in industrial display shipments throughout 2025. At the same time, panel makers remain focused on emerging technologies to unlock new applications and market opportunities,” TzuYu concluded.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), s a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Media Contact: Fasiha Khan Fasiha.Khan@omdia.com