Omdia: Flexible AMOLED Displays Power 57% of Global Smartphone Shipments

Omdia: Flexible AMOLED Displays Power 57% of Global Smartphone Shipments

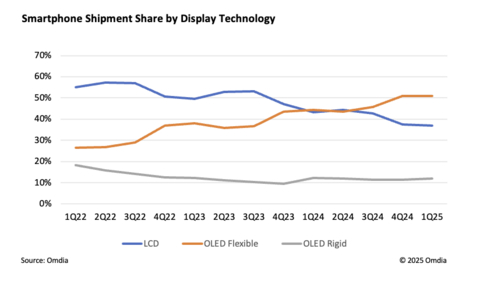

LONDON--(BUSINESS WIRE)--Flexible AMOLED displays are fast becoming the dominant display technology in smartphones, according to Omdia’s latest Smartphone Model Market Tracker. In Q1 2025, AMOLED-equipped smartphones accounted for 63% of total global shipments in the first quarter, up from 57% in the same period last year. In contrast, LCD-based smartphones dropped to 37%, continuing their steady decline.

The surge in AMOLED adoption is being driven primarily by flexible AMOLED panels with Chinese panel makers expanding production at pace. Omdia’s Smartphone Display Supply Chain Database shows that AMOLED panel shipments from Chinese manufacturers reached 364 million units last year - an increase of more than 120 million units compared to 2023.

Apple and Samsung continue to lead in AMOLED adoption, with Apple reaching 100% and Samsung 84% in Q1 2025. Apple phased out all LCD-based models by the end of 2024 with the iPhone SE (3rd generation) being the last one. While Chinese smartphone vendors are steadily increasing their AMOLED adoption, their overall AMOLED penetration rate remains below 50%, largely due to the continued focus on lower-priced models.

Smartphone shipments featuring flexible AMOLED displays reached 151 million units in Q1 2025, representing a 15% year-on-year (YoY) growth. This category, which includes foldable display, has maintained consistent annual growth in the mid-20% range over the past three years. Full-year shipments rose to 566 million units in 2024, up from 442 million units in 2023.

Meanwhile, rigid AMOLED displays are rapidly losing ground. Shipments fell by 1% YoY in Q1 2025 to just 36 million units, with Samsung accounting for most of this volume. Previously adopted by vendors such as Oppo, vivo, and Xiaomi for mid-range offerings, rigid AMOLEDs have largely been phased out as manufactures pivot toward flexible AMOLEDs, driven by expanding supply and more competitive pricing from Chinese panel suppliers.

The growing availability of AMOLED panels has also enabled the technology to reach more affordable price tiers. The average selling price (ASP) of AMOLED smartphones dropped to $510 in Q1 2025. While LCD panels still dominate the ultra-low-end segment under $100 due to their lower cost, AMOLED adoption is accelerating in smartphones priced below $200.

“AMOLED is now firmly establishing itself as the mainstream display technology in smartphones,” said Jusy Hong, Senior Research Manager at Omdia. “Omdia expects AMOLED’s share of global smartphone shipments to exceed 60% this year, with total shipments projected to exceed 750 million units by the end of 2025.”

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Fasiha Khan- fasiha.khan@omdia.com