Blend Expands Product Suite with Business Deposit Account Opening

Blend Expands Product Suite with Business Deposit Account Opening

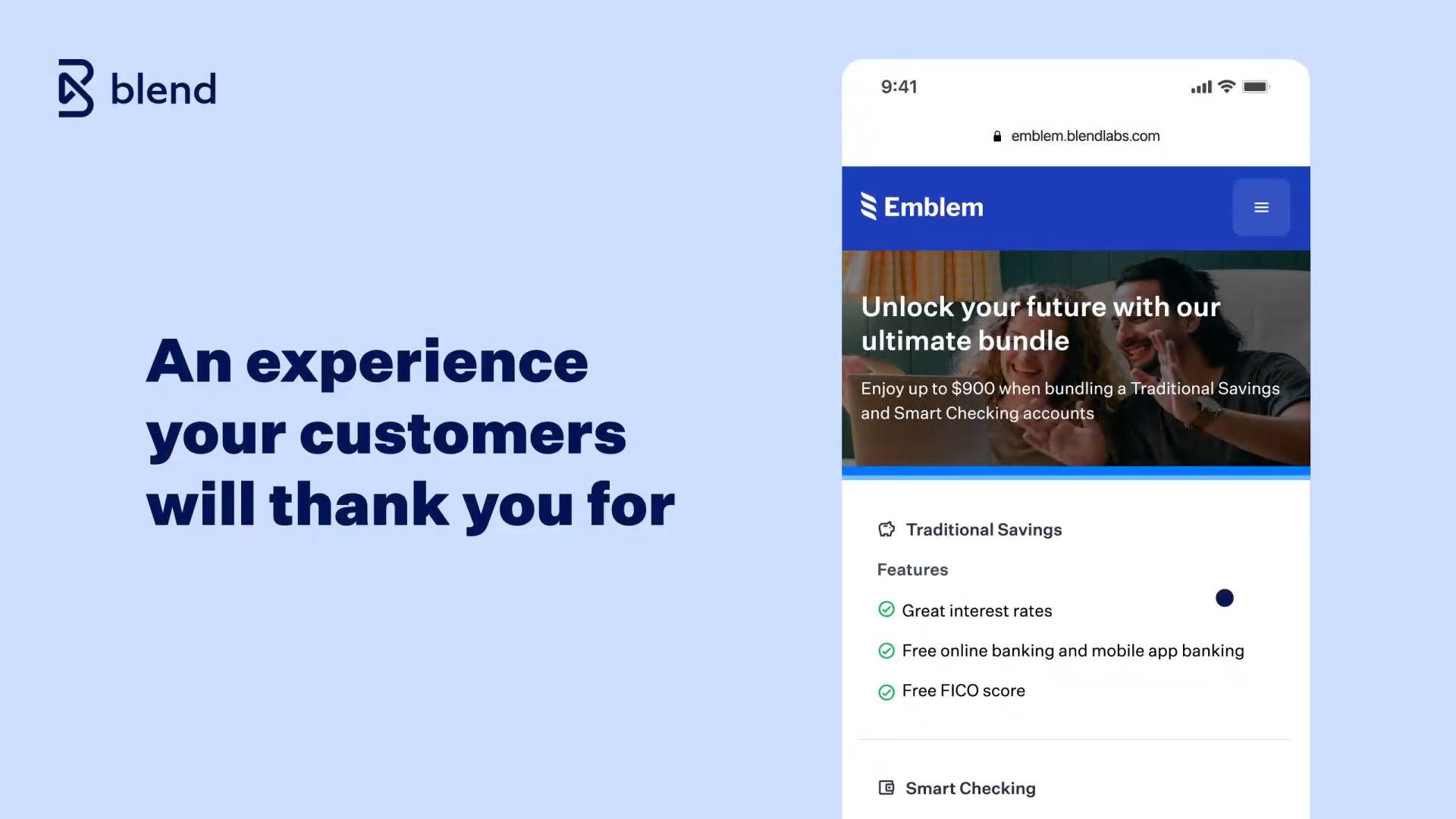

One unified platform for business and consumer onboarding—helping financial institutions deepen relationships, grow deposits, and simplify operations

SAN FRANCISCO--(BUSINESS WIRE)--Blend Labs, Inc. (NYSE: BLND), a leading origination platform for digital banking solutions, today announced the launch of its Business Deposit Account Opening solution, now available as part of Blend’s unified Consumer Banking Suite.

With this addition, financial institutions can now serve both consumers and businesses through a single, omnichannel platform that also supports personal loans, credit cards, auto loans, and home lending—helping financial institutions streamline operations, strengthen customer loyalty, and accelerate deposit and lending growth.

“Whether serving consumers or businesses, the best experiences are simple, fast, and connected—across every channel," said Srini Venkatramani, Head of Product, Technology, and Client Operations at Blend. "With Blend’s unified platform, financial institutions can deliver seamless, digital-first onboarding that deepens relationships from the very first interaction."

One Platform for Business & Consumer Deposit Growth

Today, many financial institutions rely on multiple, disconnected systems to support deposits, personal loans, credit cards, auto loans, and home lending—leading to fragmented customer experiences and operational inefficiencies.

Blend’s Business Deposit Account Opening solution addresses this challenge by bringing consumer and business deposit onboarding together on a single platform. It supports all business types and structures—including sole proprietors, LLCs, partnerships, corporations, and nonprofits—and is purpose-built to meet the needs of small businesses seeking fast, frictionless access to banking services.

With features like pre-filled applications, co-owner invites, built-in Know-Your-Business (KYB) and compliance checks, and full omnichannel support, Blend removes onboarding friction and enables real-time collaboration between applicants and bankers. Financial institutions can deliver consistent, modern experiences across digital, branch, and contact center channels.

Key Benefits of Blend Deposit Accounts include:

- Simplify onboarding across products — Onboard business and consumer deposits, auto loans, credit cards, and auto loans on one platform—creating a consistent experience for both customers and staff.

- Deliver deeper customer engagement — Strengthen relationships by surfacing cross-sell opportunities, including the ability to onboard beneficial owners as members when opening business accounts.

- Boost banker productivity — Empower teams with automation and integrated tools to deliver seamless experiences across digital, branch, and phone—freeing them to focus on customer relationships, not paperwork.

“This new solution demonstrates Blend’s commitment to ongoing innovation,” Venkatramani added. “We continue to partner with some of the country’s leading financial institutions to co-create the future of banking.”

For information on Blend’s Business Deposit Account Opening, visit blend.com/deposit-accounts.

About Blend

Blend Labs Inc., (NYSE: BLND) is a leading origination platform for digital banking solutions. Financial providers—from large banks, fintechs, and credit unions to community and independent mortgage banks—use Blend’s platform to transform banking experiences for their customers. Better banking starts on Blend. To learn more, visit blend.com.

Forward-Looking Disclaimer

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements generally relate to future events, future performance or expectations and involve substantial risks and uncertainties. Forward-looking statements in this press release may include, but are not limited to, our expectations regarding our product roadmap, future products/features, the timing of new product/feature introductions, market size and growth opportunities, macroeconomics and industry conditions, capital expenditures, plans for future operations, competitive position, technological capabilities and strategic relationships, as well as assumptions relating to the foregoing. The forward-looking statements contained in this press release are subject to risks and uncertainties that could cause actual outcomes to differ materially from the outcomes predicted. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other comparable terminology that concern Blend’s expectations, strategy, plans or intentions. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by which such performance or results will be achieved, if at all. Further information on these risks and uncertainties are set forth in our filings with the Securities and Exchange Commission. All forward-looking statements in this press release are based on information available to Blend and assumptions and beliefs as of the date hereof. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. Except as required by law, Blend does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Contacts

Press Contact

Chloé Demeunynck

Corporate Communications

press@blend.com