Arturo Unveils Groundbreaking Change Detection Technology for Insurers

Arturo Unveils Groundbreaking Change Detection Technology for Insurers

Revolutionary AI-powered solution enhances property insights and risk management

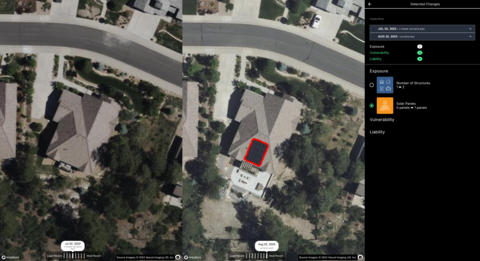

DENVER--(BUSINESS WIRE)--Arturo, a leading property intelligence company, launched its groundbreaking Change Detection technology today. This cutting-edge solution transforms how insurers monitor and assess property changes, further enhancing Arturo’s suite of advanced tools used by top carriers for risk management, underwriting, and claims insights.

Arturo’s Change Detection technology utilizes state-of-the-art AI and geospatial imagery to identify key changes, such as deteriorating roofs or new structures on a property. This proactive approach enables insurers to anticipate risks, ensure optimal coverage, and better serve policyholders.

“Arturo’s Change Detection technology allows insurers to make faster, more informed decisions, mitigate risks earlier, and ultimately provide better services to their customers by preventing coverage gaps,” said Marty Smuin, CEO of Arturo. “We are excited to introduce this cutting-edge solution to the insurance industry.”

Key features and benefits of Arturo’s Change Detection technology include:

- Comprehensive Change Detection: Captures a wide range of property changes, ensuring insurers have precise, up to date information for underwriting, risk management, and claims

- Real Time Risk Monitoring: Seamless PI-integration enables insurers to make timely and informed coverage adjustments.

- Optimized Premium Management: Insurers can adjust premiums based on significant property changes, preventing revenue leakage and ensuring fair pricing.

- Proactive Risk Mitigation: Helps to Identify vulnerabilities, allowing insurers to mitigate risks before they lead to costly claims.

- Streamlined Underwriting Process: Reduces reliance on manual inspections, speeding up underwriting decisions with precise, timely data.

With the launch of its Change Detection technology, Arturo continues to push the boundaries of property intelligence, offering insurers powerful tools to enhance risk management and ultimately provide homeowners with the right coverage when it matters most.

For more information about the new technology, visit www.arturo.ai.

About Arturo

Arturo’s AI-based solution helps insurers securely underwrite risks, efficiently allocate resources, and lower claims cost across their book of business. This allows them to focus on what matters most: the customer, and our shared commitment to protecting our world. See more about what Arturo can do at arturo.ai.

Contacts

Anna Stallmann Communications

media@annacomms.com

704-218-9362