Recent Study Finds Digital IDs Not Ready to Replace Physical Documents — Yet

Recent Study Finds Digital IDs Not Ready to Replace Physical Documents — Yet

RESTON, Va.--(BUSINESS WIRE)--As innovative digital verification methods continue to emerge, the debate around their reliability and effectiveness is heating up. Yet, a recent study “The New Imperative: Digital IDs” commissioned by Regula reveals the lasting importance of physical identity documents. Despite digital advances, a high percentage of organizations worldwide still depend on physical documents for verification.

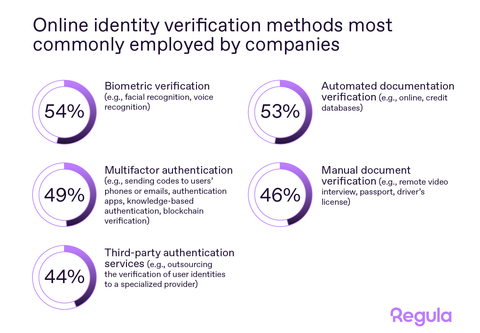

Current state. Companies employ various methods for identity verification, as shown in a Forrester Consulting study commissioned by Regula. 46% of respondents verify documents manually, even in remote scenarios involving video interviews or passport scan submission. Some companies have automated this process (53%) or switched to more secure forms of user authentication such as biometrics (54%) or multi-factor authentication (49%). A significant number of companies (44%) use third-party services that also often count on physical documents for thorough identity checks.

The Forrester Consulting study suggests that, while innovative digital verification methods are evolving, physical identity documents remain indispensable, ensuring reliable and trustworthy identity verification across various regulatory environments.

The reliance on physical documents is more pronounced in industries where security demands are stringent, such as Aviation (63%) and Finance (44%). Organizations from countries with rigid regulatory frameworks, including the US (50%) and Germany (49%), also stay true to manual checks.

Barriers to widespread Digital ID adoption. One of the obstacles on the road to broad adoption of the Digital ID concept is the lack of a general legislative framework for this form of identity proofing. 74% of respondents underscore the necessity for global digital ID standards and legislation to ensure interoperability of such IDs across borders.

However, with varied regional perspectives on identity and privacy (71%) and the technological disparity between countries (70%)—which are also named among the concerns—agreeing on these standards will be challenging. To address these difficulties, the situation requires collaborative innovation from authorities, businesses, and players in the identity verification (IDV) market.

The unified approach will become a pivot for establishing a consistently high reliability rate for Digital ID and contributing to the evolution of the IDV market. Sooner or later, this process will begin, since 72% of surveyed stakeholders believe the integration of digital IDs helps develop a robust global digital economy.

“Digital ID represents a significant change in how we approach identity verification, offering a brand-new dimension to our existing frameworks. However, the introduction of Digital ID as it now stands will not lead to the disruption of the IDV market. There are many signals indicating the need for long-term support of current identification types. While countries can adopt the new approach at their own pace domestically, a global shift to Digital IDs must be ubiquitous. This transition is hampered by various obstacles associated with political and economic issues, as well as a lack of universal public recognition of the technology. Eventually, obtaining Digital IDs will likely require presenting physical passports or ID cards, at least during the initial issuance stage. Even after the appearance of a complete ICAO standard for Digital ID, its worldwide adoption and the development of such a system will take time, and may involve considerable costs. Until this happens, we are just beginning to research the potential of this novelty,” said Ihar Kliashchou, Chief Technology Officer at Regula.

You can download the complete study with all the details for free here.

More on the topic:

- 42% of companies globally are ready to implement Digital ID.

- EU Digital Identity Wallet: Exploring Its Current Potential.

- 9 Identity Verification Trends Shaping 2024 for Forward-Thinking Businesses.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the largest library of document templates in the world, we create breakthrough technologies in document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security or speed.

Regula has been repeatedly named a Representative Vendor in the Gartner® Market Guide for Identity Verification.

Learn more at www.regulaforensics.com.

Contacts

Kristina – ks@regulaforensics.com