Partner Insurer Payout Rose 23% YoY on Ant Insurance in the Alipay App in 2023

Partner Insurer Payout Rose 23% YoY on Ant Insurance in the Alipay App in 2023

-Rising medical consultation needs and improved product offering drives online insurance market expansion

-Ant Insurance uses AI to facilitate the online claims process and improve product transparency and service quality

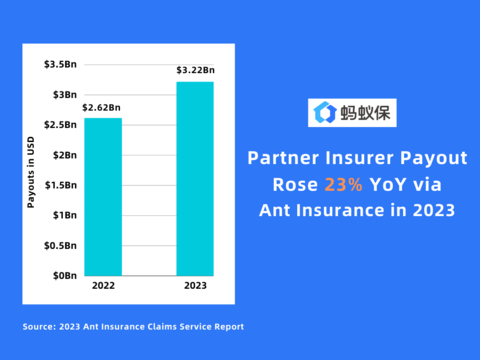

HANGZHOU, China--(BUSINESS WIRE)--In 2023, China's leading insurers recorded claim payouts totaling RMB 23.1 billion (USD 3.22 billion) on Ant Insurance, Ant Group’s leading online insurance brokerage platform in China, housed in the Alipay digital life service platform, representing 23% year-over-year (YoY) growth, according to Ant Insurance. In the health insurance category alone, the partner insurers processed 4.69 million claims on Ant Insurance.

Ant Insurance attributed the growth to recovery in medical consultation and the introduction of more zero-deductible products into the market.

Notably, 98% of the health insurance claims were facilitated by the platform's EasyClaims (Anxinpei) feature, an AI-enabled expedite settlement solution introduced in early 2022 to simplify the claiming process for users.

The EasyClaims solution has seen widespread adoption across the health and accident insurance categories on Ant Insurance, which now serves 90 products from 12 leading insurers covering outpatient services, hospitalization, critical illness, and accidents.

EasyClaims' AI-enabled customer assistance for the claim submission process has earned a 91% satisfaction rate among users, and the overall user satisfaction rate for its whole claiming process reached 94%.

Starting in January 2024, EasyClaims will publish monthly EasyClaims Scores for selected insurance products to enhance transparency and user knowledge of claim services offered by these insurance products. The Score evaluates products based on one-time submission success rate, timely completion rate, settlement acceptance rate, and user satisfaction rate.

“In partnership with insurers, Ant Insurance is committed to delivering industry-leading claims services with its broad coverage, transparency, ease of processing, and comprehensive user support,” said Fang Yong, Head of Claims Technology at Ant Insurance. “EasyClaims offers users clarity when selecting insurance products and an easy flow in claims settlement. These positive feedbacks are the result of both our collaborative efforts with our partner insurers and thoughtful integration of AI to assist users with the claim submission process.”

About Ant Group

Ant Group aims to build the infrastructure and platforms to support the digital transformation of the service industry. Through continuous innovation, we strive to provide all consumers and small and micro businesses equal access to digital financial and other daily life services that are convenient, sustainable and inclusive.

For more information, please visit our website at www.antgroup.com or follow us on Twitter @AntGroup.

Contacts

Media Inquiries

Yinan Duan

Ant Group

duanyinan.dyn@antgroup.com