TD Ameritrade Investor Movement Index: April Sees Modest Gains in IMX Score

TD Ameritrade Investor Movement Index: April Sees Modest Gains in IMX Score

Clients continued net buying equities in April, with the strongest buying interest in the Consumer Discretionary sector

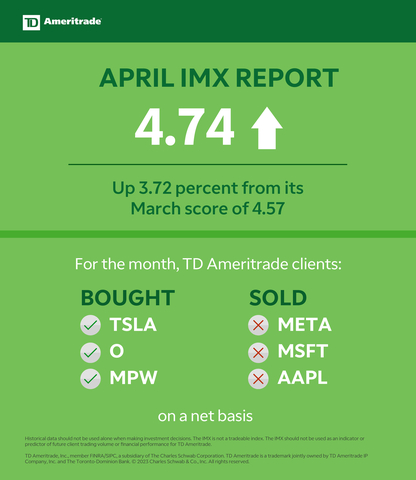

OMAHA, Neb.--(BUSINESS WIRE)--The Investor Movement Index® (IMXSM) increased to 4.74 in April, up from its score of 4.57 in March. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

The reading for the four-week period ending April 28, 2023 ranks “moderate low” compared to historic averages.

“Since the start of the year, we’ve seen the IMX score creep up month-over-month, although it remains relatively low,” said Lorraine Gavican-Kerr, Managing Director, Investor Education at TD Ameritrade. “Time will tell, but this may indicate that TD Ameritrade clients are feeling cautiously optimistic when it comes to the many unknowns the market currently faces.”

The April IMX period included several macroeconomic catalysts and the beginning of the latest earnings season. The U.S. Bureau of Labor Statistics’ Employment Situation report showed a stubbornly strong jobs market with an unemployment rate that ticked down to 3.5%. The International Monetary Fund cut its World Economic Outlook, forecasting global growth at 2.8% for 2023, down from 3.4% in 2022, before settling at 3% in 2024. The Bureau of Economic Analysis estimated that U.S. Gross Domestic Product (GDP) increased at an annual rate of 1.1% during the first quarter of 2023, well below Street forecasts of 2%. Throughout the recent corporate earnings season, many companies posted better-than-expected results but provided cautious outlooks for the rest of the year.

All of this painted a picture of economic uncertainty, which could cloud the path forward for the Federal Reserve’s efforts to restore price stability. Despite this, the S&P 500® index (SPX) managed a modest rally of 1.46%, ending on its highs for the month. The Cboe Volatility Index® (VIX) ended the April period at 15.78, its lowest level since November 2021, reflecting less-volatile trading activity during the month. Still, significant risks remain, including U.S. lawmakers’ imminent need to reach a deal on raising the debt ceiling. The 10-year Treasury note yield (TNX) moved slightly lower to 3.45%, and the U.S. Dollar Index ($DXY) eased to 101.67. Crude Oil (/CL) was volatile once again as prices fluctuated on demand concerns, but ultimately settled modestly higher at $76.63 per barrel, up 1.05% for the month.

TD Ameritrade clients were net buyers of equities overall during the period. Popular names bought included:

- Tesla Inc. (TSLA)

- Realty Income Corp. (O)

- Medical Properties Trust Inc. (MPW)

- AT&T Inc. (T)

- Verizon Communications Inc. (VZ)

Names net sold during the period included:

- Meta Platforms Inc. (META)

- Microsoft Corp. (MSFT)

- Apple Inc. (AAPL)

- Intel Corp. (INTC)

- Advanced Micro Devices Inc. (AMD)

Millennial Buys & Sells

TD Ameritrade millennial clients, like the overall TD Ameritrade client population, increased exposure during the April period and were net buyers of equities.

Both TD Ameritrade millennial clients and the overall TD Ameritrade client population were net buyers of Real Estate Investment Trust (REIT) companies Realty Income Corporation (O) and Medical Properties Trust (MPW), as they appeared to see an opportunity to increase their exposure to real estate. Both populations were net buyers of electric vehicle (EV) maker Tesla (TSLA) despite its recent price cuts weighing on the company’s margins. Amazon (AMZN) was net bought by TD Ameritrade millennials in April despite comments from company leadership during its quarterly earnings call that sounded alarms regarding the future growth rate of its Amazon Web Services (AWS) segment.

Meta Platforms (META) continued its red-hot start to 2023 with a blowout quarterly earnings report that sent shares soaring; both populations were net sellers into its strength. TD Ameritrade millennials were also net sellers of Nvidia (NVDA) as the semiconductor giant sputtered in April despite positioning itself to benefit strongly from the recent Artificial Intelligence (AI) arms race.

TD Ameritrade millennial clients bought most heavily in Consumer Discretionary names, while selling was strongest in Communication Services stocks.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010, to view the full report from April 2023, or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade. IMX data includes that from accounts of TD Ameritrade clients which recently transferred to our affiliate, Charles Schwab & Co., Inc., as part of our planned integration.

About TD Ameritrade

TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. A leader in U.S. retail trading, we leverage the latest in cutting-edge technologies and one-on-one client care to help our clients stay on top of market trends. Learn more by visiting www.tdameritrade.com.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co. Inc. All rights reserved.

Contacts

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com