Apple Notches Best MacBook Quarter Ever as Notebook Market Declines in Q3 2022, says Strategy Analytics

Apple Notches Best MacBook Quarter Ever as Notebook Market Declines in Q3 2022, says Strategy Analytics

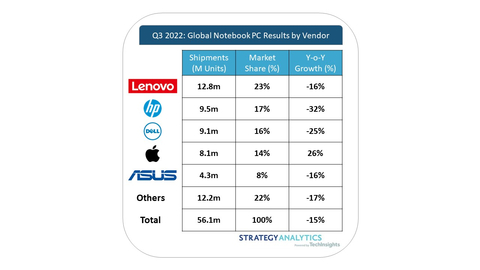

Global market declined -15% year-on-year while Apple was the only vendor with positive results among the top 7

BOSTON--(BUSINESS WIRE)--Inflation, recession, and slow growth are short term issues hurting consumer and commercial notebook demand while other factors like currency fluctuation, high unemployment, and political issues will put more pressure on spending during the holiday season and early 2023. As a result, Notebook PCs continued to struggle this year as shipments declined -15% compared to last year, according to a new report by Strategy Analytics. Looming global economic challenges will likely have an impact on manufacturing and logistic costs.

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, Preliminary Global Notebook PC Shipments and Market Share: Q3 2022 Results can be found here: https://www.strategyanalytics.com/access-services/devices/tablets-and-pcs/connected-computing-devices/market-data/report-detail/preliminary-global-notebook-pc-shipments-and-market-share-q3-2022-results

Chirag Upadhyay, Industry Analyst said, “The commercial segment continued to perform better for most vendors compared to the pre-pandemic level as upgrades continued across businesses, while consumer volume continued to be challenging for all vendors except Apple. Apple had a great quarter for MacBook PCs shipments and revenue, as they managed to deliver backlog orders which were mainly upgrades, plus MacBooks with the new M2 chipset driving sales across several regions.”

Eric Smith, Director – Connected Computing added, “One of the constants throughout the pandemic was Chromebook demand as many K-12 schools in developed markets rapidly deployed mobile computing devices for their student populations. Learning management platforms remain and are expected to drive sustained demand over the long-term, but Chromebook demand is shadow of what it was a year ago. Compare the first nine months of 2022 to the same period last year, and you’ll see that Chromebook shipments have dropped nearly 16 million units at a -51% growth rate.”

- Lenovo remains on top spot with 23% market share and 12.8 million units in Q3 2022 (calendar year); this represented a -16% decline from the 15.3 million shipped the year prior and flat compared to the previous quarter

- HP secured second position with 17% market share and 9.5 million shipments in the third quarter, a -32% decline compared to the similar period last year

- Dell maintained the third position and importantly closed the gap with HP; during Q3 2022, Dell's shipments reached over nine million units at a -25% year-on-year decline

- Apple was the only vendor to deliver positive results among top 7 personal computing vendors as shipments reached 8.1 million units (26% year-on-year growth) during the quarter

- Asus secured the fifth spot with nearly 8% market share as they managed to ship 4.3 million notebook PCs, a -16% decline year-over-year

Source: Strategy Analytics, Inc.

#SA_Devices

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com

For more information about Strategy Analytics

Connected Computing Devices: Click here

Contacts

Report contacts:

Chirag Upadhyay, +44 1908 423 643, cupadhyay@strategyanalytics.com

Eric Smith, +1 617 614 0752, esmith@strategyanalytics.com