Strategy Analytics: Apple iPhone Tops Global Smartphone Market in Q4 2021

Strategy Analytics: Apple iPhone Tops Global Smartphone Market in Q4 2021

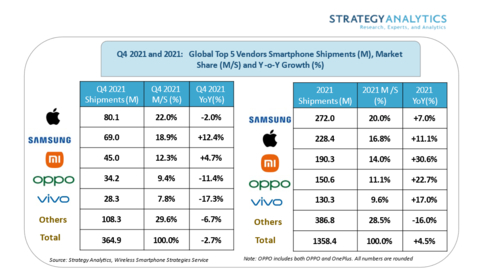

BOSTON--(BUSINESS WIRE)--According to new research from Strategy Analytics, global smartphone shipments fell -3% YoY to 365 million units in Q4 2021. Full-year smartphone shipments rose +5% YoY to 1.36 billion units in 2021. Apple iPhone topped the global smartphone market with a healthy 22% share in Q4 2021. Samsung maintained first place with 20% share in full-year 2021.

Linda Sui, Senior Director at Strategy Analytics, said, “Global smartphone shipments fell -3% YoY to 365 million units in Q4 2021. Factory constraints and component shortages continued to restrict smartphone supply in the final quarter of last year. Full-year smartphone shipments rose +5% YoY to 1.36 billion units in 2021, recovering from a sharp Covid-led decline of -8% YoY during 2020.”

Woody Oh, Director at Strategy Analytics, added, “We estimate Apple shipped 80 million iPhones and topped the global smartphone market with a healthy 22% share in Q4 2021. Demand was strong for the new iPhone 13 series in China and other markets. Samsung shipped 69 million smartphones, up +12% YoY, for 19% global marketshare in Q4 2021. Samsung had a good quarter, led by its innovative Flip and Fold 5G models. Samsung grew faster than all its major rivals. Samsung ramped up volumes in North and South America amid the withdrawal of LG, however the competition in Asia remained fierce. Samsung maintained first place for full-year 2021, with 20% global smartphone marketshare, followed by Apple in second spot.”

Yiwen Wu, Senior Analyst at Strategy Analytics, added, “Xiaomi shipped 45 million smartphones and took third place with 12% global marketshare in Q4 2021, up slightly from 11% a year ago. Xiaomi benefitted from the withdrawal of Huawei and LG and expanded its retail footprint into all major regions last year. OPPO (OnePlus) held fourth spot and captured 9% global smartphone marketshare during Q4 2021. Vivo stayed fifth with 8% global smartphone marketshare in Q4 2021. OPPO (OnePlus) and Vivo both lost ground in the final quarter of last year, as 5G competition from Honor and other smartphone competitors intensified sharply at home in China.”

Neil Mawston, Executive Director at Strategy Analytics, added, “Global competition among other major smartphone brands, beyond the top-five, was fierce during Q4 2021. Honor, Lenovo-Motorola, Realme and Transsion all outperformed the overall market and posted double-digit growth rates. Honor continued to soar in China. Lenovo-Motorola gained share from LG in the Americas. Realme had a very strong quarter in India, China, and elsewhere. Transsion held firm across the Africa region.”

Linda Sui, Senior Director at Strategy Analytics, added, “We forecast global smartphone shipments to grow a mild +3% YoY in full-year 2022. This year will be a tale of two halves. Component shortages, price inflation, and Covid uncertainty will continue to weigh on the smartphone market during the first half of 2022, before the situation eases in the second half due to Covid vaccines, interest rate rises by central banks, and less supply disruption at factories.”

About Strategy Analytics

Strategy Analytics is a global, independent research and consulting firm. The company is headquartered in Boston, US, with offices in the UK, France, Germany, Japan, South Korea, Taiwan, India, and China. Visit www.strategyanalytics.com for more information.

Contacts

Analyst Contacts

Yiwen Wu, Senior Analyst, ywu@strategyanalytics.com

Linda Sui, Senior Director, lsui@strategyanalytics.com

Neil Mawston, Executive Director, nmawston@strategyanalytics.com

Woody Oh, Director, woh@strategyanalytics.com