CrowdStreet Identifies Their 20 Best Places to Invest in Private Equity Real Estate in 2022

CrowdStreet Identifies Their 20 Best Places to Invest in Private Equity Real Estate in 2022

The $2.8B property investing platform, which has capitalized projects worth $22B, evaluates hundreds of commercial real estate opportunities yearly nationwide; here’s where they see tremendous growth.

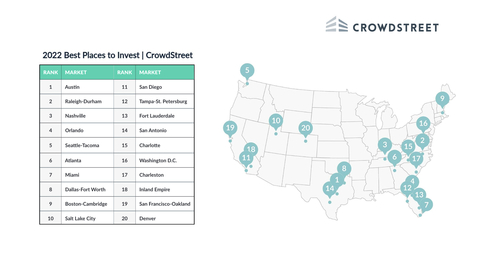

AUSTIN, Texas--(BUSINESS WIRE)--CrowdStreet, one of the leading real estate investing marketplaces, has released its annual Best Places to Invest report for 2022. CrowdStreet rates Austin, Texas as the best market for commercial real estate investing overall in the national ranking, followed by Raleigh-Durham, Nashville, Orlando and Seattle. The comprehensive report also breaks down the best places to invest in seven property sectors: multifamily, build-to-rent, industrial, office, hotel, retail and life sciences.

“We take all property types into account since the deals on our platform cover private real estate opportunities in all multifamily and commercial real estate sectors. But to make the top 20, a market must consistently rank highly across multiple real estate classes,” CrowdStreet’s Chief Investment Officer Ian Formigle said of CrowdStreet’s analysis.

A team of highly experienced analysts contributed to the report. “Their depth and breadth of knowledge is voluminous, in part because we evaluate hundreds of private real estate deals annually,” Formigle noted.

“While the CrowdStreet Marketplace features well over 100 individual offerings every year, we see around 20 deals for every one that we bring to our investor community for their consideration. We have a rigorous, objective evaluation process. We analyze sponsors’ business plans, past performance*, fee structure, transparency and more to find projects that meet our standards for inclusion on the Marketplace” Formigle explained.

For the Best Places to Invest in Real Estate report, CrowdStreet’s investment team ranks markets based on 28 key indicators ranging from micro- and macroeconomics to quality of life and taxes.

Best Places to Invest in Real Estate Are Often the Best Places to Live, Work, Learn, Play

Even though multifamily rents increased an average of 11% year-over-year in 2021—the single highest increase ever recorded, data analyst CoStar noted—no single market possesses all 28 attributes CrowdStreet used to rank its top 2022 markets. CrowdStreet’s findings, however, show the top-ranking places enjoy strong job and population growth. Also, they tend to have major research universities, thriving tech sectors and unique cultural assets that make them ‘work from anywhere’ markets. In turn, these assets generally create ecosystems that ultimately boost absorption rates, rent growth and the local economy.

This year’s top Best Place to Invest in Real Estate, Austin, finished second in 2021. It continues to have many advantages to recommend it, from its relative affordability and vibrant cultural offerings to its enviable status as a relocation city of choice for Silicon Valley businesses and employees. It continues to outperform much larger cities in the build-to-rent, retail, office and multifamily markets (finishing first, second, second and third respectively in those sectors).

The city of 950,000 has seen its population skyrocket 21% over the last decade, driven by strong tech sector job growth; major players such as Tesla, Oracle, and Google have either moved or expanded there. The presence of the state capital and more than 25 universities—including the nation’s sixth top public university —along with its location in a tax-free state, also contribute to Austin’s strong long-term outlook.

Raleigh-Durham, CrowdStreet’s number one market in 2021, again finished strong, this time at number two. Its combined population of more than 750,000 in the 2020 census has grown by 23% since 2010, making it the nation’s second-fastest growing metropolitan statistical area after Austin. This contributes to its position as the nation’s top multifamily housing market, according to CrowdStreet.

In fact, Raleigh-Durham has seen its job and population growth continue to accelerate even under pandemic conditions. It benefits from its proximity to three tier-1 research universities—more than 550 life sciences companies are based there, including Biogen and Bayer—and its burgeoning market reflects robust deal-making in the office, retail and life sciences markets.

In the number three position, Nashville continues to benefit from a tech sector influx; CrowdStreet ranks Nashville as the nation’s top real estate market for office space. Orlando, Fla. jumped from 18th to 4th for 2022, thanks in large part to a 2021 surge in multifamily demand that spurred 23.1% annual rent growth and absorption that has outpaced supply.

Seattle also moved way up—nine spots—to finish at number five. With Amazon.com slated to add 25,000 jobs over the next five years, “We expect to continue to see meaningful rent growth and higher property values here in 2022 across several sectors including multifamily, retail, and industrial,” Formigle said.

Industrial and Life Sciences Sectors Should Be Promising Investment Opportunities

Real estate investors have been enamored with two property sectors that have seen accelerated—and exponential—growth thanks to the pandemic: life sciences with its medical office buildings, research labs and biotech facilities and industrial, which includes warehouses and distribution centers. While the Best Places to Invest in life sciences list did not change between 2021 and 2022, fundamentals have changed substantially in the industrial sector.

A combination of razor-thin vacancy, robust rent growth and above-average barriers to entry (both administrative and geographical) helped cement the top rankings in industrial markets for 2022. Los Angeles topped the industrial marketplace ranking, followed by neighboring Orange County at number two (up from 14 in 2021), Seattle at three (up from eight in 2021), Inland Empire at four (down from two in 2021) and San Francisco-Oakland at five (down from 10 in 2021).

With major ports in or geographically accessible to all five of these markets, they have significant need for warehouses. By size, the Ports of Los Angeles and Long Beach rank first and third nationally and the Inland Empire borders both counties to the west, while the Ports of Seattle and Oakland rank sixth and tenth respectively.

Predictably, warehouse vacancy rates dropped to .9% and 2% in the Inland Empire and Los Angeles respectively at the end of 2021—among the lowest of all major U.S. industrial hubs–boosting the Orange County industrial market as well. The Inland Empire remains one of the most prominent distribution hubs in the western U.S., with many e-commerce warehouses (including one of Amazon’s largest fulfillment centers) and a booming economy.

In Seattle, a 9% year-over-year increase in port volumes has fueled industrial demand and led to a 4% vacancy rate in its industrial market, while San Francisco-Oakland has strong demand from research and development businesses to lease industrial space for product development and logistics.

Adding more fuel to the already sizzling industrial market is the fact that the crop of leases expiring this year are from 2016, before the massive surge in e-commerce instigated by the pandemic. Prices to lease these industrial properties are up an average of 25% over the rates of the five-year contracts that are expiring, according to CBRE data.

Visit CrowdStreet’s Top Real Estate Markets for the full report or to learn more about CrowdStreet’s methodology and research on each market and property sector.

About CrowdStreet: Since 2014, CrowdStreet has launched nearly 600 private equity real estate investment opportunities across the U.S. Our investor community has committed more than $2.8 billion in investment dollars, including more than $1.2 billion of equity in 2021 alone, and has earned more than $417 million in distributions**. Based on the performance of CrowdStreet’s 80 fully realized deals, the investment opportunities on the platform have realized an averaged 18.6% IRR. Some of the world’s largest sponsors have used CrowdStreet to raise capital. CrowdStreet has consistently been named Best Overall Real Estate Crowdfunding Site by Investopedia and was just named a Benzinga 2022 Alternative Investments Listmaker. Learn more at www.crowdstreet.com.

*Past performance is not indicative of future results or success.

**The information in this communication, including information regarding amounts funded and deals closed, was provided by CrowdStreet as of Dec 31, 2021.

The statements made herein are made solely by the third party and are based solely upon the opinions of (name of third party). All information contained is obtained by (third party) from sources believed by (third party) to be reliable. CrowdStreet or any of its affiliates do not warrant, express or implied, the accuracy, timeliness, or completeness, of this information. Under no circumstances shall CrowdStreet or any of its affiliates have any liability resulting from the use of any such information. Nothing herein should be construed as an offer, recommendation, or solicitation to buy or sell any security or investment product issued by CrowdStreet or otherwise. This article is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. Information in this communication, including information regarding realized returns, is not indicative of future results. Past performance does not guarantee future results or success.

Information on the website (including information regarding targeted returns or investment performance) relating to specific investments has been provided by the Sponsor of the applicable investment opportunity and is subject to change. Although CrowdStreet believes any such information to be reliable, it makes no representations or warranties as to the accuracy or completeness of such information and accepts no liability therefor. Forward-looking statements, hypothetical information or calculations, financial estimates and targeted returns are inherently uncertain. Such information should not be used as a primary basis for an investor’s decision to invest. Investment opportunities on the Marketplace are speculative and involve substantial risk. You should not invest unless you can sustain the risk of loss of capital, including the risk of total loss of capital. CrowdStreet recommends that you consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any investment opportunity. See full disclosures here.

Contacts

Allie Kuopus

akuopus@purposebrand.com

262-957-6020