New Data from HouseCanary Paints Bleak Picture for Housing Affordability

New Data from HouseCanary Paints Bleak Picture for Housing Affordability

Homes Under $200K Continue to be in Short Supply as Net New Listing Activity is Down Nearly 30% Year-Over-Year

List-to-Sale Price Ratio Hovers Slightly Above 100, Underscoring a Sustained Seller-Friendly Environment

Gap Between Contract Volume and Net New Listing Volume Continues to Shrink, Signaling a Decrease in the Outsized Demand for New Homes

SAN FRANCISCO--(BUSINESS WIRE)--HouseCanary, Inc. (“HouseCanary”), a national brokerage known for its real estate valuation accuracy, today released its latest Market Pulse report, covering 22 listing-derived metrics and comparing data between September 2020 and September 2021. The Market Pulse is an ongoing review of proprietary data and insights from HouseCanary’s nationwide platform.

Jeremy Sicklick, Co-Founder and Chief Executive Officer of HouseCanary, commented: “The record growth in home prices over the past year driven by short supply has made homeownership less affordable for many Americans, especially for would-be first-time homebuyers and those searching for homes under $200K. It’s also worth noting that mortgage rates have increased recently, topping 3% for the first time since early July. Higher borrowing rates, in tandem with lofty prices, could potentially limit the demand for new homes and refinances. Now that we are exiting the peak summer market season, median prices – while still near record highs – are beginning to cool off, especially with the holiday season right around the corner. We continue to see prospective buyers making above-list price offers on homes given the ultra-competitive market environment and if the supply shortage holds through the winter, we could expect to see additional rapid price growth in spring 2022, but at a lower rate compared to 2021."

Select findings from this month’s Market Pulse are below. Be sure to review the Market Pulse in full for extensive state-level data.

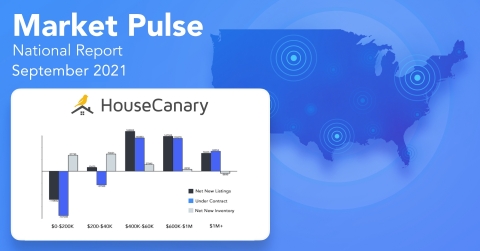

Total Net New Listings:

- Since September 2020, there have been 3,201,229 net new listings placed on the market, which is an 9.9% increase versus the same period in 2020

-

Percentage of total net new listings over the last 52 weeks, broken down by home price:

- $0-$200k: 18.0%

- $200k-$400k: 41.3%

- $400k-$600k: 20.8%

- $600k-$1mm: 13.3%

- >$1mm: 6.6%

-

Percent change in net new listing activity over the last 52 weeks versus the same period in 2020, broken down by home price:

- $0-$200k: (-17.2%)

- $200k-$400k: +1.2%

- $400k-$600k: +34.0%

- $600k-$1mm: +53.1%

- >$1mm: +55.9%

Monthly Net New Listing Volume (Single-Family Detached Homes):

- Monthly new listing volume was down 10% compared to September 2020

- In September, there were 287,468 net new listings placed on the market, representing a 14.0% decrease year-over-year

-

For the month of September, the percent change in net new listing volume compared to September 2020, broken down by home price:

- $0-$200k: (-27.1%)

- $200k-$400k: (-18.6%)

- $400k-$600k: +0.7%

- $600k-$1mm: +3.1%

- >$1mm: (-11.6%)

Listings Under Contract:

- Over the last 52 weeks, 3,421,890 properties have gone into contract, representing a 3.6% increase relative to the same period in 2020

-

Percentage of total contract volume since September 2020, broken down by home price:

- $0-$200k: 18.4%

- $200k-$400k: 41.6%

- $400k-$600k: 20.4%

- $600k-$1mm: 13.0%

- >$1mm: 6.6%

-

Percent change in contract volume over the last 52 weeks versus the same period in 2020, broken down by home price:

- $0-$200k: (-23.0%)

- $200k-$400k: (-3.9%)

- $400k-$600k: +25.3%

- $600k-$1mm: +45.6%

- >$1mm: +58.7%

Monthly Contract Volume (Single-Family Detached Homes):

- For the month of September, there were 352,185 listings that went under contract nationwide, which is a 1.7% decrease year-over-year

-

For the month of September, the percent change in contract volume compared to September 2020, broken down by home price:

- $0-$200k: (-12.5%)

- $200k-$400k: (-7.1%)

- $400k-$600k: +12.1%

- $600k-$1mm: +14.2%

- >$1mm: +2.4%

Median Listing Price Activity (Single-Family Detached Homes):

- For the week ending October 1, 2021, the median price of all single-family listings in the U.S. was $383,800, a 7.5% increase year-over-year

- For the week ending October 1, 2021, the median closed price of single-family listings in the U.S. was $383,878, a13.9% increase year-over-year

- The median price of all single-family listings in the U.S. is down 0.3% month-over-month and the median price of closed listings has increased by 0.2% month-over-month

As a nationwide real estate broker, HouseCanary’s broad multiple listing service (“MLS”) participation allows us to evaluate listing data and aggregate the number of new listings as well as the number of new listings going into contract for all single-family detached homes observed in the HouseCanary database. Using this data, HouseCanary continues to track listing volume, new listings, and median list price for 41 states and 50 individual Metropolitan Statistical Areas (“MSAs”).

About HouseCanary

Founded in 2013, valuation-focused real estate brokerage HouseCanary empowers consumers, financial institutions, investors, lenders, and mortgage investors, with industry-leading valuations, forecasts, and transaction support. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more. Learn more at www.housecanary.com.

If you are currently working with a real estate agent, this is not meant as a solicitation of your business.

HouseCanary, Inc. is a Licensed Real Estate Brokerage in KS, NM, SC and under the Trade Name ComeHome in AL, AK, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KY, LA, MA, MD, ME, MO, MN, MS, MT, NC, ND, NE, NH, NJ, NV, NY, OH, OK, OR, PA, RI, SD, TN, TX, VA, VT, WA, WI, WV, WY.

Trade Name ComeHome Real Estate in MI and UT.

Trade Name ComeHome by HouseCanary in AR.

HouseCanary, Inc., brokerage information

TREC Info About Brokerage Services

TREC Consumer Protection Notice

California DRE #02113022

AVM Disclosure: An AVM is an estimated sale price for a property. It is not the same as the opinion of value in an appraisal developed by a licensed appraiser under the Uniform Standards of Professional Appraisal Practice.

Contacts

MKA

Ashley Areopagita / Bela Kirpalani

housecanary@mkacomms.com