Fifth Third Marks National Financial Capability Month With Virtual Financial Literacy Events with Operation Hope

Fifth Third Marks National Financial Capability Month With Virtual Financial Literacy Events with Operation Hope

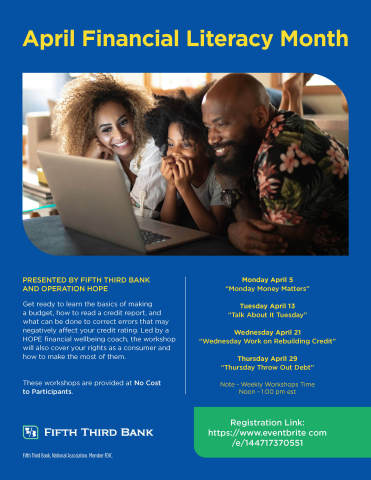

CINCINNATI--(BUSINESS WIRE)--Fifth Third Bank, National Association is pleased to join with Operation Hope to present a series of four free virtual financial education events in April to coincide with National Financial Capability Month, also commonly known across the U.S. as Financial Literacy Month.

Fifth Third and Operation Hope’s webinar events are designed to promote personal financial empowerment and will address topics such as rebuilding credit, budgeting, saving and eliminating debt. Each webinar is from noon to 1 p.m., ET. Topics and registration are as follows:

- April 5, Monday Money Matters: Budgeting and Managing Money

- April 13, Talk About it Tuesday: Saving Money and Tax Refund Tips

- April 21, Wednesday Work on Rebuilding Credit: Improving Your Personal Credit

- April 29, Thursday Throw Out Debt: Useful Tips and Tools on Debt Management

Since 2004, Fifth Third Bank has been a leader in the delivery of financial education programs. Fifth Third L.I.F.E. (Lives Improved through Financial Empowerment®) programs are designed to financially empower people at every age and every stage of life. Over 2.6 million people have been financially educated through Fifth Third’s programs over the last 17 years. In 2020, Fifth Third transitioned many of its L.I.F.E. programs into a virtual format—and expanded access to them—to continue to provide this service at no cost during the COVID-19 pandemic.

The Young Bankers Club® helps students learn key math life skills online at any time. Nearly 500,000 students have been impacted by this financial literacy education. Young Bankers Club features comprehensive curriculum that meets national and state educational standards for fifth-grade mathematics and provides a unique, engaging approach to financial literacy that helps students apply their knowledge gradually as they work toward more complex scenarios. The digital program introduces 10-year-old character, Maximillion Money™, the president of Young Bankers Club®. Maximillion Money™ guides students on a journey that takes them to financial sites such as the New York Stock Exchange and the U.S. Mint and also takes them to a virtual Fifth Third financial center. Students discover hidden clues, win rewards and badges, unlock avatars, and level up to new adventures each week.

Fifth Third Finance Academy is a financial education and entrepreneurship program for high school students offered at no cost to schools or taxpayers. The course builds the foundation for students’ future well-being through a series of 30-45-minute financial education modules, covering topics like investing basics and common financial accounts. More than 1.5 million students have been impacted by this literacy education before beginning their adult lives. Modules provide bite-sized instruction that make topics approachable and relatable. Also, Finance Academy immerses students in real-life financial scenarios and documentation, such as filling out a FAFSA form. Through the entrepreneurship course, Finance Academy focuses on building and empowering the next generation of business owners and entrepreneurs by guiding them through the creation of a business plan—from idea generation to taking a business to market to sustainable business practices for growth.

Fifth Third Bank Empower U® is a program for adults delivered directly to Fifth Third business clients as an offering for their employees and through community outreach in partnership with local non-profit and community development organizations. Fifth Third Retirement University is a free educational program that helps consumers prepare for aspects of retirement.

In addition, the Bank reaches out to the community through the Financial Empowerment Mobile, or eBus, a high-tech financial classroom on wheels. It is staffed by Fifth Third professionals and travels throughout the Bank's markets to reach neighborhoods in low- and moderate-income areas that have been traditionally underserved by banks. Nearly 500,000 individuals have been impacted by the eBus since 2004. The mission of the Financial Empowerment Mobile, as well as a pop-up shop called Banking to Go, is to take quality financial products and services directly to people and empower them to take control of their financial future. Last year, Financial Empowerment Mobile services went virtual to meet the needs of the community.

About Operation HOPE

Operation HOPE is a nonprofit for-purpose organization working to disrupt poverty and empower inclusion for low and moderate-income youth and adults. Operation HOPE’s focus is financial dignity and inclusion. The organization equips young people and adults with the financial tools and education to secure a better future—coaching them through their personal aspirations and life’s challenges and facilitating their journey to financial independence. Since 1992, Operation Hope has been moving America from civil rights to “silver rights” with the mission of making free enterprise and capitalism work for the underserved. Follow Operation HOPE on Twitter and Facebook @operationhope and online at operationhope.org.

About Fifth Third

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio and the indirect parent company of Fifth Third Bank, National Association, a federally chartered institution. As of Dec. 31, 2020, Fifth Third had $205 billion in assets and operated 1,134 full-service banking centers and 2,397 ATMs with Fifth Third branding in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, North Carolina and South Carolina. In total, Fifth Third provides its customers with access to approximately 52,000 fee-free ATMs across the United States. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending and Wealth & Asset Management. Fifth Third is among the largest money managers in the Midwest and, as of Dec. 31, 2020, had $434 billion in assets under care, of which it managed $54 billion for individuals, corporations and not-for-profit organizations through its Trust and Registered Investment Advisory businesses. Investor information and press releases can be viewed at www.53.com. Fifth Third’s common stock is traded on the Nasdaq® Global Select Market under the symbol “FITB.” Fifth Third Bank was established in 1858. Deposit and Credit products are offered by Fifth Third Bank, National Association. Member FDIC.

Contacts

Stacie Haas (Media Relations)

Stacie.Haas@53.com | 513-534-5113

Chris Doll (Investor Relations)

Christopher.Doll@53.com | 513-534-2345