Three-fourths of All New Cars to be Connected in Five Years

Three-fourths of All New Cars to be Connected in Five Years

- Half of all cars shipped in 2020 will be connected

SAN DIEGO & BUENOS AIRES & LONDON & NEW DELHI & HONG KONG & BEIJING & SEOUL--(BUSINESS WIRE)--The global connected car market is expected to double in the next five years with more than 270 million of such cars to be shipped during 2020-2025, according to the latest research from Counterpoint’s Smart Automotive service. The data only represents the global passenger car shipments with embedded connectivity and does not include connectivity via smartphone.

Commenting on the findings, Senior Analyst Aman Madhok said, “The market saw a healthy growth of 18% YoY in Q2 2020 with connected car shipments reaching close to seven million units during the period. The penetration of connectivity in cars continues to increase, and 2020 will see half of all cars sold worldwide having embedded connectivity in them.”

Discussing the impact of COVID-19 on the market, Madhok added, “While the market witnessed YoY growth, the shipments declined by 5% when compared to Q1 2020 due to the subdued passenger car sales following the COVID-19 pandemic, even though rebounding car sales in China helped in market recovery to some extent.”

Commenting on the findings from the connectivity perspective, Research Associate Fahad Siddique said, “Automakers continue to adopt the latest technology, with 4G LTE-based connected cars accounting for almost 88% of all shipments in Q2 2020. 5G connected cars will enter mass production next year. By 2025, one out of every five connected cars will have 5G embedded connectivity. China and the US will together account for the majority of 5G connected cars sold in the next five years.”

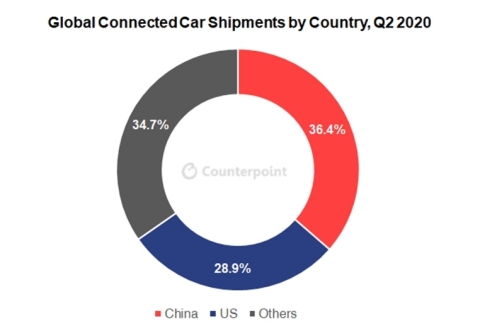

Discussing the key trends, Research Director Peter Richardson said, “While the E-call regulation has been driving connected car shipments in Europe, increasing cockpit digitization coupled with customer preference for connected services is driving the growth in the US and China. Both the countries together accounted for close to two-thirds of connected car shipments in Q2 2020. Automakers too are promoting connected services to attract buyers and earn additional revenue through subscriptions.”

The comprehensive and in-depth ‘Global Connected Car Tracker 2020’ is now available for purchase at report.counterpointinsights.com. Feel free to reach out to us at press(at)counterpointresearch.com for further questions regarding our latest research and insights, or for press enquiries.

Contacts

Analysts:

Neil Shah

neil@counterpointresearch.com

Aman Madhok

aman@counterpointresearch.com

Fahad Siddiqui

fahad@counterpointresearch.com