SAN FRANCISCO--(BUSINESS WIRE)--Glu Mobile Inc. (NASDAQ:GLUU), a leading global developer and publisher of mobile games, today announced financial results for its third quarter ended September 30, 2020. The company also provided an outlook for its financial performance in the fourth quarter and raised its financial guidance for the full year 2020.

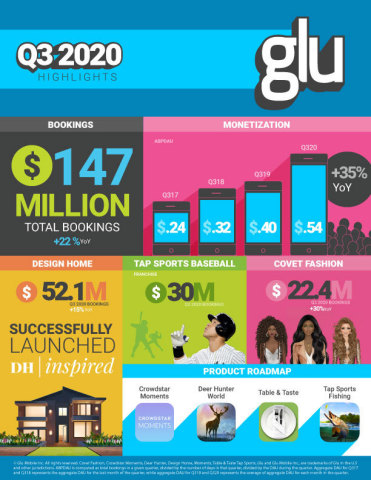

“We followed up a very strong second quarter with a better-than-expected third quarter that saw year-over-year bookings growth of 22% led by the continued strong performance of our Growth Games,” said Nick Earl, Chief Executive Officer. “Our focus on margin expansion led to significantly higher profitability driven by greater productivity from our marketing spend. We announced the title and genre of our new Crowdstar game, Table & Taste, which will serve the culinary category and complement our Crowdstar brand perfectly with a larger and more diverse addressable user base. We anticipate a very strong finish to the year driven by our core brands, Crowdstar and Glu Sports, as well as our growth initiatives. Looking ahead, our continued expected growth, future game launches, and strategic initiatives give us confidence as we enter 2021 with significant, positive momentum.”

Third Quarter 2020 Financial Highlights:

| Three Months Ended | ||

| in millions, except per share data | September 30, 2020 | September 30, 2019 |

| Revenue | $158.5 |

$107.1 |

| Gross margin | 63.9% |

64.7% |

| Net income/(loss) | $13.4 |

($5.1) |

| Net income/(loss) per share – basic | $0.08 |

($0.03) |

| Net income/(loss) per share – diluted | $0.07 |

($0.03) |

| Weighted-average common shares outstanding – basic | 171.3 |

146.2 |

| Weighted-average common shares outstanding – diluted | 181.6 |

146.2 |

| Cash generated from operations excluding royalty advances | 33.4 |

$3.3 |

| Cash paid for royalty advances that are included in cash used in operations | (1.2) |

($0.0) |

| Cash and cash equivalents | $318.1 |

$102.4 |

| Additional Financial Information | |||||

Three Months Ended |

|

Guidance provided for three months ended

|

|||

September 30, 2020 |

September 30, 2019 |

|

Low |

High |

|

| Bookings | $147.3 |

$120.4 |

|

$130.0 |

$135.0 |

| Platform commissions, excluding any impact of deferred platform commissions* | $39.7 |

$32.1 |

|

$35.6 |

$36.9 |

| Royalties, excluding any impact of deferred royalties* | $9.9 |

$7.2 |

|

$9.0 |

$9.3 |

| Hosting costs | $1.9 |

$2.0 |

|

$2.1 |

$2.3 |

| User acquisition and marketing expenses | $34.5 |

$40.2 |

|

$36.9 |

$37.9 |

| Adjusted other operating expenses* | $36.8 |

$30.7 |

|

$38.9 |

$39.1 |

| Depreciation | $1.4 |

$1.0 |

|

$1.5 |

$1.5 |

| * Platform commissions, excluding any impact of deferred platform commissions, Royalties, excluding any impact of deferred royalties, and Adjusted other operating expenses are non-GAAP financial measures. These non-GAAP financial items should be considered in addition to, but not as a substitute for, the information provided in accordance with GAAP. Reconciliations for these non-GAAP financial items to the most directly comparable financial items based on GAAP are provided in GAAP to Adjusted results reconciliation table. |

“Our strong third quarter financial results reflect continued positive player engagement trends and higher monetization as our business scales,” said Eric R. Ludwig, COO and CFO. “Our much stronger than anticipated profitability and solid cash flow generation was driven by strong bookings growth, more efficient and productive UA investment, and operating expense reductions. Our balance sheet remains strong and liquid with $318.1 million in cash, supporting our acquisition growth strategy. Based on our significant third quarter outperformance, we are raising our assumptions on the top and bottom line for the fourth quarter and the full year 2020.”

Financial Outlook as of November 5, 2020:

Glu is providing its financial outlook for the fourth quarter of 2020 and updating guidance for the full year 2020 as follows:

Fourth Quarter 2020 Guidance:

| in millions | Low | High |

| Bookings | $119.5 |

$124.5 |

| Platform commissions, excluding any impact of deferred platform commissions | $32.3 |

$36.6 |

| Royalties, excluding any impact of deferred royalties | $7.6 |

$8.0 |

| Hosting costs | $1.7 |

$1.8 |

| User acquisition and marketing expenses | $19.0 |

$19.0 |

| Adjusted other operating expenses | $38.4 |

$38.6 |

| Depreciation | $1.5 |

$1.5 |

|

|

|

| Supplemental information: |

|

|

| Income tax | $1.5 |

$1.5 |

| Stock-based compensation | $8.8 |

$8.8 |

| Amortization of intangible assets | $0.6 |

$0.6 |

| Weighted-average common shares outstanding – basic | 172.5 |

172.5 |

| Weighted-average common shares outstanding – diluted | 185.2 |

185.2 |

Full Year 2020 Guidance:

| in millions | Low | High |

| Bookings | $555.3 |

$560.3 |

| Platform commissions, excluding any impact of deferred platform commissions | $150.1 |

$154.4 |

| Royalties, excluding any impact of deferred royalties | $37.9 |

$38.3 |

| Hosting costs | $7.6 |

$7.7 |

| User acquisition and marketing expenses | $146.1 |

$146.1 |

| Adjusted other operating expenses | $148.0 |

$148.2 |

| Depreciation | $5.6 |

$5.6 |

|

|

|

| Supplemental information: |

|

|

| Income tax | $1.4 |

$1.4 |

| Stock-based compensation | $31.8 |

$31.8 |

| Amortization of intangible assets | $3.3 |

$3.3 |

| Weighted-average common shares outstanding – basic | 162.5 |

162.5 |

| Weighted-average common shares outstanding – diluted | 173.2 |

173.2 |

| Cash and cash equivalent balance | At least $365.0 |

|

Glu does not provide guidance on a GAAP basis primarily due to the fact that Glu is unable to predict, with reasonable accuracy, future changes in its deferred revenue and corresponding cost of revenue. The amount of Glu’s deferred revenue and cost of revenue for any given period is difficult to predict due to differing estimated useful lives of paying users across games, variability of monthly revenue, platform commissions and royalties by game and unpredictability of revenue from new game releases. Future changes in deferred revenue and deferred cost of revenue are uncertain and could be material to Glu’s results computed in accordance with GAAP. Accordingly, Glu is unable to provide a reconciliation of the non-GAAP financial measure guidance to the corresponding GAAP measure without unreasonable effort.

Quarterly Conference Call Information:

Glu will discuss its quarterly results via teleconference today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). Please dial (866) 582-8907 (domestic), or (760) 298-5046 (international), with conference ID #7448906 to access the conference call at least five minutes prior to the 2:00 p.m. Pacific Time start time. A live webcast and replay of the call will also be available on the investor relations portion of the company's website at www.glu.com/investors. An audio replay will be available between 5:00 p.m. Pacific Time, November 5, 2020, and 8:59 p.m. Pacific Time, November 12, 2020, by calling (855) 859-2056, or (404) 537-3406, with conference ID #7448906.

Disclosure Using Social Media Channels

Glu currently announces material information to its investors using SEC filings, press releases, public conference calls and webcasts. Glu uses these channels as well as social media channels to announce information about the company, games, employees and other issues. Given SEC guidance regarding the use of social media channels to announce material information to investors, Glu is notifying investors, the media, its players and others interested in the company that in the future, it might choose to communicate material information via social media channels or, it is possible that information it discloses through social media channels may be deemed to be material. Therefore, Glu encourages investors, the media, players and others interested in Glu to review the information posted on the company forum (http://ggnbb.glu.com/forum.php) and the company Facebook site (https://www.facebook.com/glumobile) and the company twitter account (https://twitter.com/glumobile). Investors, the media, players or other interested parties can subscribe to the company blog and twitter feed at the addresses listed above. Any updates to the list of social media channels Glu will use to announce material information will be posted on the Investor Relations page of the company's website at www.glu.com/investors.

Use of Non-GAAP Financial Measures

To supplement Glu's unaudited condensed consolidated financial data presented in accordance with GAAP, Glu uses certain non-GAAP measures of financial performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Glu's results of operations as determined in accordance with GAAP. The non-GAAP financial measures used by Glu include historical and estimated bookings, platform commissions, excluding any impact of deferred platform commissions, royalties, excluding any impact of deferred royalties, and adjusted operating expenses. These non-GAAP financial measures exclude the following items from Glu's unaudited consolidated statements of operations:

- Change in deferred platform commissions;

- Change in deferred royalties;

- Amortization of intangible assets;

- Stock-based compensation expense;

- Transitional costs;

- Litigation costs; and

- Restructuring costs

Bookings do not reflect the deferral of certain game revenue that Glu recognizes over the estimated useful lives of paying users of Glu’s games and excludes changes in deferred revenue.

Glu may consider whether significant items that arise in the future should also be excluded in calculating the non-GAAP financial measures it uses.

Glu believes that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding Glu's performance by excluding certain items that may not be indicative of Glu's core business, operating results or future outlook. Glu's management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing Glu's operating results, as well as when planning, forecasting and analyzing future periods. These non-GAAP financial measures also facilitate comparisons of Glu's performance to prior periods.

Cautions Regarding Forward-Looking Statements

This news release contains forward-looking statements, including those regarding our “Financial Outlook as of November 5, 2020” (“Fourth Quarter 2020 Guidance,” “Full Year 2020 Guidance”), and the statements that we expect significantly higher bottom-line results for full year 2020; that Table & Taste will be the third title launched by the Crowdstar studio and offers a strong growth opportunity with a larger and more diverse addressable user base; that the core business driven by the Crowdstar and Glu Sports brands, along with new titles and growth initiatives, positions the company for higher growth in 2021; that we anticipate a very strong finish to the year driven by our core brands, Crowdstar and Glu Sports, as well as our growth initiatives; that our continued expected growth, future game launches, and strategic initiatives give us confidence as we enter 2021 with significant, positive momentum; and that our strong and liquid balance sheet supports our acquisition growth strategy.

These forward-looking statements are subject to material risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Investors should consider important risk factors, which include: the risk that consumer demand for smartphones, tablets and next-generation platforms does not grow as significantly as we anticipate or that we will be unable to capitalize on any such growth; the risk that we do not realize a sufficient return on our investment with respect to our efforts to develop free-to-play games for smartphones, tablets and next-generation platforms, the risk that we will be unable build successful Growth Games that provide predictable bookings and year over year growth; the risk that we will not be able to maintain our good relationships with Apple and Google; the risk that our development expenses for games for smartphones, tablets and next-generation platforms are greater than we anticipate; the risk that our recently and newly launched games are less popular than anticipated or decline in popularity and monetization rate more quickly than we anticipate; the risk that our newly released games will be of a quality less than desired by reviewers and consumers; the risk that the mobile games market, particularly with respect to free-to-play gaming, is smaller than anticipated; the risk that we may lose a key intellectual property license; the risk that we are unable to recruit and retain qualified personnel for developing and maintaining the games in our product pipeline resulting in reduced monetization of a game, product launch delays or games being eliminated from our pipeline altogether; the risks related to the COVID-19 pandemic; and other risks detailed under the caption "Risk Factors" in our Form 10-Q filed with the Securities and Exchange Commission on August 7, 2020 and our other SEC filings. You can locate these reports through our website at http://www.glu.com/investors. We are under no obligation, and expressly disclaim any obligation, to update or alter our forward-looking statements whether as a result of new information, future events or otherwise.

About Glu Mobile

Glu Mobile (NASDAQ:GLUU) is a leading developer and publisher of mobile games. Founded in 2001, Glu is headquartered in San Francisco with additional locations in Foster City, Orlando, Toronto and Hyderabad. With a history spanning over a decade, Glu’s culture is rooted in taking smart risks and fostering creativity to deliver world-class interactive experiences for our players. Glu’s diverse portfolio features top-grossing and award-winning original and licensed IP titles including, Covet Fashion, Deer Hunter, Design Home, Diner DASH Adventures, Disney Sorcerer’s Arena, Kim Kardashian: Hollywood and MLB Tap Sports Baseball available worldwide on various platforms including the App Store and Google Play. For more information, visit www.glu.com or follow Glu on Twitter, Facebook and Instagram.

Covet Fashion, Deer Hunter, Design Home, Diner DASH, Table & Taste, Tap Sports, Glu and Glu Mobile are trademarks of Glu Mobile Inc.

| Glu Mobile Inc. | ||||||||||||||||

| Condensed Consolidated Statements of Operations | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

2020 |

2019 |

2020 |

2019 |

|||||||||||||

| Revenue | $ |

158,531 |

|

$ |

107,077 |

|

$ |

399,121 |

|

$ |

298,502 |

|

||||

| Cost of revenue: | ||||||||||||||||

| Platform commissions, royalties and other |

|

56,390 |

|

|

36,758 |

|

|

140,091 |

|

|

102,834 |

|

||||

| Amortization of intangible assets |

|

888 |

|

|

1,040 |

|

|

2,663 |

|

|

3,348 |

|

||||

| Total cost of revenue |

|

57,278 |

|

|

37,798 |

|

|

142,754 |

|

|

106,182 |

|

||||

| Gross profit |

|

101,253 |

|

|

69,279 |

|

|

256,367 |

|

|

192,320 |

|

||||

| Operating expenses: | ||||||||||||||||

| Research and development |

|

30,778 |

|

|

22,968 |

|

|

88,729 |

|

|

69,250 |

|

||||

| Sales and marketing |

|

42,222 |

|

|

46,140 |

|

|

150,168 |

|

|

109,285 |

|

||||

| General and administrative |

|

7,870 |

|

|

5,879 |

|

|

21,803 |

|

|

17,465 |

|

||||

| Total operating expenses |

|

80,870 |

|

|

74,987 |

|

|

260,700 |

|

|

196,000 |

|

||||

| Income/(loss) from operations |

|

20,383 |

|

|

(5,708 |

) |

|

(4,333 |

) |

|

(3,680 |

) |

||||

| Interest and other income/(expense), net: |

|

413 |

|

|

271 |

|

|

782 |

|

|

1,591 |

|

||||

| Income/(loss) before income taxes |

|

20,796 |

|

|

(5,437 |

) |

|

(3,551 |

) |

|

(2,089 |

) |

||||

| Income tax benefit/(provision) |

|

(7,391 |

) |

|

348 |

|

|

117 |

|

|

170 |

|

||||

| Net income/(loss) | $ |

13,405 |

|

$ |

(5,089 |

) |

$ |

(3,434 |

) |

$ |

(1,919 |

) |

||||

| Net income/(loss) loss per common share - basic | $ |

0.08 |

|

$ |

(0.03 |

) |

$ |

(0.02 |

) |

$ |

(0.01 |

) |

||||

| Net income/(loss) per common share - diluted | $ |

0.07 |

|

$ |

(0.03 |

) |

$ |

(0.02 |

) |

$ |

(0.01 |

) |

||||

| Weighted average common shares outstanding - basic |

|

171,252 |

|

|

146,210 |

|

|

159,201 |

|

|

145,381 |

|

||||

| Weighted average common shares outstanding - diluted |

|

181,590 |

|

|

146,210 |

|

|

159,201 |

|

|

145,381 |

|

||||

| Glu Mobile Inc. | ||||||||

| Condensed Consolidated Balance Sheets | ||||||||

| (in thousands) | ||||||||

| (unaudited) | ||||||||

| September 30, | December 31, | |||||||

2020 |

2019 |

|||||||

| ASSETS | ||||||||

| Cash and cash equivalents | $ |

318,099 |

|

$ |

127,053 |

|

||

| Accounts receivable, net |

|

53,592 |

|

|

29,304 |

|

||

| Prepaid royalties |

|

14,516 |

|

|

15,347 |

|

||

| Deferred royalties |

|

7,937 |

|

|

5,067 |

|

||

| Deferred platform commission fees |

|

40,248 |

|

|

29,239 |

|||

| Prepaid expenses and other assets |

|

10,835 |

|

|

8,629 |

|||

| Total current assets |

|

445,227 |

|

|

214,639 |

|

||

| Property and equipment, net |

|

16,854 |

|

|

17,643 |

|

||

| Operating lease right of use assets |

|

32,512 |

|

|

35,170 |

|

||

| Long-term prepaid royalties |

|

20,658 |

|

|

26,879 |

|

||

| Other long-term assets |

|

2,939 |

|

|

2,733 |

|

||

| Intangible assets, net |

|

2,096 |

|

|

4,758 |

|

||

| Goodwill |

|

116,227 |

|

|

116,227 |

|

||

| Total assets | $ |

636,513 |

|

$ |

418,049 |

|

||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Accounts payable and accrued liabilities | $ |

15,609 |

|

|

17,535 |

|

||

| Accrued compensation |

|

18,072 |

|

|

11,260 |

|

||

| Accrued royalties |

|

16,070 |

|

|

20,802 |

|

||

| Short-term operating lease liabilities |

|

4,677 |

|

|

3,528 |

|

||

| Deferred revenue |

|

134,311 |

|

|

97,629 |

|||

| Total current liabilities |

|

188,739 |

|

|

150,754 |

|||

| Long-term accrued royalties |

|

20,559 |

|

|

26,842 |

|

||

| Long-term operating lease liabilities |

|

35,740 |

|

|

37,351 |

|||

| Other long-term liabilities |

|

1,104 |

|

|

15 |

|||

| Total liabilities |

|

246,142 |

|

|

214,962 |

|

||

| Common stock |

|

17 |

|

|

15 |

|

||

| Additional paid-in capital |

|

825,460 |

|

|

634,721 |

|

||

| Accumulated other comprehensive loss |

|

(60 |

) |

|

(37 |

) |

||

| Accumulated deficit |

|

(435,046 |

) |

|

(431,612 |

) |

||

| Total stockholders' equity |

|

390,371 |

|

|

203,087 |

|||

| Total liabilities and stockholders' equity | $ |

636,513 |

|

$ |

418,049 |

|

||

| Glu Mobile Inc. | ||||||||||||||||||||||||

| GAAP to Adjusted Results Reconciliation | ||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

Three Months Ended |

||||||||||||||||||||||||

| June 30, | September 30, | December 31, | March 31, | June 30, | September 30, | |||||||||||||||||||

2019 |

|

2019 |

|

2019 |

|

2020 |

|

2020 |

|

2020 |

||||||||||||||

| GAAP platform commissions | $ |

24,799 |

|

$ |

28,122 |

|

$ |

30,092 |

|

$ |

28,727 |

|

$ |

35,032 |

|

$ |

43,040 |

|

||||||

| Change in deferred platform commissions |

|

1,860 |

|

|

3,972 |

|

|

(1,345 |

) |

|

(232 |

) |

|

14,613 |

|

|

(3,371 |

) |

||||||

| Platform Commissions, excluding any impact of deferred platform commissions | $ |

26,659 |

|

$ |

32,094 |

|

$ |

28,747 |

|

$ |

28,495 |

|

$ |

49,645 |

|

$ |

39,669 |

|

||||||

| GAAP royalties (including impairment of royalties and minimum guarantees) | $ |

6,245 |

|

$ |

6,643 |

|

$ |

6,285 |

|

$ |

6,381 |

|

$ |

9,617 |

|

$ |

11,467 |

|

||||||

| Change in deferred royalties |

|

1,071 |

|

|

592 |

|

|

(410 |

) |

|

1 |

|

|

4,420 |

|

|

(1,551 |

) |

||||||

| Royalties, excluding any impact of deferred royalties | $ |

7,316 |

|

$ |

7,235 |

|

$ |

5,875 |

|

$ |

6,382 |

|

$ |

14,037 |

|

$ |

9,916 |

|

||||||

| GAAP other operating expenses (GAAP operating expenses excluding user acquisition and marketing expenses) | $ |

29,652 |

|

$ |

34,791 |

|

$ |

37,904 |

|

$ |

43,307 |

|

$ |

43,921 |

|

$ |

46,330 |

|

||||||

| Stock-based compensation |

|

(2,035 |

) |

|

(4,080 |

) |

|

(4,461 |

) |

|

(6,382 |

) |

|

(8,106 |

) |

|

(8,523 |

) |

||||||

| Transitional costs |

|

(5 |

) |

|

(5 |

) |

|

(1 |

) |

|

(4 |

) |

|

- |

|

|

- |

|

||||||

| Litigation costs |

|

416 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

||||||

| Restructuring costs |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(1,015 |

) |

||||||

| Adjusted other operating expenses | $ |

28,028 |

|

$ |

30,706 |

|

$ |

33,442 |

|

$ |

36,921 |

|

$ |

35,815 |

|

$ |

36,792 |

|

||||||

In addition to the reasons stated above, which are generally applicable to each of the items Glu excludes from its non-GAAP financial measures, Glu believes it is appropriate to exclude certain items for the following reasons:

Change in Deferred Platform Commissions and Deferred Royalties. At the date we sell certain premium games and micro-transactions, Glu has an obligation to provide additional services and incremental unspecified digital content in the future without an additional fee. In these cases, we recognize any associated cost of revenue, including platform commissions and royalties, on a straight-line basis over the estimated life of the paying user. Internally, Glu’s management excludes the impact of the changes in deferred platform commissions and deferred royalties related to its premium and free-to-play games in its non-GAAP financial measures when evaluating the company’s operating performance, when planning, forecasting and analyzing future periods, and when assessing the performance of its management team. Glu believes that excluding the impact of the changes in deferred platform commissions and deferred royalties from its operating results is important to facilitate comparisons to prior periods and to understand Glu’s operations.

Amortization of Intangible Assets. When analyzing the operating performance of an acquired entity or intangible asset, Glu's management focuses on the total return provided by the investment (i.e., operating profit generated from the acquired entity as compared to the purchase price paid) without taking into consideration any allocations made for accounting purposes. Because the purchase price for an acquisition necessarily reflects the accounting value assigned to intangible assets (including acquired in-process technology and goodwill), when analyzing the operating performance of an acquisition in subsequent periods, Glu's management excludes the GAAP impact of acquired intangible assets to its financial results. Glu believes that such an approach is useful in understanding the long-term return provided by an acquisition, and that investors benefit from a supplemental non-GAAP financial measure that excludes the accounting expense associated with acquired intangible assets.

Stock-Based Compensation Expense. Glu applies the fair value provisions of Accounting Standard Codification Topic 718, Compensation-Stock Compensation (“ASC 718”). ASC 718 requires the recognition of compensation expense, using a fair-value based method, for costs related to all share-based payments. Glu's management team excludes stock-based compensation expense from its short and long-term operating plans. In contrast, Glu's management team is held accountable for cash-based compensation and such amounts are included in its operating plans. Further, when considering the impact of equity award grants, Glu places a greater emphasis on overall stockholder dilution rather than the accounting charges associated with such grants. Glu believes it is useful to provide a non-GAAP financial measure that excludes stock-based compensation in order to better understand the long-term performance of its business.

Transitional Costs. GAAP requires expenses to be recognized for various types of events associated with a business acquisition such as legal, accounting and other deal related expenses. Transitional costs also include divestiture related expenses and termination of certain game related contracts. Glu believes that these transitional costs affect comparability from period to period and that investors benefit from a supplemental non-GAAP financial measure that excludes these expenses.

Litigation Costs. Glu incurred legal costs related to the complaint filed by the former Chief Executive Officer of Crowdstar in the Superior Court of the State of California for the County of Santa Clara against Glu, Time Warner Inc., Intel Capital Corporation, Middlefield Ventures Inc., Rachel Lam, and Jose Blanc. Glu believes that these legal costs have no direct correlation to the operation of its ongoing core business and affect comparability from period to period and, as a result, that investors benefit from a supplemental non-GAAP financial measure that excludes these expenses.

Restructuring Costs. Glu undertook restructuring activities in the third quarter of 2020 and recorded restructuring charges due to the termination of certain employees in its Canada and U.S. offices. Glu recorded the severance costs as an operating expense when it communicated the benefit arrangement to the employees and no significant future services, other than a minimum retention period, were required of the employees to earn the termination benefits. Glu believes that these restructuring charges do not reflect its ongoing operations and that investors benefit from a supplemental non-GAAP financial measure that excludes these charges.