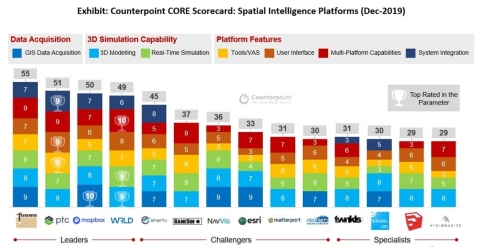

Counterpoint Research: Fugro, PTC and Mapbox Lead the Spatial Intelligence Platform Capabilities

Counterpoint Research: Fugro, PTC and Mapbox Lead the Spatial Intelligence Platform Capabilities

WRLD, Nomoko and Gamesim are providing customized solutions while NavVis, Enertiv, Siradel Engie and SketchUp are developing niche categories

NEW DELHI & HONG KONG & SEOUL & LONDON & BEIJING & SAN DIEGO & BUENOS AIRES--(BUSINESS WIRE)--With the expansion of connectivity, several innovative technologies are becoming more prevalent; location intelligence is one; leveraging location and positioning data to generate insights and create value. However, location intelligence and navigation have historically lacked the ability to navigate effectively inside buildings. This has given rise to a technology innovation that we term “Spatial Intelligence.”

Spatial intelligence platforms leverage real-time simulation of 3D models to provide visualized real-time insights, which include absorbing multiple data sets, IoT integration and enabling rapid development of digital twins. The technology can collaborate with existing new technologies like smart city, digital twins, Industry 4.0, AR/VR to create multiple innovative use-cases.

Commenting on the existing platforms’ capabilities, Prachir Singh, Senior Analyst said, “Fugro leads the Spatial Intelligence Platform Capability Index followed by PTC and Mapbox, according to Counterpoint’s CORE scorecard. Fugro is a complete spatial intelligence platform having capabilities in every parameter and focuses on Utilities and Natural Resources sector. PTC has been focusing on industrial IoT for Industry 4.0 applications, primarily “digital twins” to focus on monitoring and maintaining assets as well as for training and learning development of industrial workers. Mapbox is using 3D maps and simulation to enhance its dominance in location intelligence. WRLD, is focused on smart buildings and smart venues. Other platforms, like Enertiv and NavVis, are focusing on in-building navigation and positioning, and other related insights.”

Spatial intelligence platforms can be applied in multiple ways to create value through improvements in operational efficiency, enabling businesses to generate incremental revenues in existing businesses as well as support the creation of new and unconventional sources of revenue. As the spatial intelligence sector is in a nascent stage, leading players in real estate, manufacturing and automation, utilities and infrastructure, event management as well as AR/VR and gaming, should partner with these platforms to enhance their offerings. This will drive their existing digital transformation by making digital twins of assets, visualization of IoT data and integration of new technologies like augmented reality to drive user experience.

The comprehensive report on “Spatial Intelligence Platforms and Ecosystem” can be download here.

Contacts

Analysts:

Prachir Singh

prachir@counterpointresearch.com

+91 9558671354

Gareth Owen

gareth@counterpointresearch.com