Lively Releases 2019 Data Showing HSA Users are Spending, Not Saving

Lively Releases 2019 Data Showing HSA Users are Spending, Not Saving

The majority of HSA contributions are spent on routine healthcare visits, but show a shift toward online retailers and digital health experiences

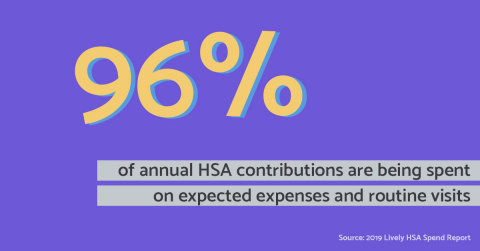

SAN FRANCISCO--(BUSINESS WIRE)--Lively, Inc., creators of the modern Health Savings Account (HSA), today released its second annual HSA Spend Report, giving a view into how and where consumers spend on healthcare costs each year. Findings show that 96 percent of annual contributions were spent on expected expenses and routine visits, indicating that the rising cost of healthcare is preventing people from achieving the long-term benefits of using an HSA to save for unexpected health events and the high cost of healthcare in retirement.

“Rising healthcare costs will have serious implications on the wellbeing of individuals and families,” said Shobin Uralil, COO and Co-Founder of Lively. “As much as people are increasingly putting HSA money aside, our 2019 report alerts us to one dangerous outcome: rather than saving funds to create a safety net for healthcare costs into retirement, Americans have to use almost the entirety of their HSAs to cover basic health needs every year.”

Where did the money go?

In 2019, the average HSA account holder spent their savings on doctor visits and services (50 percent); prescription drug costs (10 percent); dental care (16 percent); vision and eyewear (5 percent); chiropractor (3 percent); lab work (2 percent); and other (1 percent).

Other key findings and trends to note include:

-

While traditional pharmacies lead in healthcare spending, superstores and online retailers are becoming increasingly popular for consumer health spending

- Traditional national pharmacies reign supreme: Of the total 10 percent Rx spend, 76 percent of transactions were at Walgreens, CVS and Rite Aid.

- Superstores are nipping at their heels: 8 percent of spending happened at pharmacies in Target, Walmart, Costco and Sam’s Club.

- Amazon is lurking: While only a small percentage of HSA purchases occurred through Amazon, the web giant captured a large portion of web and mobile purchases (vs. in-store).

- Online spending is key for vision & mental health: More than 15 percent of all HSA vision and eyecare spending happened online, dominated by 1-800-Contacts and Warby Parker. Additionally, more than 15 percent of all mental health spending was through virtual experience apps, and/or digital experiences that connect consumers to mental health professionals.

-

Healthcare spending increased across all categories

- Doctor visits & services spending increased moderately by 22 percent, from 41 percent in 2018 to 50 percent in 2019.

- Hospital spending increased 114 percent - from 7 percent in 2018 to 15 percent in 2019.

- Dental spending increased 78 percent - from 9 percent in 2018 to 16 percent in 2019.

“High deductible healthcare plans are the new norm, and that’s not going to change anytime soon,” continued Uralil. “Combine that with rising healthcare costs in almost every consumer spend category, HSAs are now vital to affording everyday necessities in this country. As such, we must ensure that Americans with HDHPs take advantage of HSAs to put more savings in their pockets."

About Lively

Lively is the modern HSA experience built for—and by—those seeking stability in the ever-shifting healthcare landscape. By harnessing modern innovation and deep industry expertise, Lively is committed to bridging today’s savings with tomorrow’s unknowns. Unlike traditional institutions hindered by bureaucracy, Lively’s commitment extends beyond initial set up. It provides dedicated, ongoing support and education during every step, so that each HSA can reach its maximum potential with minimal headache. Lively is headquartered in San Francisco, CA. For more information please visit Livelyme.com or follow us on Twitter (@LivelyHSA).

Contacts

Jennifer Parson

lively@thekeypr.com