OMAHA, Neb.--(BUSINESS WIRE)--The personal savings rate in the U.S. was about seven percent of income in 20181, and if faced with an unexpected expense of $400, 40 percent of Americans would need to either sell something or borrow money to cover it. 2

Against these dismal statistics, a recent survey conducted for TD Ameritrade uncovered a group of “Super Savers” – Americans whose savings rate tops 20 percent – and revealed just how dramatically their saving and spending behaviors differ from the norm.

“The biggest difference between super savers and others is simply the amount they save – on average, 29 percent of their income, compared to non-super savers, who save six percent,” said Dara Luber, senior manager of retirement at TD Ameritrade. “Three in four super savers are financially independent, or on the path to be, compared to less than half of non-super savers, with more of them heading toward an early retirement.”

Starting Young and Ending Young

Starting young is a key

component of super savers’ investment strategies. More than half (54

percent) began investing by age 30, compared to 39 percent of other

respondents, with three in 10 starting by age 25, compared to two in 10

of their non-super saver counterparts. Just four percent say they don’t

invest at all, compared to 23 percent of non-super savers. Fifty-seven

percent of super savers say they either have retired or plan to retire

earlier than their parents did, compared to 46 percent of non-super

savers.

Spending versus Saving

Super savers are spending less than

non-super savers in nearly every category, with the biggest differences

being in housing (14 percent versus 23 percent of income) and household

expenses (16 percent versus 21 percent of income). Despite these

differences, both of the cohorts allocate the same percentage of their

income to traveling (7 percent).

Financial Independence through Income and Financial Decision Making

Eighty-eight

percent of super savers say it’s worth it to sacrifice now to achieve

financial independence sooner, and 55 percent say they’d rather increase

their savings rate by increasing their income (just 36 percent of

non-super savers say the same). Overall, super savers are strikingly

ahead of non-super savers on four key metrics of financial decision

making:

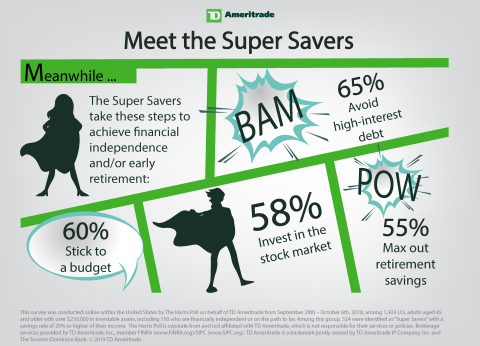

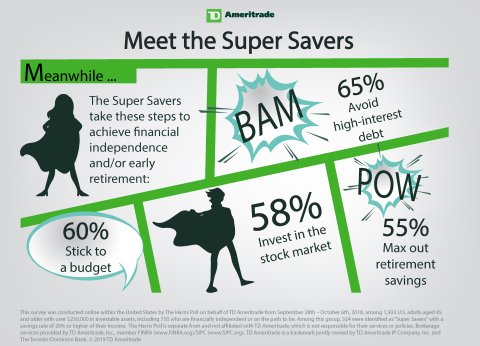

- 65 percent avoid high-interest debt, compared to 56 percent of others

- 60 percent stick to a budget, compared to 49 percent of others

- 58 percent invest in the stock market, compared to 34 percent of others

- 55 percent max out their retirement savings, compared to 30 percent of others

“The good news is that the tools and practices these super savers are employing to pursue their financial goals are available to all Americans,” said Luber. “Low and no-fee ETFs, brokerage accounts with low or no trading fees, retirement accounts, and other investment vehicles are widely available, and it’s never too late to set up a budget or start investing.”

Carefully consider the investment objectives, risks, charges and expenses before investing. A prospectus, obtained by calling 800-669-3900, contains this and other important information about an investment company. Read carefully before investing.

ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Trading prices may not reflect the net asset value of the underlying securities. Commission fees typically apply.

About TD Ameritrade Holding Corporation

TD Ameritrade

provides investing

services and education to

more than 11 million client accounts totaling approximately $1.2

trillion in assets, and custodial

services to more than 7,000 registered investment advisors. We are a

leader in U.S. retail trading, executing an average of approximately

900,000 trades per day for our clients, more than a quarter of which

come from mobile devices. We have a proud history

of innovation, dating back to our start in 1975, and today our team

of 10,000-strong is committed to carrying it forward. Together, we are

leveraging the latest in cutting edge technologies and one-on-one client

care to transform lives, and investing, for the better. Learn more by

visiting TD Ameritrade’s newsroom at www.amtd.com,

or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org).

About The Harris Poll

The Harris Poll is one of the

longest-running surveys in the U.S., tracking public opinion,

motivations and social sentiment since 1963. It is now part of Harris

Insights & Analytics, a global consulting and market research firm that

strives to reveal the authentic values of modern society to inspire

leaders to create a better tomorrow. We work with clients in three

primary areas; building twenty-first-century corporate reputation,

crafting brand strategy and performance tracking, and earning organic

media through public relations research. Our mission is to provide

insights and advisory to help leaders make the best decisions possible.

The Harris Poll is separate from and not affiliated with TD Ameritrade,

which is not responsible for their services or policies.

About the Super Savers Survey

This survey was conducted

online within the United States by The Harris Poll on behalf of TD

Ameritrade from September 28 - October 6, 2018, among 1,503 U.S. adults

aged 45 and older with over $250,000 in investable assets. Among this

group, 324 were identified as “Super Savers” with a savings rate of 20

percent or higher of their income.

1 https://fred.stlouisfed.org/series/PSAVERT#0