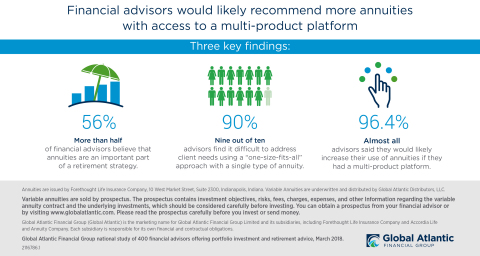

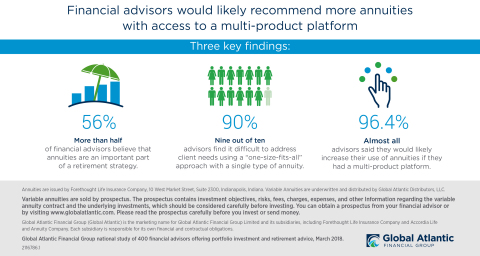

NEW YORK--(BUSINESS WIRE)--More than half of financial advisors (56%) believe that annuities are an important part of a retirement plan, but nine out of ten (90%) find it difficult to address client needs using a “one-size-fits-all” approach with a single type of annuity. Of these advisors, almost all (96.4%) said they would likely increase their use of annuities if they had access to a multi-product platform and distribution partners who could help select the best strategies based on client objectives.

These are some of the major findings of a Global Atlantic Financial Group national study of 400 financial advisors offering portfolio investment and retirement advice. The study was conducted in March 2018 by Echo Research, a global market analytics firm.

When asked about the benefits of a multi-product annuity platform, the majority of advisors (57%) said it allows for customizable retirement planning based on client need and lifestyle, and half (51%) noted the simplicity of a single point of contact for multiple product offerings.

“In this volatile investing environment and with a new era of regulation as a backdrop, advisors need to show clients that they have a full set of solutions at their disposal to meet income planning and retirement savings needs,” said Paula Nelson, President, Retirement at Global Atlantic Financial Group.

Investor Education Materials are Key

The survey also revealed the need for more advisor resources and investor education. While three-quarters of advisors (76%) believe they have a strong understanding of annuities, nearly two-thirds (62%) say their clients do not have a very strong understanding of the product.

“Advisors recognize that they need to offer choices on how to solve their client’s challenges and goals solutions to stay competitive,” noted Nelson. “But in order to be effective, they need partners that are not only offering a robust line-up of products, but also providing education, guidance, and consultation when needed.”

When asked how they educate their clients, most advisors (62%) said they spend time to explain product features and answer questions. About half (53%) use written materials supplied by partners or their company. When asked what would help them better utilize annuities among clients, half (50%) said better guidance and education from distribution partners on the differences between products, and nearly half (46%) would like the ability to withdraw from the annuity’s value for emergencies. Less than one-third (31%) cited a desire for fee-based rather than commission-based annuities.

“The results of this research indicate advisors need very broad and deep support when it comes to annuities – from general education to the specific applications of different solutions,” added Nelson. “We see this as a great opportunity considering Global Atlantic’s focus on taking a consultative approach in supporting advisors across all channels.”

Methodology

The 2018 Global Atlantic Financial Advisor Survey was completed online by Echo Research in March 2018, among 400 financial advisors who offer portfolio investment and retirement advice that includes annuities. The surveyed financial advisors work at full-service brokerages, wirehouses, banks, registered investment advisors, and independent and regional broker-dealers. The margin of error for this sample +/- 4.9% at the 95% confidence level.

About Global Atlantic

Global Atlantic Financial Group, through its subsidiaries, offers a broad range of retirement, life and reinsurance products designed to help our customers address financial challenges with confidence. A variety of options help Americans customize a strategy to fulfill their protection, accumulation, income, wealth transfer and end-of-life needs. In addition, Global Atlantic offers custom solutions and responsive service for the capital, risk and legacy-business management of life and annuity insurance companies around the world.

Global Atlantic was founded at Goldman Sachs in 2004 and separated as an independent company in 2013. Its success is driven by a unique heritage that combines deep product and distribution knowledge with insightful investment and risk management capabilities, alongside a strong financial foundation of over $60 billion in assets.

Global Atlantic Financial Group (Global Atlantic) is the marketing name for Global Atlantic Financial Group Limited and its subsidiaries, including Accordia Life and Annuity Company, Commonwealth Annuity and Life Insurance Company, Forethought Life Insurance Company and Global Atlantic Re Limited. Each subsidiary is responsible for its own financial and contractual obligations.

Annuities are issued by Forethought Life Insurance Company, 10 West Market Street, Suite 2300, Indianapolis, Indiana. Variable annuities are underwritten and distributed by Global Atlantic Distributors, LLC.

This material is authorized for distribution only when accompanied or preceded by a prospectus for the annuities being offered. The prospectus contains investment objectives, risks, fees, charges, expenses, and other information regarding the variable annuity contract and the underlying investments, which should be considered carefully before investing. You should read the prospectus carefully before investing money.