ACI Worldwide Report: Global Refund Volumes Surge 18% as Retailers Tighten Returns

ACI Worldwide Report: Global Refund Volumes Surge 18% as Retailers Tighten Returns

New analysis shows holiday-driven refund growth, rising fraud risk, and growing pressure on retail margins despite strong eCommerce growth

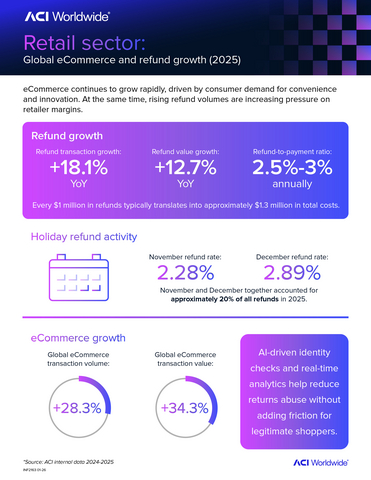

OMAHA, Neb. & LONDON--(BUSINESS WIRE)--Annual refund volumes in the global retail sector increased 18.1 % in 2025, while refund value rose 12.7% year-on-year, according to ACI’s annual Global Ecommerce Report. ACI Worldwide (NASDAQ: ACIW), an original innovator in global payments technology, analysed billions of retail transactions worldwide as part of the study.

Refund activity peaked sharply during the holiday season; November and December together accounted for approximately 20% of all refunds in 2025. December alone recorded a 2.89% refund rate, meaning nearly three out of every 100 purchases resulted in a return, compared with an average refund rate of 2.25% between January and October.

The findings come amid continued growth in global eCommerce. Across all retail sectors, eCommerce transaction volumes grew 28.3% in 2025, while total transaction value increased 34.3% year-on-year, driven by consumer demand for convenience, sustained innovation across the retail ecosystem, and rising levels of consumer trust.

While refund rates are rising more slowly than eCommerce transactions, their financial impact for retailers remains significant. Every $1 million in refunds typically translates into around $1.3 million in total costs once reverse logistics, inventory depreciation, payment processing fees, and fraud-related overheads are accounted for.

As refund volumes accelerate, retailers are rethinking their approach to returns and fraud management. This includes deploying AI-driven identity verification, real-time monitoring, and tighter, more adaptive return policies. Increasingly, merchants are applying real-time analytics traditionally reserved for fraud prevention to refund and return activity—seeking to reduce abuse while preserving a frictionless experience for legitimate customers.

“The sharp rise in refund volumes is exposing a growing pressure point for retailers—one that directly threatens margins, especially during peak periods and extended return windows,” said Adriana Iordan, head of merchant product management and payments intelligence at ACI Worldwide. “Retailers need smarter, AI‑driven controls that spot abuse in real time and adapt policies dynamically, without adding friction for genuine customers. By bringing fraud and refund management together, merchants can curb losses, protect profitability, and still deliver a customer seamless experience—even as refund volumes continue to climb.”

Key Highlights at a Glance (Year‑on‑Year, Retail)

- Refund Growth: Refund transactions increased 18.1%, while refund value rose 12.7%, indicating higher refund frequency but lower average refund values.

- Holiday Surge: November and December together accounted for ~20% of annual refunds, driven by extended return windows and elevated fraud risk.

-

Refund‑to‑Payment Ratio: Averaged 2.5%–3% across the year, highlighting growing pressure within omnichannel retail environments.

- January–October: 2.25%

- November: 2.28%

- December: 2.89%

- Payment Expansion: eCommerce payment volumes increased 28.3%, with transaction values up 34.3%, reflecting sustained consumer spending growth.

- Strategic Implications: The widening gap between payment growth and refund growth underscores the opportunity for retailers to tighten refund controls without eroding customer experience—particularly during peak periods.

About the Report:

ACI’s Global Annual Ecommerce Report provides insight on the latest eCommerce trends based on an analysis of billions of global retail transactions processed in 2024 and 2025.

About ACI Worldwide

ACI Worldwide, an original innovator in global payments technology, delivers transformative software solutions that power intelligent payments orchestration in real time so banks, billers and merchants can drive growth, while continuously modernizing their payment infrastructures, simply and securely. With nearly 50 years of trusted payments expertise, we combine our global footprint with a local presence to offer enhanced payment experiences to stay ahead of constantly changing payment challenges and opportunities.

© Copyright ACI Worldwide, Inc. 2026

ACI, ACI Worldwide, ACI Payments, Inc., ACI Pay, Speedpay, and all ACI product/solution names are trademarks or registered trademarks of ACI Worldwide, Inc., or one of its subsidiaries, in the United States, other countries, or both. Other parties’ trademarks referenced are the property of their respective owners.

Contacts

Media

Katrin Boettger | Communications and Corporate Affairs Director | katrin.boettger@aciworldwide.com

Pierce Rohrmann I Head of Communications and Corporate Affairs I pierce.rohrmann@aciworldwide.com