JIM.com Turns Its AI Agent Into an Operating System for Microbusinesses

JIM.com Turns Its AI Agent Into an Operating System for Microbusinesses

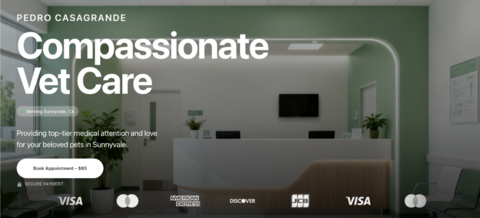

A fully transactional online store generated automatically by JIM’s AI agent - requiring no coding, no designers, and no setup time

SUNNYVALE, Calif.--(BUSINESS WIRE)--JIM.com, the AI-powered financial platform for micro and small sellers, today announced a significant evolution of its core technology. The platform, which has already disrupted the U.S. payments market by turning smartphones into payment terminals for thousands of solo and micro-entrepreneurs, is expanding the capabilities of its AI Business Agent to manage the entire lifecycle of a business.

Since its market entry in early 2025, JIM.com has operated on a clear philosophy: the "dematerialization" of business infrastructure. First, it removed the need for card readers, dongles, and the delay to access funds. Now, it is removing the need for fragmented, expensive software.

With today’s update, the JIM.com agent evolves from a payment company into a comprehensive business partner that functions like an AI operating system. It proactively manages online sales, marketing execution, and financial analysis - allowing merchants to operate with the sophistication of a Fortune 500 company, but without the headcount.

“With tens of thousands of clients across all 50 U.S. states, we proved that hardware was optional. Now, we are proving that microbusinesses don't need to pay for overpriced software,” said Luis Silva, CEO of CloudWalk, the technology company behind JIM.com. “Our agent started by helping merchants get paid instantly and organizing their business. Now, it helps them sell more, find customers, and grow - automatically.”

The Evolution of the "Pocket" Workforce

For the 70 million gig workers and independent entrepreneurs in the U.S., the administrative burden of being their own CFO, CMO, and IT support is the single biggest barrier to growth. JIM.com’s expanded agent directly addresses this by automating tasks that typically require multiple subscriptions.

Imagine a vintage sneaker reseller starting their day. Instead of manually analyzing sales or searching for leads, they receive a proactive alert from JIM identifying a major local trade show happening that weekend near their shop. Recognizing the merchant’s specific inventory, the agent doesn’t just offer advice - it executes. In seconds, JIM generates a custom, payment-enabled website populated with the merchant’s top products, specifically tailored for that event. The merchant receives a live link, shares it with their customer base, and turns a proactive insight into a new sales channel before finishing their morning coffee.

In early testing, the agent has already begun proactively building websites and diagnosing account issues for live merchants just like this.

New Agent Capabilities:

- Context-Aware Web Presence: The agent doesn't just wait for instructions; it can proactively generate a payment-enabled website based on the merchant's profile. Users can then refine the store simply by chatting (e.g., "I don't sell baby items, update the catalog"), turning offline sellers into online retailers in minutes.

- Operational Intelligence: Beyond processing payments, the agent acts as a first-line analyst. It can instantly diagnose account status, explain declined transactions, and check balances in real-time. Crucially, it also scans the local market to proactively find trade shows and events where merchants can boost their sales.

- Growth Engines: The agent analyzes transaction data to suggest marketing actions, write high-converting sales copy for direct messages, and create Payment Links for remote customers.

- Financial Autopilot: Building on its "instant payout" foundation, the agent offers deeper operational guidance, comparing sales periods and spotting cash flow trends before they become problems.

From "Tap to Pay" to "Self-Driving Finance"

JIM.com gained traction in the U.S. by offering Tap to Pay on iPhone with a transparent flat fee, solving the "liquidity crisis" for merchants who couldn't wait days for their money - depositing earnings instantly for immediate use. This update leverages that financial infrastructure to power the AI’s decision-making.

“Most AI tools are disconnected from the money,” Silva added. “Because JIM.com controls the payment rail and the point of sale, its intelligence is actionable. It doesn’t just tell you to sell more; it creates the website and processes the sale for you.”

Backed by a $1.2 Billion AI Powerhouse

JIM.com is the U.S. flagship of CloudWalk, one of the fastest-growing tech companies globally, serving over 6 million clients in Brazil. The company recently surpassed $1.2 billion in annualized revenue and $128 million in net income. Recognized for its AI-first approach, the company generates $1.7 million in revenue per employee - a figure that nearly doubled in the last year as autonomous agents took over internal operations.

“We are leading the transition to Self-Driving Finance,” said Silva. “By mastering AI internally to build a profitable billion-dollar company, we are now giving that same power to the micro-merchant - allowing them to run their business with the efficiency of a tech giant.”

Availability

The expanded AI agent capabilities are rolling out automatically to JIM.com users on iOS across the U.S. Merchants can download the app and start accepting payments in minutes at JIM.com.

Contacts

Media Contact:

BAM for JIM

cloudwalk@bambybig.agency