Cache 2025 Review Details How the Cache Exchange Fund Platform Scaled From $290M to Over $1B While Maintaining 98–99% Benchmark Correlation

Cache 2025 Review Details How the Cache Exchange Fund Platform Scaled From $290M to Over $1B While Maintaining 98–99% Benchmark Correlation

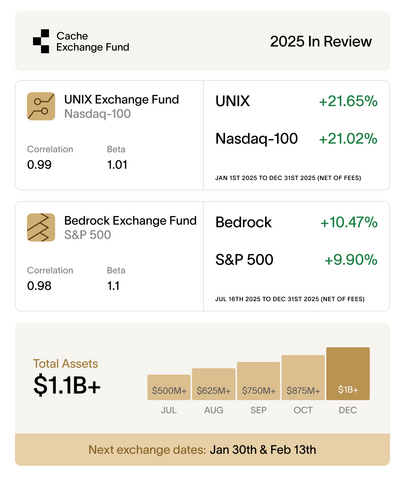

Cache Exchange Fund 2025 performance overview. The graphic summarizes Cache’s year-end results, showing the UNIX Exchange Fund tracking the Nasdaq-100 with 0.99 correlation and a 21.65% net return in 2025 versus 21.02% for the index, and the Bedrock Exchange Fund tracking the S&P 500 with 0.98 correlation and a 10.47% net return since inception on July 16, 2025, versus 9.90% for the S&P 500. Total assets on the Cache platform grew to more than $1.1 billion by year-end. Data shown net of fees. Correlation and beta metrics reflect benchmark alignment as assets scaled.

NEW YORK--(BUSINESS WIRE)--Cache 2025 Review is now live, highlighting a year of growth in which the Cache Exchange Funds scaled from approximately $290 million to more than $1 billion in total assets while maintaining very tight precision across its flagship exchange funds.

The Cache 2025 Review report outlines how Cache achieved this growth without sacrificing portfolio behavior — a longstanding challenge for exchange funds.

"We could have grown the business much faster in 2025, but precision defines our thesis and is how investors should think about exchange funds," said Srikanth Narayan, CEO and cofounder, Cache. "As we grew nearly 4x, portfolios didn’t drift. Tracking improved. Sector exposure, beta, and risk metrics stayed within our thresholds. A small team did the work of one several times its size, and the product held up under real-world pressure.”

Cache Exchange Fund Performance in 2025

According to Cache 2025 Review, Cache’s flagship exchange funds delivered tight benchmark alignment throughout 2025, even as assets grew more than threefold:

-

UNIX (Nasdaq-100 aligned exchange fund):

0.99 correlation, delivering a 21.65% return after fees in 2025, compared to 21.02% for the Nasdaq-100, for 2025

-

Bedrock (S&P 500 aligned exchange fund):

0.98 correlation, delivering a 10.47% return after fees since its inception on July 16th, compared to 9.90% for the S&P 500

As detailed in Cache 2025 Review, portfolio tracking tightened as assets scaled. Sector exposure, beta, and risk characteristics remained within designed thresholds.

The full Cache 2025 Review report is available at https://usecache.com/companion/2025-wrapped-scaling-to-1b-with-precision-and-whats-next

About Cache

Cache is a San Francisco–based brokerage platform purpose-built for managing large, concentrated stock positions. Learn more at usecache.com.

Disclosures

“Cache” refers to Cache Financials, Inc., the parent company of Cache Securities LLC, a registered broker-dealer and member FINRA/SIPC, and Cache Advisors LLC, an SEC-registered investment adviser. Registration does not imply a certain level of skill or training.

Cache Exchange Funds and related products are alternative investments available only to accredited investors or qualified purchasers. Cache does not provide recommendations; any investment decision is the responsibility of the investor. Investors should carefully review all applicable offering materials before participating. Exchange Funds involve risk, including possible loss of principal, limited liquidity, and higher fees than traditional investments.

Total assets refer to gross assets of Exchange Funds managed by Cache Advisors LLC, as well as pending contributions to an Exchange Fund, assets on the Cache platform, and assets associated with Collar Advance transactions. Assets pending contribution and Collar Advance assets are not managed. Data is as of December 31, 2025 and not updated.

“Flagship Funds” refers to Exchange Funds available to Qualified Purchasers only. Cache Exchange Fund – UNIX, LLC benchmarked to the Nasdaq-100 Index, consisting of 100 of the largest non-financial companies listed on the Nasdaq Stock Market. Cache Exchange Fund – Bedrock, LLC is benchmarked to the S&P 500 Index, an index composed of approximately 500 leading U.S. publicly traded companies. Broad-based indices are unmanaged, and investments cannot be made directly into an index.

Correlation measures how closely an investment’s returns move in relation to a benchmark and is backward-looking. Correlation figures shown are measured over a one-month period in arrears. Beta measures the sensitivity of an investment’s returns relative to a benchmark.

Contacts

Media Contact:

Colin Crook

E: colin@usecache.com

P: 650-269-5235