Greenoaks Takes Legal Action to Stop Korea's Discrimination Against Coupang and Other U.S. Companies

Greenoaks Takes Legal Action to Stop Korea's Discrimination Against Coupang and Other U.S. Companies

Leading U.S. investment firms notify Korea of intent to file arbitration claims and request a U.S. government investigation to restore fair competition for U.S. companies in Korea

Actions follow Korean Government's unprecedented assault on U.S. company Coupang

SAN FRANCISCO--(BUSINESS WIRE)--Greenoaks, along with Altimeter (the “U.S. Investors”), today filed two distinct actions to defend U.S. businesses and investors from discriminatory acts and unfair trade practices by the Government of the Republic of Korea (the “ROK Government”).

The actions follow sustained ROK Government interference in the Korean business operations of Coupang, Inc. (NYSE: CPNG), a U.S.-founded and headquartered technology company whose publicly traded stock is widely held by U.S. pension funds and other American shareholders. The ROK Government’s actions against Coupang appear designed to target, disable, and destroy an innovative American competitor to the apparent benefit of domestic and Chinese companies in the Korean market.

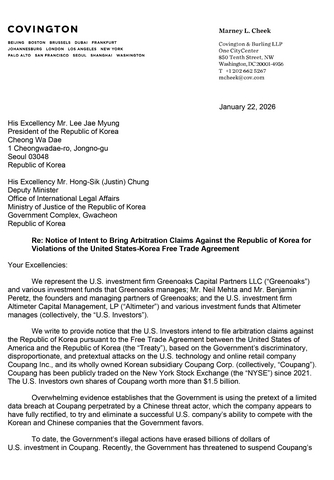

In response, the U.S. Investors have served formal notice of their intent to file arbitration claims against the ROK Government under the U.S.-Korea Free Trade Agreement (“KORUS”), which protects U.S. investors and companies against discriminatory acts and unfair trade practices.

Separately, the U.S. Investors have petitioned the U.S. Trade Representative to investigate the ROK Government’s unreasonable and discriminatory conduct under Section 301 of the Trade Act of 1974 and impose appropriate trade remedies.

The Notice of Intent under KORUS and the full Petition under Section 301 of the Trade Act are attached for download.

As detailed in these documents, the U.S. investors’ actions follow:

- A multi-year pattern of selective government enforcement and escalating regulatory pressure singling out Coupang, marked by extraordinary investigations, audits, and on-site inspections that appear to far exceed the regulatory scrutiny imposed on domestic Korean and Chinese competitors. As Coupang took increasing market share from Korean and Chinese competitors, enforcement actions across the Korea Fair Trade Commission, National Tax Service, Ministry of Employment and Labor, Financial Supervisory Service, and others increased, resulting in hundreds of audits, inspections, and raids and more penalties against Coupang than any other company in Korean history.

- False and defamatory claims by the ruling Democratic Party of Korea (“DPK”) administration about Coupang’s limited and contained 2025 data incident. Following a data breach by a China-based threat actor, the threat actor downloaded and retained data from only approximately 3,000 accounts which did not include financial information, government ID numbers, or login credentials. Yet senior DPK officials ignored that evidence and falsely framed the incident as involving tens of millions of “victims” and even suggested it implicated home-entry passcodes, in an apparent attempt to inflame Korean public opinion and provide cover for efforts to eliminate Coupang and benefit domestic and Chinese competitors.

- A disproportionate and whole-of-government escalation. In the weeks following disclosure of the data incident, the DPK administration mounted a sweeping, multiagency campaign against Coupang. More than a dozen government bodies were mobilized over several weeks, including law enforcement, tax, labor, financial, media, customs, land use, and national intelligence agencies, many with no role in data or cybersecurity matters. Among many other actions, authorities conducted repeated raids, blocked commercial agreements unrelated to the data breach, pressured the national pension to divest its Coupang holdings, and marshaled overwhelming resources, including hundreds of officials, to launch an administrative assault on the company, including a 150-member National Tax Service task force and an 86-member police task force focused solely on investigating the company.

- Open threats to destroy the company through enforcement. Senior DPK officials have publicly called for penalties and sanctions explicitly designed to force Coupang out of business, including statements advocating fines large enough to cause the company’s collapse. Korean Prime Minister Kim Min-seok urged regulators to approach enforcement against Coupang for the data breach “with the same determination used to wipe out mafias,” and officials repeatedly raised the possibility of bankrupting the company, revoking its licenses, imposing the largest fine in Korean history against it, and forcing it to divest its affiliates.

- Criminal referrals for company executives who are U.S. nationals. The DPK administration has also referred several Coupang executives for criminal prosecution, including the company’s Chairman Bom Kim and Chief Administrative Officer Harold Rogers, who are both U.S. nationals.

- Billions of dollars in lost market capitalization as a result of the DPK administration's targeted and hostile interference following the data incident. These losses have been borne directly by U.S. shareholders – including individual investors and institutional funds holding the retirement savings of millions of American workers.

“When a close ally penalizes a U.S. company for its success, it compromises a vital partnership and opens the door to competitors that don’t play by the rules,” said Neil Mehta, Founder and Managing Partner of Greenoaks. “That is bad for U.S. investors, bad for Korean consumers and workers, and bad for the U.S.-Korea relationship. Trade agreements are only as strong as our willingness to stand up for them, and we are acting today to ensure that international competition is governed by rules, not the whims of politicians.”

ABOUT GREENOAKS

Greenoaks is a concentrated, long-term partner to extraordinary founders building generational businesses.

ABOUT ALTIMETER

Altimeter is a technology-focused investment firm that invests across public and private markets.

Contacts

Greenoaks

media@greenoaks.com