Apartments.com Releases Multifamily Rent Growth Report for December 2025

Apartments.com Releases Multifamily Rent Growth Report for December 2025

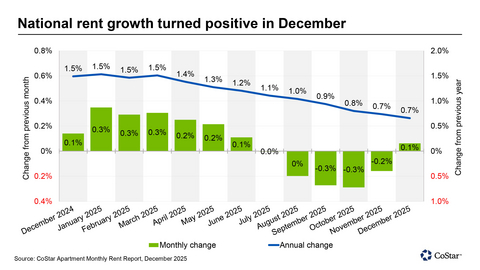

National rent growth turned positive, snapping five-month trend of flat or falling rents

ARLINGTON, Va.--(BUSINESS WIRE)--Today Apartments.com, an industry-leading online marketplace of CoStar Group (NASDAQ: CSGP), published its latest report on multifamily rent trends for December 2025.

U.S. apartment rents grew in December, with the national average increasing to $1,708 — a +0.1% increase from November’s upwardly revised figure of $1,707. This uptick marks a reversal of the previous five consecutive month trend of flat or negative monthly rent change. Annual rent growth eased marginally to 0.66% in December 2025 from 0.74% in the prior month and down from +1.5% at the start of 2025.

Apartment rent growth generally follows a seasonal pattern - accelerating in the spring and slowing in late summer and fall. December typically marks a seasonal turning point where rents begin to rise again, and 2025 largely adhered to that historical trend. While late summer and early fall declines were more pronounced in 2025, the moderation that began in November persisted through year-end. Supply pressures remain elevated, tempering momentum, but December data indicates a possible gradual return to more typical rent growth patterns in 2026.

Three of the four regions also snapped the downward trend that had persisted for the previous five months. The Midwest led with a +0.12% month-over-month increase, followed by the South, up +0.07%, and the Northeast, up +0.06%. The West continued to post rent declines, down -0.01%. On an annual basis, the Midwest posted the strongest performance with +2.2% growth, followed by the Northeast at +1.5%. The South’s rents declined -0.1% year-over-year, while the West declined -1.4%.

Metro-level performance improved across the U.S., with 25 of the top 50 markets posting rent increases, up from just seven in November. Rent growth leaders were San Francisco +0.64%, Norfolk +0.53% and Richmond +0.42%.

The steepest monthly declines occurred in Portland, OR, down -0.29%, followed by Memphis, Salt Lake City, San Antonio and Denver, each down between -0.21% and -0.26%. Miami, Las Vegas and Tucson posted monthly declines of -0.15% to -0.19%. Most of these Mountain West and Sun Belt markets face elevated vacancy amid aggressive new supply, putting downward pressure on rents. Portland, Memphis, Las Vegas and Tucson face additional demand headwinds from falling employment.

San Francisco posted the strongest annual rent growth at +5.9%, followed by Norfolk at +3.8%, with Chicago and San Jose each at +3.4%. In contrast, Austin recorded a -4.6% decline, while Denver and San Antonio fell -3.4% and -3.3%, respectively, each reflecting oversupply outpacing demand.

These patterns reinforce the broader trends: markets with the highest levels of new construction are seeing the weakest rent performance, while more supply-constrained metros — particularly in the Midwest and select coastal areas — continue to outperform. In select markets, however, falling employment and softening demand may also be contributing to weaker rent growth.

While many markets have moved past peak supply, a substantial, though easing, inventory overhang continues to weigh on rent growth across the country.

About CoStar Group

CoStar Group (NASDAQ: CSGP) is a global leader in commercial real estate information, analytics, online marketplaces, and 3D digital twin technology. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics, and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; Homes.com, the fastest-growing residential real estate marketplace; and Domain, one of Australia’s leading property marketplaces. CoStar Group’s industry-leading brands also include Matterport, a leading spatial data company whose platform turns buildings into data to make every space more valuable and accessible, STR, a global leader in hospitality data and benchmarking; Ten-X, an online platform for commercial real estate auctions and negotiated bids; and OnTheMarket, a leading residential property portal in the United Kingdom.

CoStar Group’s websites attracted over 143 million average monthly unique visitors in the third quarter of 2025, serving clients around the world. Headquartered in Arlington, Virginia, CoStar Group is committed to transforming the real estate industry through innovative technology and comprehensive market intelligence. From time to time, we plan to utilize our corporate website as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

Contacts

Media:

Matthew Blocher

Vice President, Corporate Marketing & Communications

CoStar Group

(202) 346-6775

mblocher@costar.com