75% of Americans to Maintain or Increase Charitable Giving Through End of 2025, Church Mutual® Survey Finds

75% of Americans to Maintain or Increase Charitable Giving Through End of 2025, Church Mutual® Survey Finds

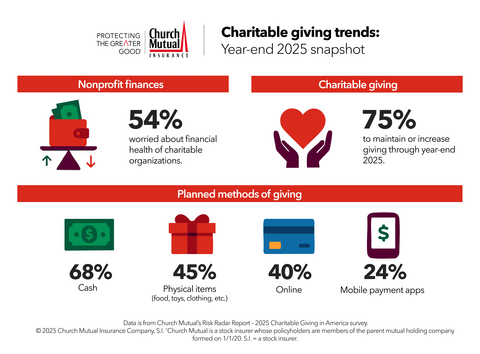

More than half express concerns about the financial health of charitable causes they support amid economic uncertainty

MERRILL, Wis.--(BUSINESS WIRE)--A new national survey, Risk Radar Report—2025 Charitable Giving in America1, from Church Mutual Insurance Company, S.I. (a stock insurer)2 reveals that Americans’ generosity won’t waver as conversations about the U.S. economy continue to dominate year-end headlines. According to the survey, 75% plan to maintain or increase their charitable giving through the end of 2025, despite mixed feelings about the economy and their personal finances.

Church Mutual conducted the survey to better understand giving trends that impact the organizations it serves — nonprofits, houses of worship, schools, and camps and outdoor recreation — so it can help protect them as they navigate changing conditions.

Economic sentiment and giving outlook

The findings provide a year-end snapshot of donor sentiment with 43% of consumers noting they donate most often between October through December, a period when charitable giving peaks.

Among respondents, 40% feel uncertain or concerned about today’s economic conditions, while 60% describe themselves as cautiously optimistic or confident.

Still, Americans overwhelmingly report they’ll keep supporting causes they care about:

- 25% expect to increase giving by end of 2025.

- 50% plan to keep giving steady.

- 25% expect to reduce donations.

Looking ahead to 2026, giving remains largely stable:

- 48% expect to make no changes.

- 25% expect to reduce donations.

“Despite mixed economic signals, the survey findings highlight how committed Americans are to supporting the causes they care about,” said Elisabeth Aleman, assistant vice president - Nonprofit and Human Services. “Even when people tighten their budgets, they find ways to give — whether through donations or volunteering — and that’s inspiring.”

Charitable giving ranks high among discretionary spending

When asked what they prioritize beyond basic living expenses and debt obligations, respondents ranked charitable giving nearly as highly as leisure activities:

- Dining out: 45%.

- Travel and experiences: 42%.

- Giving to charities/causes they’re passionate about: 41%.

Charitable giving ranked higher than entertainment (36%), sports and recreational activities (25%), and gadgets or electronics (16%).

Financial health of nonprofits is a growing concern — and motivating factor

In a notable finding, more than half (54%) of respondents say they’re concerned about the financial health of the charitable organizations they support. This concern may help explain why Americans remain motivated to maintain or increase their giving —ensuring the causes they care about can continue their work.

How Americans plan to give

Respondents cited a mix of traditional and digital giving methods:

- Cash or check in person: 68%.

- Physical items (food, clothes, toys, etc.): 45%.

- Online donations: 40%.

- Mobile payment apps (Venmo, PayPal, etc.): 24%.

Generosity by generation

Among those planning to give more by the end of 2025, younger Americans show the greatest intent to increase their donations:

- Gen Z (ages 18–25): 36%.

- Millennials (ages 26–41): 36%.

- Gen X (ages 42–57): 25%.

- Baby Boomers (ages 58+): 11%.

Among those reducing monetary donations, 58% say they'll increase non-monetary generosity, such as volunteering or advocacy.

“The reality for nonprofits is increased generosity often comes alongside increased demand for services — sometimes without the staff or resources to match. We saw a very similar situation this past Fall across food pantries throughout the U.S.,” explained Aleman. “That demand creates operational and financial pressures. With every nonprofit we talk with, we’re finding creative solutions to help them manage increased activity safely and effectively, while making sure they’re financially protected as the landscape shifts.”

About Risk Radar Report

2025 Charitable giving in America is the latest in Church Mutual’s Risk Radar initiative that provides proprietary, primary research to gather key, forward-looking insights for nonprofits, schools, camps and houses of worship, helping them maximize opportunities and minimize risk. Risk Radar Report – 2025 Charitable Giving in America surveyed 1,010 U.S. adults (ages 18+).

About Church Mutual

Church Mutual Insurance Company, S.I., founded in 1897, offers specialized insurance for religious organizations of all denominations, public and private K-12 schools, colleges and universities, secular and non-secular camps and conference centers, and nonprofit and human services organizations throughout the United States. To learn more, visit churchmutual.com.

1Church Mutual Insurance Company, S.I. conducted an online survey through Padilla, The Church Mutual Risk Radar Report—2025 Charitable Giving in America, in December 2025, with a nationally representative sample of 1,010 adults aged 18+.

2Church Mutual is a stock insurer whose policyholders are members of the parent mutual holding company formed on 1/1/20. S.I. = a stock insurer.

Contacts

Contact: Avery Faehling

Title: Manager - Corporate Communications

Phone: (715) 697-4590

Email: afaehling@churchmutual.com