Dream Industrial REIT Announces Strategic Partnership With CPP Investments and $805 Million Portfolio Recapitalization

Dream Industrial REIT Announces Strategic Partnership With CPP Investments and $805 Million Portfolio Recapitalization

This press release contains forward-looking information that is based upon assumptions and is subject to risks and uncertainties as indicated in the cautionary note contained within this press release. All dollar amounts are in Canadian dollars unless otherwise indicated.

Transaction Highlights

- Dream Industrial REIT and CPP Investments form a new joint venture focused on acquiring Canadian industrial assets, with $1.1 billion of total equity allocation.

- Dream Industrial REIT has agreed to sell a 3.6 million square foot portfolio to the newly formed joint venture for $805 million.

- The transaction delivers compelling value to unitholders, with pricing slightly above current IFRS values, representing a substantial premium to the value implied by the REIT's unit trading price.

- Dream Industrial REIT expects to deploy the proceeds on an accretive basis through a combination of $100 to $200 million of REIT unit buybacks and strategic growth initiatives.

TORONTO--(BUSINESS WIRE)--Dream Industrial Real Estate Investment Trust (TSX: DIR.UN) (the "Trust" or the "REIT" or "DIR" or "we" or "us") is pleased to announce a strategic partnership with Canada Pension Plan Investment Board (“CPP Investments”), marking a significant new growth initiative for the REIT as it continues to add scale to its private capital partnership business. Under a definitive agreement, DIR has agreed to sell a portfolio of 12 Canadian industrial assets totaling 3.6 million square feet across Ontario, Quebec, and Alberta (the "Initial Portfolio"), to a newly formed joint venture between CPP Investments and DIR (the "Joint Venture") (collectively, the “Transaction”). The Joint Venture is acquiring the Initial Portfolio for a purchase price of $805 million, with pricing slightly above IFRS value of the Initial Portfolio. The Trust's IFRS NAV represents a significant premium to current trading price of the REIT's units.

The Joint Venture will be 10% owned by DIR and 90% owned by CPP Investments. CPP Investments and DIR have allocated $1.1 billion of equity capital, in aggregate, to the Joint Venture to be deployed over time, with the intention of acquiring up to $3 billion of additional industrial assets in Canada.

“This transaction is a testament to the quality of our assets, the strength of our platform, and the opportunities in the Canadian industrial market,” said Alexander Sannikov, Chief Executive Officer of Dream Industrial REIT. “With this transaction and joint venture with CPP Investments, we are reinforcing the intrinsic value of our assets, growing our private capital partnerships business, and unlocking an additional avenue for portfolio growth. We look forward to building on our partnership with CPP Investments and delivering market leading returns for all stakeholders.”

Initial Portfolio & Transaction Details

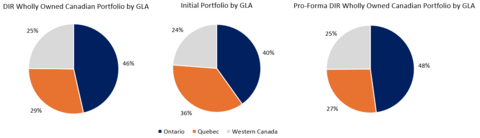

The Initial Portfolio comprises 12 assets (27 buildings) that are representative of the overall quality of DIR’s wholly owned Canadian portfolio. By GLA, 37% of the Initial Portfolio is in the Greater Toronto Area (“GTA”), 36% is in Montreal, 24% is in Calgary and 3% is in London, Ontario. The average in-place and committed base rent for the assets in the Initial Portfolio was approximately $11 per square foot as at September 30, 2025 with a weighted average lease term of approximately three years.

See Figure 1, Initial Portfolio by GLA as at September 30, 2025

Key characteristics such as the average year built, clear height, and geographic split of the Initial Portfolio are similar to DIR’s wholly-owned Canadian portfolio. As at September 30, 2025, the Initial Portfolio’s in-place and committed occupancy was below DIR’s Canadian portfolio average. The Transaction is expected to increase the Trust’s in-place and committed occupancy with no material change to the spread between in-place and estimated market rent for its Canadian portfolio.

|

Current

Wholly-Owned

|

Pro Forma

Wholly-Owned

|

Owned GLA (in thousands of square feet) |

20,373 |

16,797 |

In-Place Occupancy |

93.5% |

93.7% |

In-Place and Committed Occupancy |

94.3% |

94.5% |

Mark-to-Market Potential(1) |

19.9% |

19.2% |

*As at September 30, 2025 |

||

(1) Calculated as estimated market rent to in-place and committed base rent spread (%) |

||

The Joint Venture intends to pursue a value-add strategy focused on acquiring assets with material existing vacancy, near-term lease-rollover, larger capital investments, and/or intensification and redevelopment opportunities.

See Figure 2, Highlighted Assets from the Initial Portfolio

A subsidiary of DIR will provide property management, capital expenditure management, and leasing services to the Joint Venture at market rates. A subsidiary of Dream Unlimited Corp. (“Dream”) (TSX: DRM) will be the asset manager for the Joint Venture. DIR’s interest in the Joint Venture will be managed under the same terms as its current asset management agreement with Dream.

The Initial Portfolio will be sold to the Joint Venture on an unencumbered basis. The Transaction is expected to close in two similar-sized tranches over the course of H1 2026 and is subject to customary closing conditions.

Strategic Rationale

The Transaction represents a compelling value to the Trust on the Initial Portfolio. The purchase price of $805 million is slightly above the current IFRS value. The Trust’s IFRS NAV as at September 30, 2025 was $16.74 per unit representing over 37% premium to the last closing price of the REIT’s units on December 16, 2025.

The Transaction is a strong validation of the institutional quality of the Trust’s assets, with the Initial Portfolio being representative of the Trust’s overall portfolio quality. It highlights the continued strength of the private transaction market for urban industrial assets in Canada and confidence in the industrial fundamentals from leading global institutional investors.

The formation of the Joint Venture underscores the strength of the Dream Industrial platform and its appeal to leading institutional investors. The Joint Venture will further accelerate the growth of the Trust’s property management business, enhancing the return on invested capital. As the Joint Venture reaches its target scale, the Trust expects that it will contribute to the growth in its property management and leasing margin of over 40%.

The strategy of the Joint Venture is complementary to the Trust’s strategy for its wholly owned portfolio and its existing private capital partnerships in Canada. The Joint Venture is expected to increase the Trust’s already well-diversified sources of capital. With the expanded scope of capital sources, the Trust is well positioned to pursue accretive growth initiatives opportunistically at different points in the business cycle.

In addition to contributing to the growth of the Trust’s private capital partnerships, the Transaction is a continuation of the Trust’s ongoing capital recycling strategy. Since 2019, the Trust completed over $900 million of dispositions and reinvested the net proceeds into accretive initiatives.

Use of Proceeds

The Trust expects to receive over $730 million in net proceeds, following the new debt financing of the Initial Portfolio within the Joint Venture. These proceeds are expected to be allocated towards a combination of unit buybacks and strategic growth initiatives on an accretive basis.

The Trust anticipates the Transaction to be accretive to its diluted FFO per unit on a leverage neutral basis. The annualized run rate accretion to 2026 diluted FFO per unit is expected to be in the low to mid-single digit percentage on a leverage neutral basis upon intended deployment of proceeds. We expect that the proceeds from the transaction will initially be utilized towards repaying existing indebtedness, and subsequently, the Trust expects to deploy the proceeds as follows, subject to market conditions:

- Unit buybacks: $100 to $200 million of net proceeds directed towards unit buybacks via the REIT’s existing normal-course issuer bid program.

- Strategic growth initiatives: Acquisitions, funding existing development pipeline and ancillary revenue initiatives including its solar program.

The Trust intends to suspend its Distribution Reinvestment and Unit Purchase Plan (the “DRIP”) effective as of the distribution payable on January 15, 2026 to unitholders of record as at December 31, 2025 (the “December Distribution”). The DRIP will remain suspended until further notice and commencing with the December Distribution, distributions of the Trust will be paid only in cash. Upon reinstatement of the DRIP, plan participants enrolled in the DRIP at the time of its suspension who remain enrolled at the time of its reinstatement will automatically resume participation in the DRIP.

The Trust remains committed to maintaining its credit rating with Morningstar DBRS, which was recently upgraded to BBB (High). The Trust expects to continue reducing its leverage over time, as measured by its Net Debt to Normalized Adjusted EBITDAFV ratio, consistent with its trajectory over the past few years. The Trust anticipates its leverage metrics will remain consistent with its current leverage profile proforma the contemplated uses of proceeds from the Transaction.

"Over the past several years, our FFO payout ratio has improved to the mid-60% range and our retained cash flows have grown, driven by strong organic growth and multiple growth levers embedded within the business,” said Lenis Quan, Chief Financial Officer of Dream Industrial REIT. "We expect the Transaction to be accretive to FFO and cash flow while maintaining our credit metrics and balance sheet flexibility, which allows us to continue to add scale in our target Canadian markets at attractive economics to the REIT."

The REIT has held the assets in the Initial Portfolio for over 10 years on average, generating an unlevered IRR in excess of 10% over this period. At the proposed sale price for the 90% interest in the Initial Portfolio, the Transaction will generate a gain of approximately $317 million relative to the Initial Portfolio’s historical cost basis.

Consistent with the Trust’s financial disclosure, the Trust expects an incentive fee to be payable as a result of the disposition gains from the Initial Portfolio. The Trust and Dream have agreed to settle the incentive fee at closing by way of 75% cash and 25% in units of the Trust at a price of $16.74 per unit, representing the REIT’s IFRS NAV as at September 30, 2025. The actual incentive fee payable would be calculated based on the Trust’s actual financial results for the year ending December 31, 2026.

Capital Allocation Strategy

The Transaction reinforces the Trust’s focus on executing across its core pillars, further increasing the proportion of modern mid-bay infill assets in its target markets through acquisition and development, driving organic growth through active leasing strategies and embedded lease escalators, driving ancillary revenue streams and growing its private capital partnerships business.

“Our growth strategy for the wholly owned portfolio in Canada remains focused on acquiring and developing newer vintage, small and mid-bay infill assets with strong occupancy, embedded lease escalators and built-in mark-to-market potential. Assets such as our recently completed 343,000 square foot development in Calgary, now fully leased to 9 tenants and our recent 192,000 square foot acquisition in the GTA North built in late 2000’s and leased to 4 tenants are representative of our target asset profile in Canada,” said Bruce Traversy, Chief Investment Officer of Dream Industrial REIT. “In the near-term, we are also looking to increase our exposure in Western Europe, where we see attractive going-in cap rates, lower capital values and strong outlook for rental growth in core infill locations.”

Thus far in 2025, the Trust has closed on over $115 million of acquisitions at an average mark-to-market cap rate of 7%. The Trust is currently in various stages of negotiations and due diligence on over $600 million of acquisitions of infill mid-bay assets in its target markets across Europe and Canada with an average target going-in cap rate of over 6%. Additionally, the Trust is currently pursuing multiple intensification projects on its existing sites and is adding further scale to its renewable energy pipeline at target yields on cost of 7% to 10%.

Board and Special Committee Approvals

The Board of Trustees of Dream Industrial REIT and a Special Committee comprised of independent trustees have unanimously approved the Transaction. The Special Committee was established to oversee the negotiation process and ensure the Transaction aligns with the best interests of unitholders.

Advisors

TD Securities is acting as exclusive financial advisor to DIR. National Bank is acting as independent financial advisor and Goodmans LLP is acting as independent legal counsel to the REIT’s Special Committee.

About Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an owner, manager, and operator of a global portfolio of well-located, diversified industrial properties. As at September 30, 2025, the REIT has an interest in and manages a portfolio comprising 340 industrial assets (552 buildings) totaling approximately 73.2 million square feet of gross leasable area in key markets across Canada, Europe, and the U.S. The REIT’s objective is to deliver strong total returns to its unitholders through secure distributions and growth in net asset value and cash flow per unit, underpinned by its high-quality portfolio and investment-grade balance sheet. Dream Industrial REIT is an unincorporated, open-ended real estate investment trust. For more information, please visit www.dreamindustrialreit.ca.

Non-GAAP financial measures and ratios and supplementary financial measures

The Trust’s condensed consolidated financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). In this press release, the Trust discloses and discusses FFO which is a non-GAAP financial measure and diluted FFO per unit, FFO payout ratio and NAV per Unit which are non-GAAP ratios. These non-GAAP financial measures and ratios are not defined by IFRS and do not have a standardized meaning under IFRS. The Trust’s method of calculating these non-GAAP financial measures and ratios may differ from other issuers and may not be comparable with similar measures presented by other issuers. The Trust has presented such non-GAAP financial measures and ratios as Management believes they are relevant measures of the Trust’s underlying operating and financial performance. Certain additional disclosures such as the composition, usefulness and changes, as applicable, of the non-GAAP financial measures and non-GAAP ratios included in this press release have been incorporated by reference from the management’s discussion and analysis of the financial condition and results from operations of the Trust for the three and nine months ended September 30, 2025, dated November 4, 2025 (the “Q3 2025 MD&A”) and can be found under the section “Non-GAAP Financial Measures” and the respective sub-heading “Funds from operations (“FFO”)” and under the section "Non-GAAP Ratios” and respective sub-heading labelled “Net asset value (“NAV”) per Unit”. The Q3 2025 MD&A is available on SEDAR+ at www.sedarplus.com under the Trust’s profile and on the Trust’s website at www.dreamindustrialreit.ca under the Investors section. Non-GAAP financial measures and ratios should not be considered as alternatives to net income, net rental income, cash flows generated from (utilized in) operating activities, cash and cash equivalents, total assets, non-current debt, total equity, or comparable metrics determined in accordance with IFRS as indicators of the Trust’s performance, liquidity, cash flow, and profitability.

Forward looking information

This news release contains forward-looking information within the meaning of applicable securities legislation, including statements regarding the Trust; the Trust’s expectations regarding the amount of net proceeds from the sale of the Initial Portfolio and the deployment and use thereof, including the repayment of indebtedness, quantum of unit buybacks and strategic growth initiatives; the Trust’s ability to complete the Transaction, the terms thereof and timing thereto; the anticipated acquisition capacity of the Joint Venture; the Trust’s expectations regarding the impact of the Joint Venture and its ability to deliver returns for stakeholders; the Trust’s expectation that the proposed Transaction will increase the Trust’s in-place and committed occupancy with no material change to the spread between in-place and estimated market rent for its Canadian portfolio; the ability for the Joint Venture to pursue assets in line with its strategy; the Trust’s belief that the Initial Portfolio is representative of DIR’s overall portfolio quality; the Trust’s expectations regarding the private transaction market for urban industrial assets in Canada; the appeal of the Trust’s industrial platform to leading institutional investors; the impact of the Joint Venture on the Trust’s property management business and returns and growth therefrom; the Trust’s expectations regarding the impact of the Transaction on its FFO per unit, cash flow and balance sheet; the Trust’s expectations regarding the suspension of the DRIP, including timing; the Trust’s expectations regarding its leverage profile including that it will continue reducing leverage consistent with prior years; the expectation regarding the gain generated by the Transaction relative to the Initial Portfolio’s historical cost basis; the Trust’s expectations regarding the incentive fee payable as a result of the disposition gains from the Initial Portfolio, including the calculation and the mix of cash and units in satisfaction thereof; the Trust’s growth strategy, including geographies where it is looking to increase exposure; and the results of the Trust’s negotiations for assets across target markets and the cap rate and yields on cost targets. Forward-looking information generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plans”, or “continue”, or similar expressions suggesting future outcomes or events.

Forward-looking information is based on a number of assumptions and is subject to risks and uncertainties, many of which are beyond the Trust’s control, which could cause actual results to differ materially from those disclosed or implied. These risks and uncertainties include, but are not limited to, general and local economic and business conditions; employment levels; mortgage and interest rates and regulations; inflation; risks related to a potential economic slowdown in certain of the jurisdictions in which we operate and the effect inflation and any such economic slowdown may have on market conditions and lease rates; risks that the Trust’s operations may be affected by adverse global market, economic and political conditions and other events beyond our control, including risks related to the imposition of duties, tariffs and other trade restrictions and their impacts; uncertainties around the timing and amount of future financings; geopolitical events, including disputes between nations, war and international sanctions; the financial condition of tenants; leasing risks, including those associated with the ability to lease vacant space; rental rates and the strength of rental rate growth on future leasing; and interest and currency rate fluctuations. The Trust’s objectives and forward-looking statements are based on certain assumptions, including that the general economy remains stable, including that future market and economic conditions will occur as expected and that geopolitical events, including disputes between nations or the imposition of duties, tariffs, quotas, embargoes or other trade restrictions (including any retaliation to such measures), will not disrupt global economies; inflation and interest rates will not materially increase beyond current market expectations; conditions within the real estate market remain consistent; competition for acquisitions remains consistent with the current climate; and the capital markets continue to provide ready access to equity and/or debt. All forward-looking information in this press release speaks as of the date of this press release. The Trust does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise except as required by law. Additional information about these assumptions, risks, and uncertainties is contained in the Trust’s filings with securities regulators, including its latest annual information form and MD&A, available at www.dreamindustrialreit.ca.

Contacts

For further information, please contact:

Dream Industrial REIT

Alexander Sannikov

President & Chief Executive Officer

(416) 365-4106

asannikov@dream.ca

Lenis Quan

Chief Financial Officer

(416) 365-2353

lquan@dream.ca