Omdia: AMOLED 2H25 Display Revenues to Reach $29 Billion, Falling Short of 2H24

Omdia: AMOLED 2H25 Display Revenues to Reach $29 Billion, Falling Short of 2H24

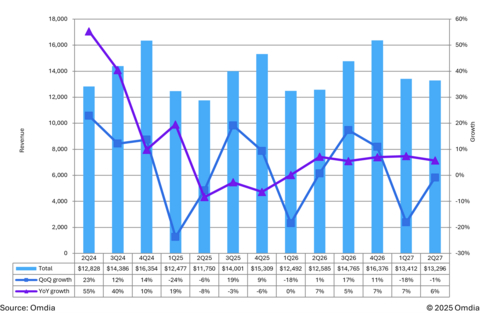

LONDON--(BUSINESS WIRE)--Global AMOLED display revenues are projected to reach $53 billion by the end of 2025, a slight decline from $54 billion in 2024, according to Omdia’s latest Display Long-Term Demand Forecast Tracker. The stagnation comes despite a second-half recovery driven by new smartphone models and mobile PC panel growth, which was not enough to offset a challenging first half of the year marked by intense panel price competition.

“AMOLED revenues growth is facing value-diminishment issues right now before it refreshes in 2026," said David Hsieh, Senior Director for Display in Omdia.

Share

AMOLED revenues are expected to grow by 19% quarter-on-quarter (QoQ) and 9% QoQ respectively in 3Q25 and 4Q25. The revenues growth is largely driven by the shipment growth of LTPO-backplane flexible AMOLED smartphone display and LTPS-backplane mobile PC display. For 2H25, AMOLED shipments are expected to grow by 10% QoQ in 3Q25 and 7% in 4Q25 respectively.

The growth in 2H25 is mainly driven by:

- Expansion of flexible LTPO-backplane smartphone OLED production, particularly for the new iPhone 17 series OLED display and new models from Chinese brands such as Oppo, Vivo and Xiaomi.

- Continued growth in mobile PC OLED panels, which is expected to reach a new quarterly high in 4Q25.

- Increased demand for OLED TV and monitor panels.

However, despite this strong performance pushing AMOLED revenues to $29 billion in 2H25, the total remains slightly lower than the same period of 2024, which reached $30 billion in 2H24.

This means AMOLED revenue growth in 2025 is stagnant. 1H25 was a challenging period for AMOLED as display prices drop continuously, significantly impacting revenues, while the reductions were viewed as a method to stimulate adoption even though they cause losses for most OLED panel makers.

For 2026, Omdia expects AMOLED revenues to reach $56 billion, a 5% year-over-year (YoY) growth from 2025. Key driving factors such as LTPO smartphone, OLED mobile PC panels and the 65-inch to 83-inch OLED TV panels will continue to contribute to 2026 AMOLED revenues growth.

“AMOLED revenues growth is facing value-diminishment issues right now before it refreshes in 2026. Due to the absence of new growth momentum in smartphone OLED displays as penetration has reached more than 50%, smartphone OLED panel prices continue to drop, even with advanced features added to stimulate growth. Meanwhile, notebook OLED and tablet PC OLED are expected to continue to grow with greater specifications, especially better form factors and power-consumption performance, but PC brands and OEMs are seeking lower cost. The OLED price premium over LCD panels continue to shrink. With more China Gen8.6 OLED fab capacity joining the market in the next few years, which will manufacture multiple-application panels such as smartphone, tablet, notebook and even monitor, AMOLED price and specifications competitions will become harsher from now on,“ said David Hsieh, Senior Director for Display in Omdia.

Omdia’s Display Long-Term Demand Forecast Tracker provides a comprehensive quarterly analysis of display shipments and revenues, covering a wide range of applications and technologies. The service offers detailed forecasts and insights to help clients navigate the dynamic display market landscape.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

Contacts

Fasiha Khan: fasiha.khan@omdia.com