B2B Payments on ACH Network Increase 10% in Third Quarter

B2B Payments on ACH Network Increase 10% in Third Quarter

RESTON, Va.--(BUSINESS WIRE)--New figures from Nacha confirm that businesses and other organizations continue to shift their business-to-business payments from checks to ACH.

“The switch by businesses from checks to ACH is being made for good reasons. ACH is safer than a check in the mail, and it’s also faster, whether using Same Day ACH or standard.” - Jane Larimer, Nacha President and CEO

Share

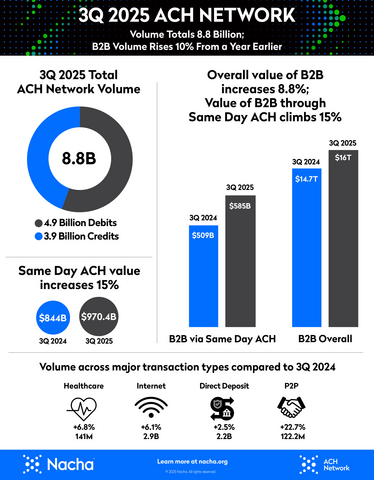

Overall B2B volume was nearly 2.1 billion payments, an increase of 10% from the third quarter of 2024. The value of those payments was $16 trillion, up 8.8%, and accounting for 69% of total ACH Network payments value in the third quarter. Among those B2B payments $585 billion were made using Same Day ACH, up 15% from 2024’s third quarter.

Nacha’s numbers come on the heels of the Association for Financial Professionals’ (AFP) most recent Digital Payments Survey in September, which found that the use of checks in B2B payments has declined steeply from 81% of B2B payments in 2004 to just 26% in 2024.

“The switch by businesses from checks to ACH is being made for good reasons,” said Jane Larimer, Nacha President and CEO. “ACH is safer than a check in the mail, and it’s also faster, whether using Same Day ACH or standard.”

ACH Network overall third quarter volume was 8.8 billion payments valued at $23.2 trillion, increases of 5.2% and 8.2% respectively from a year earlier. Through the third quarter, Same Day ACH volume is up 9.2% for the year, and the value of those payments has increased 16.7%. September’s Same Day ACH volume was more than 120 million payments, the highest monthly volume in 2025 and an increase of over 20% compared to September 2024.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 33.6 billion ACH Network payments made in 2024, valued at $86.2 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org