Socure Launches Hosted Flows: Build Branded, Identity Verification Experiences in Days — No Code Required

Socure Launches Hosted Flows: Build Branded, Identity Verification Experiences in Days — No Code Required

The new offering delivers branded verification and customizable front-end flows that enable speed-to-market, conversion optimization, little-to-no engineering lift, and the industry’s best performance

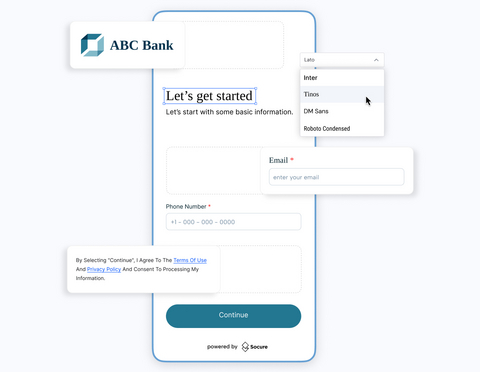

INCLINE VILLAGE, Nev.--(BUSINESS WIRE)--Socure, the leading provider of artificial intelligence for digital identity verification, authentication, KYC, KYB, sanctions screening, and fraud prevention in over 190 countries, today announced the launch of Hosted Flows, a no-code solution that reimagines how organizations rapidly build, deploy, and optimize end user experiences for identity verification and fraud detection.

Hosted Flows eliminates the engineering and UX effort required to design, test, and maintain verification experiences. Product, risk, and compliance teams can now create intelligent, adaptive onboarding flows with drag-and-drop simplicity, complete with conditional logic, global branding controls, built-in accessibility, and dynamic risk orchestration powered by Socure’s Identity Graph.

“Every company wants a secure, branded, and seamless verification experience—but building it from scratch is slow, expensive, and hard to maintain,” said Johnny Ayers, Founder and CEO of Socure. “Hosted Flows from RiskOS™ empowers product teams to design and deploy enterprise-grade onboarding experiences in minutes, backed by Socure’s best-in-class fraud and risk platform. It’s everything customers expect from Socure, just faster, simpler, and entirely customizable.”

Enterprises can use Hosted Flows to accelerate product launches, pilot programs, or market expansions without re-architecting their verification stack. The platform’s built-in theming and page builder ensure brand consistency across sub-brands and partner experiences, while its low-lift API integration and redirect architecture allow rapid deployment and global scalability.

The platform includes:

-

Design — No-Code Page & Theme Builder

Drag-and-drop interface for customizing layouts, input fields, and validation logic without engineering effort.

-

Deploy — Pre-Built Templates & RiskOS™ Integration

Templates for onboarding, DocV, and industry-specific flows accelerate deployment, all powered by Socure’s 400+ integrated data services.

-

Optimize — Real-Time Analytics & A/B Testing

Centralized analytics and live flow testing allow teams to monitor completion rates, detect drop-offs, and fine-tune conversion and fraud performance.

-

Scale — Global Branding & Step-Up Logic

Consistent brand experiences across devices and regions, with risk-based triggers that automatically initiate higher-friction steps such as OTP or DocV only when needed.

By dramatically reducing development cycles and enabling continuous iteration, Hosted Flows allows teams to focus on growth, not plumbing. Early adopters are seeing deployment timelines drop from months to hours, with measurable improvements in verification completion rates and fraud capture accuracy.

About Socure

Socure is the leading provider of AI-powered digital identity verification and fraud prevention solutions, trusted by the largest enterprises and government agencies to build trust and mitigate risk throughout the customer lifecycle. Leveraging AI and machine learning extensively, Socure's industry-leading platform achieves the highest accuracy, automation, and capture rates in the world.

Serving more than 2,800 customers across financial services, government, gaming, marketplaces, healthcare, telecom, and e-commerce, Socure's customer base includes 18 of the top 20 banks, the largest HR payroll providers, the largest sportsbook operators, 28 state agencies, four federal agencies, and more than 500 fintechs. Leading organizations including Capital One, Citi, Chime, SoFi, Green Dot, Robinhood, Dave, Gusto, Poshmark, Uber, DraftKings, PrizePicks, the State of California, and many more trust Socure to deliver certainty in identity across onboarding, authentication, payments, account changes, and regulatory compliance.

Contacts

NextTech Communications

Ella Ceron

SocurePR@NextTechComms.com