-

Azelis Delivers 11% Free Cash Flow Growth in H1 2025

Azelis Delivers 11% Free Cash Flow Growth in H1 2025

Share

ANTWERP, Belgium--(BUSINESS WIRE)--Azelis (Brussels:AZE):

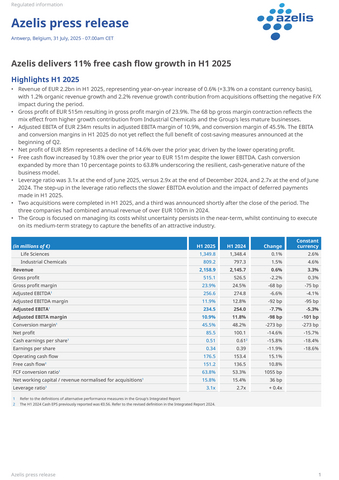

Highlights H1 2025

- Revenue of EUR 2.2bn in H1 2025, representing year-on-year increase of 0.6% (+3.3% on a constant currency basis), with 1.2% organic revenue growth and 2.2% revenue growth contribution from acquisitions offsetting the negative F/X impact during the period.

- Gross profit of EUR 515m resulting in gross profit margin of 23.9%. The 68 bp gross margin contraction reflects the mix effect from higher growth contribution from Industrial Chemicals and the Group's less mature businesses.

- Adjusted EBITA of EUR 234m results in adjusted EBITA margin of 10.9%, and conversion margin of 45.5%. The EBITA and conversion margins do not yet reflect the full benefit of cost savings measures announced at the beginning of Q2.

- Net profit of EUR 85m represents a decline of 14.6% over the prior year, driven by the lower operating profit.

- Free cash flow increased by 10.8% over the prior year to EUR 151m despite the lower EBITDA. Cash conversion expanded by more than 10 percentage points to 63.8% underscoring the resilient, cash-generative nature of the business model.

- Two acquisitions were completed in H1 2025, and a third was announced shortly after the close of the period. The three companies had combined annual revenue of over EUR 100m in 2024.

- The Group is focused on managing its costs whilst uncertainty persists in the near-term, whilst continuing to execute on its medium-term strategy to capture the benefits of an attractive industry.

Comment from Anna Bertona, Group CEO: "Our results in H1 2025 reflect the resilience of our business model and the dedication of our teams, allowing us to navigate short-term volatility whilst continuing to position Azelis as the industry reference in our focus end markets.

Despite the impact of the growing trade and geopolitical uncertainty around the world, we remain confident that we have the right strategy to ensure that we capture the opportunities created by the volatility in the industry and emerge stronger than before.”

Contacts

Azelis Investor Relations

T: +32 3 613 01 27

E: investor-relations@azelis.com

More News From Azelis

Full-Year 2025 Results: Azelis Delivers Strong Cash Flow Growth in Challenging Markets

ANTWERP, Belgium--(BUSINESS WIRE)--Regulatory News: Azelis (Brussels:AZE): Highlights full year 2025 Revenue of EUR 4.1bn in 2025, representing year-on-year growth of 1.3% in constant currency (-2.4% on a reported basis). In Q4, the Group achieved a revenue of EUR 937m, a decline of 1.3% in constant currency, driven by organic contraction of 4.9%, mitigated by revenue growth contribution of 3.6% from recent acquisitions. Gross profit of EUR 968m achieved for the year, translating to gross profi...

Azelis Group NV: Transparency Notification from First Pacific Advisors, LP.

ANTWERP, Belgium--(BUSINESS WIRE)--Regulatory News: In accordance with Article 14 of the Belgian Transparency law of May 2, 2007, Azelis Group NV (Brussels:AZE) announces that it has received a transparency notification from First Pacific Advisors, LP. 1. Summary of the notification First Pacific Advisors, LP reported in its notification dated 22 December 2025, that on 16 December 2025, following a disposal of voting securities, First Pacific Advisors, LP decreased its participation and downwar...

Azelis: Transparency Notification From UBS Group AG

ANTWERP, Belgium--(BUSINESS WIRE)--Regulatory News: In accordance with Article 14 of the Belgian Transparency law of 2 May 2007, Azelis Group NV (Brussels:AZE) announces that on 25 November 2025, it has received a transparency notification from UBS Group AG. 1. Summary of the notification UBS Group AG reported in its notification dated 25 November 2025, that on 19 November 2025, following a disposal of equivalent financial instruments, UBS Switzerland AG, one of the affiliates of UBS Group AG,...