FundingShield Q2 2025 Wire Fraud Risk Report Showing Nearly Half of Transactions at Risk

FundingShield Q2 2025 Wire Fraud Risk Report Showing Nearly Half of Transactions at Risk

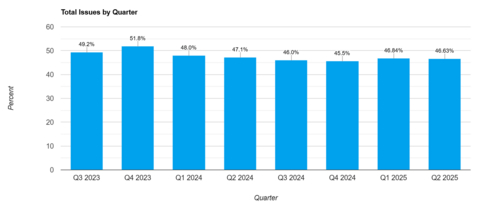

NEWPORT BEACH, Calif.--(BUSINESS WIRE)--During Q2 2025, nearly 46.63% of transactions within an approximately $81 billion portfolio—spanning residential, commercial, and business-purpose loans—were flagged for issues that posed a significant risk of wire and title fraud. On average, each problematic loan exhibited 2.2 issues, highlighting a troubling trend: existing controls by closing agents and lenders are proving insufficient to consistently detect and resolve these vulnerabilities before closing.

“As fraud risks and regulatory expectations grow, we must strengthen controls around data accuracy, third-party oversight, and transaction integrity. These needs are reflected in FHFA guidance, GSE selling guides & MORA Audits, and compliance standards."

Share

The mortgage and settlement services industry continued to face heightened scrutiny around fraud prevention, data integrity, and closing process controls. FundingShield proactively identifies and blocks risks before funds are ever transferred, thus how we are able to report these metrics. This approach is key to preventing wire fraud by ensuring that only verified, authorized parties are involved in the disbursement process and allows our solutions to be utilized by Banks, Credit Unions, Law firms, Disbursement Agents, Warehouse Lenders, Non-QM lenders, Private credit funds, PE Firms and direct lenders among others involved in US real estate and finance.

Q2 2025 saw consistent elevated levels for CPL validation related errors (9.4% of transactions) for critical data points such as borrower information, vesting / vested parties, non-borrowing parties on title, property addresses, borrower information and more. This is another example of a lack of accuracy between lender and title systems alongside the CPL issues that are at 44.43% of transactions.

There were wire related errors at 8.57% of transactions in Q2, the 7th straight quarter with over 8% for this category. License issues remained at elevated levels of 5.1% from Q1 2025 to Q2 2025 due to entities having lapsed, terminated, or suspended licenses and inconsistent data when verified with registrars, insurance regulators and licensing bodies. These persistently high levels, combined with the CPL Validation and key data element mismatch, highlight the need for source data verification in workflows and for trusted data sets being used as part of critical processes.

Quarter-over-Quarter Comparison (Q2 2025 vs. Q1 2025)

- License Issues: 5.11%

- Wire Instruction Issues: 1.97%

- Insurance Issues: 103.81%

Key Observations

Recent initiatives by federal regulators and housing finance authorities have reinforced the importance of proactive fraud detection and data integrity:

- Fannie Mae, in collaboration with Palantir, has launched advanced analytics programs to detect fraud and anomalies in loan data, reflecting a broader shift toward real-time risk monitoring. FundingShield issued a press release discussing our alignment with the FHFA’s stated goal of reducing fraud in the mortgage market.

- The FHFA has emphasized the need for stronger controls in the closing process, particularly in light of increased fraud activity in both residential and multifamily lending.

- These efforts align with existing compliance requirements under the Dodd-Frank Act, CFPB service provider oversight rules, and GSE seller/servicer guidelines, all of which require lenders to ensure that third-party service providers are vetted and monitored. FundingShield has been cited in many recent MORA Audits done by Fannie Mae on their sellers seeking validation of transaction level and controls of closing agent data, licensing, good standing and enforceability of claims should the need arise.

These trends underscore the need for source data verification and the use of trusted, independently validated datasets in closing workflows. Without these controls, lenders face increased exposure to fraud, compliance violations, and post-closing recovery challenges. CPL validation is an example of a way that supports these mandates by providing a verifiable control that confirms the legitimacy of the closing process and the parties involved.

Conclusion

As fraud risks and regulatory expectations grow, the mortgage industry must strengthen controls around data accuracy, third-party oversight, and transaction integrity. These needs are reflected in FHFA guidance, GSE selling guides, and federal compliance standards.

FundingShield supports these efforts by providing real-time validation of closing agents, licensing, insurance, and transaction data—helping institutions meet regulatory requirements, reduce fraud exposure, and improve loan quality through trusted, independently verified data.

Contacts

Media Inquiries

FundingShield LLC

+1 949-706-7888

info@fundingshield.com