Omdia: Global TV Shipments Grow 2.4% in 1Q25 Despite Tariff Concerns

Omdia: Global TV Shipments Grow 2.4% in 1Q25 Despite Tariff Concerns

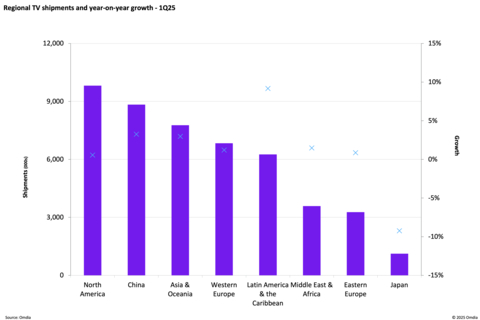

LONDON--(BUSINESS WIRE)--New analysis from Omdia’s quarterly TV sets market tracker reveals steady growth in 1Q25, defying concerns over tariff-related disruptions, with global shipments rising 2.4% year-on-year. Stable demand from Western Europe and North America combined with government incentives in China helped offset softer conditions in Japan.

According to Omdia’s latest TV Sets (Emerging Technologies) Market Tracker: History – 1Q25, global TV shipments reached 47.5 million in the first quarter of 2025, up from 46.4 million the previous year. This growth is notable given ongoing uncertainty around potential US tariff implementations.

“The North American market was subdued in the first quarter of 2025, but remained in positive territory, with 0.6% year-on-year growth, explains Matthew Rubin, Principal Analyst, TV Set Research, Omdia. “This aligns with historical patterns, where US TV demand tends to remain resilient during economic shocks, as TVs are considered essential home entertainment, even when other discretionary spending declines.”

In the short-to-medium term, Omdia does not expect there to be a considerable impact on US TV demand from tariffs. Healthy inventory levels and the presence of assembly operations in Mexico - which benefits from a 0% TV import tariffs - are helping brands mitigate potential risks.

Additionally, several factors will offset the potential negative impacts on the US market over the long term:

- Consumers who typically purchased TVs shipped directly from China continue to have ample choice, by switching to alternative brands or screen sizes.

- Major brands and OEMs maintain significant assembly capacity in Mexico, where tariffs remain at 0%. This not only benefits the larger players but also creates opportunities for smaller brands to capitalize on the favorable trade environment.

- The US government appears to be adopting a more moderate stance on tariffs, with most global tariffs now in the 10-15% range, making assembly in countries like Vietnam viable again. Prospects of a trade agreement with China also highlight decreasing volatility.

“However, these combined factors may yet result in changes to screen size dynamics and brand market shares, depending on capacity restraints, shipping costs, and strategic decisions made over the coming months,” said Rubin.

In China, the government’s ‘Swap Old for New’ stimulus program continues to boost domestic demand, contributing to 3.3% year-on-year growth in 1Q25. However, this initiative is set to expire later this year and is effectively pulling forward future demand. Similarly, the 9.2% year-on-year growth in Latin America & the Caribbean is primarily due to short term measures. Brands have been accelerating higher shipment levels to the region in anticipation of possible US trade disruptions, rather than in response to strong local demand.

Japan was the only region to see a fall in shipments, down 9.2% year-on-year. A notable drop in interest for OLED TVs has significantly impacted the market, with OLED shipments falling over 50% year-on-year. Weaker consumer confidence has suppressed the demand for premium technologies, a sharp contrast to Western Europe, where OLED shipments grew 18% year-on-year despite similar macro-economic challenges. Globally, OLED shipments increased 11%, marking the fourth consecutive quarter of growth.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Media Contact: Fasiha Khan

fasiha.khan@omdia.com