Central Asia's Venture Capital Market Reaches $95 Million in 2024

Central Asia's Venture Capital Market Reaches $95 Million in 2024

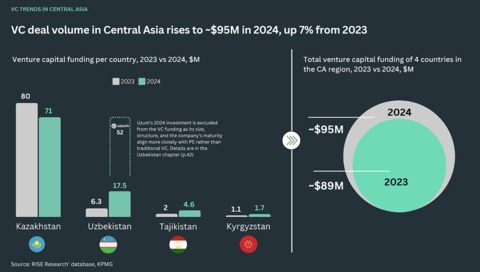

ALMATY, Kazakhstan--(BUSINESS WIRE)--Research by RISE Research, EA Group, MA7 Ventures, BGlobal Ventures, KPMG, and Dealroom.co shows Central Asia's venture capital market grew 7% to $95 million in 2024. The region now hosts over 1,800 startups and more than 100 active investors, representing significant ecosystem growth over the past five years.

Kazakhstan leads with 74% of regional investments, attracting $71 million in 2024 for a total startup valuation of $710 million. Deal sizes grew significantly, with 40% ranging from $200,000-$500,000, compared to 62% under $200,000 in 2021. Foreign investors contributed 53% of funding, coming from the USA, UAE, UK, Saudi Arabia, Singapore, Azerbaijan, Turkey, Estonia, and others. Twelve Kazakhstani venture funds hold $157 million collectively, with 32% already invested and 44% raised from high-net-worth individuals.

Uzbekistan's market grew 2.7 times to $17.5 million across 38 deals, with average deal size quadrupling to $460,000. Local investors provided 52% of funding, while international investment decreased by 11% compared to 2023. Five new venture funds launching in Q1 2025 signal increasing activity, though the market remains focused on early-stage investments.

Kyrgyzstan attracted $1.7 million with 19% annual growth since 2022. Women-founded startups were prominent, accounting for one-third of deals but two-thirds of investment volume. While accelerators and hubs made the most deals (50%), venture funds (mostly foreign) provided 66% of capital, highlighting the importance of international connections.

Tajikistan reached $4.6 million in venture financing, focusing on halal fintech and AI credit scoring models, supported by tax incentives for startups in IT Park Dushanbe and a new $5 million fund. This represents the country's first significant steps in developing venture investment infrastructure.

Leading sectors across the region include AI, fintech, educational and medical technologies. However, later-stage funding remains scarce, pushing startups toward international markets. Currently, Central Asian founders have established 200+ startups in the USA, 50+ in the UK, and 20+ in the UAE.

Analysts predict continued growth and integration into the global ecosystem in coming years.

The study is available at the following link.

Contacts

Press Contacts:

Jeanna Skripal

skripal@itcomms.io