NRG to Acquire 738 MW of Natural Gas Generation in Texas

NRG to Acquire 738 MW of Natural Gas Generation in Texas

Expanding Flexible and Dispatchable Fleet to Meet Growing Energy Demand

The 738 MW portfolio is currently ~50% hedged through 2028. Using the steady-state power price assumptions embedded in our 2025 guidance and 5-year outlook (~$47/MWh ATC) the portfolio implies an annual Adj EBITDA of ~$50-60 MM through 2028. The corresponding ‘100% Open’ or unhedged position implies an annual Adj EBITDA of ~$70-80 MM. The portfolio has upward sensitivity to power prices and capacity factors. It will not be included in guidance until closing. (Graphic: Business Wire)

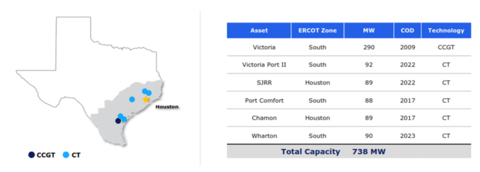

HOUSTON--(BUSINESS WIRE)--NRG Energy Inc. (NYSE:NRG) has entered into a definitive agreement to acquire six power generation facilities from Texas-based Rockland Capital, LLC, adding 738 Megawatts (MW) of modern, flexible natural gas-fired capacity to its portfolio. The acquisition includes one combined-cycle unit and five peaker units, further strengthening NRG’s position in the rapidly growing market.

NRG is acquiring these assets for $560 MM or $760 per kW, significantly below the cost of new construction. The acquisition is earnings-accretive and will be primarily funded through corporate debt, with no impact on the Company's stated capital allocation plan.

“This acquisition reinforces our position as a leading generator in Texas,” said Robert J. Gaudette, Executive Vice President, President of NRG Business and Wholesale Operations. “Expanding our natural gas generation portfolio with modern, flexible assets enhances our integrated platform as Texas experiences record electricity growth driven by electrification, onshoring, population growth, and data centers – creating long-term value for our shareholders.”

The acquisition is subject to Hart-Scott-Rodino (HSR) regulatory approval and is expected to close in the second quarter of 2025.

About NRG

NRG Energy Inc. is a leading energy and home services company powered by people and our passion for a smarter, cleaner, and more connected future. A Fortune 500 company operating in the United States and Canada, NRG delivers innovative solutions that help people, organizations, and businesses achieve their goals while also advocating for competitive energy markets and customer choice. More information is available at www.nrg.com. Connect with NRG on Facebook, Instagram, LinkedIn and X.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to certain risks, uncertainties and assumptions and typically can be identified by the use of words such as “may,” “should,” “could,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “expect,” “intend,” “seek,” “plan,” “think,” “anticipate,” “estimate,” “predict,” “target,” “potential” or “continue” or the negative of these terms or other comparable terminology. Although NRG believes that the expectations are reasonable, it can give no assurance that these expectations will prove to be correct, and actual results may vary materially.

NRG undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Factors that could cause actual results to differ materially from those contemplated herein include, among others, general economic conditions; hazards customary in the power industry; the inability to execute NRG’s strategies, initiatives, or partnerships; the failure of NRG’s expectations regarding load growth to materialize; legislative and regulatory changes; and the other risks and uncertainties detailed in NRG’s most recent Forms 10-K, 10-Q and 8-K filed with or furnished to the SEC at www.sec.gov.

Contacts

Media:

NRG: Erik Linden 609.524.4519 erik.linden@nrg.com

Investors:

NRG: Brendan Mulhern 609.524.4767 investor.relations@nrg.com