Omdia: OLED Display Shipments Surpass TFT LCD for the First Time, Capturing 51% Market Share in 2024

Omdia: OLED Display Shipments Surpass TFT LCD for the First Time, Capturing 51% Market Share in 2024

LONDON--(BUSINESS WIRE)--AMOLED display shipments for smartphones continued to rise in 2024, surpassing TFT LCD shipments and driven by strong demand for flexible AMOLEDs, according to Omdia’s latest OLED Display Market Tracker.

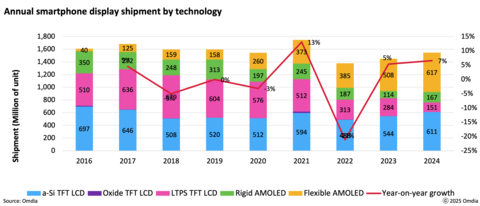

The global smartphone display market grew 7% year-over-year (YoY) in 2024, reaching 1.55 billion units, marking its second consecutive year of growth. Total AMOLED display shipments roses to 784 million units, a 26% YoY increase, while TFT LCD shipments declined to 761 million units, an 8% YoY decrease. As result, AMOLED display shipments surpassed TFT LCD shipments for the first time, accounting for 51% of total smartphone display shipments in 2024.

Since the second half of 2022, Chinese display makers have significantly reduced the prices of flexible AMOLED panels. since This has led to major smartphone OEMs to upgrade mid-range smartphone screens, which traditionally use rigid AMLED and LTPS TFT LCD panels, to flexible AMOLEDs. This display replacement trend has continued in 2024, driving flexible AMOLED’s market share up from 28% of the total smartphone display market in 2022 to 40% in 2024.

Chinese display makers' AMOLED display shipments increased by 45% YoY in 2024, compared to 2023 enabled by the rapid market expansion of Chinese local smartphone OEMs. As a result, their AMOLED display shipment share continued to rise reaching 45% of total AMOLED smartphone display shipments. Meanwhile, Korean display makers' shipment saw their. Market share continue decline. Instead, they focused on the premium segment supplyin Apple and Samsung which offer more stable demand and higher-margin products.

According to Brian Huh, Senior Analyst in Omdia’s Display research practice, “AMOLED display shipments for smartphones are expected to continue growing in 2025 due to strong demand from Apple including the launch of the new iPhone SE launch, as well as ongoing AMOELD adoption by Android OEMs replacing TFT LCDs. Additionally, Chinese display makers are expected to further increase their market share, leveraging their strong supply chain relationships with local smartphone brands.”

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Fasiha Khan: Fasiha.khan@omdia.com