ShareBuilder 401k is Waiving 401(k) Plan Setup Costs for Small Business and the Self-Employed

ShareBuilder 401k is Waiving 401(k) Plan Setup Costs for Small Business and the Self-Employed

ShareBuilder 401k wants businesses of all sizes to have the opportunity to save for retirement

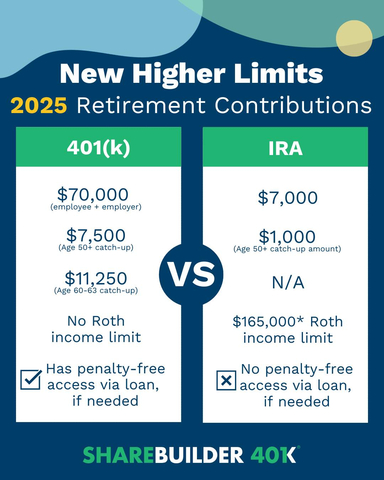

Starting in 2025, the IRS has introduced a special increased 401(k) contribution limit to enhance your retirement savings. Dubbed by the media as the “super catch-up", this new rule allows you to add substantially more to your 401(k), ensuring you have the funds you need for a comfortable retirement. (Graphic: Business Wire)

SEATTLE--(BUSINESS WIRE)--ShareBuilder 401k, a leading provider of affordable, all-ETF 401(k) plans for small businesses and medium-sized companies, today announced that all setup costs for small business and solo 401(k) plans are being waived through December 23, 2024. Companies of any size with more than one employee can open a 401(k) and experience savings of up to $995 in setup costs, and self-employed and owner-only shops with no employees can open a Solo 401(k) and save up to $150 through the promotion.

"We have heard repeatedly from small business owners as well as sole proprietors that they don't think they are either big enough to qualify to offer a 401(k) plan. It’s a big misperception in the marketplace, as any size business can offer a 401(k), even the self-employed. A big goal of ours is to show that any business, regardless of size, can open a very affordable retirement plan for themselves and employees and build for a comfortable retirement while saving on taxes too,” said Stuart Robertson, CEO of ShareBuilder 401K.

A recent survey from ShareBuilder 401k identified that 55% of small business owners believe their business is too small to access a plan or cannot afford to offer a company match (28%). Additionally, 22% of owners believe providing a 401(k) plan is too expensive. However, providers like ShareBuilder 401k have developed low-cost, high service retirement plans catering to small businesses' needs. Coupled with the Secure Act 2.0, which was enacted to provide significant tax incentives for small businesses with employees, offering 401(k) plans can be nearly cost-neutral for the first three years of the plan, helping provide a more secure and affordable option for businesses.

In 2025, Small Business 401(k) participant contribution limits will increase to $23,500. Total 401(k) contribution limits (employer contributions plus employee contributions) will increase to 70,000 ($77,500 if you're 50 years of age to 59, $81,250 for ages 60 to 63). For the self-employed, a Solo 401(k) plan must be purchased and set up before year-end if their business structure is a corporation, partnership, or multi-member LLC. Then, plan owners will have until their tax deadline to make contributions for 2024 by April 15, 2025. Sole proprietors and single-member LLCs have until their tax deadline to open a plan that can qualify for 2024 to help lower taxes.

ShareBuilder 401k offers a range of plans tailored to meet the needs of different-sized businesses, focusing on low costs, easy-to-use technology, and exceptional customer service. To learn more and to sign up for a 401(k) with no setup fees, visit www.sharebuilder401k.com

About ShareBuilder 401k

ShareBuilder 401k is a leading digital 401(k) provider specializing in low-cost, all-ETF retirement products and resources for small- to mid-sized companies, including owner-only businesses. Founded in 2005, and now serving more than 6,500 businesses across the US, ShareBuilder 401k is a pioneer of the index-based 401(k), digital quoting and purchasing of retirement plans, and providing investment management (ERISA 3(38)) services for every client’s fund roster. ShareBuilder 401k is committed to expanding access to retirement plans and leading more Americans to save through cutting-edge technology, low costs and quality education and support.

Contacts

Patrick Mendoza, mendozap@aristoscomms.com