Milliman Retiree Health Cost Index: A 65-year-old couple needs $395,000 in savings for healthcare in retirement

Milliman Retiree Health Cost Index: A 65-year-old couple needs $395,000 in savings for healthcare in retirement

SEATTLE--(BUSINESS WIRE)--Milliman, Inc., a premier global consulting and actuarial firm, recently released its 2024 Retiree Health Cost Index which projects how much money, on average, a healthy 65-year-old can expect to spend on healthcare costs in retirement. The index explains how factors like when a person retires, where a person lives, and which coverage a person chooses will impact the total cost of premiums and out-of-pocket expenses.

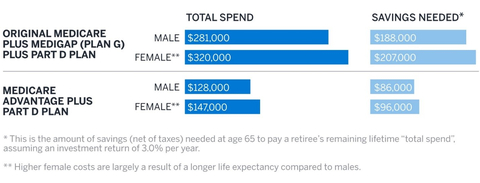

The two most common healthcare coverage options chosen by Medicare-eligible retirees are Medicare Advantage Part D (MAPD) and Original Medicare with Medigap plus Part D. A healthy 65-year-old male retiring in 2024 with an MAPD plan is projected to spend $128,000 on healthcare in his remaining lifetime. A female with the same coverage is projected to spend $147,000 in her remaining lifetime. The difference in cost is largely because women on average live longer than men.

Under Original Medicare with Medigap plus Part D instead, these projections increase to $281,000 for a male and $320,000 for a female, or a combined total of $601,000 for a 65-year-old couple. In today’s dollars (assuming a 3% investment return), this reflects $395,000 in savings needed.

In 2024, Medicare Advantage costs decreased about 4% and Medigap costs increased about 2% when compared to 2023. The largest drivers of these changes include:

- Increased drug spending, including weight-loss and diabetes drugs such as Ozempic and Jardiance

- Higher Medicare Part B premiums

- Lower MAPD premiums and out-of-pocket costs

- The Inflation Reduction Act, which required changes to Medicare Part D

"Healthcare expenses are an important and sometimes overlooked component of retirement planning," said Robert Schmidt, a Milliman principal and co-author of the Retiree Health Cost Index. "By taking a realistic look at their health status and healthcare expenses, and then budgeting accordingly, people can take steps to enjoy a less stressful, financially healthier retirement.”

To view the complete Retiree Health Cost Index, visit https://www.milliman.com/retireehealthcosts.

About Milliman

Milliman is among the world's largest providers of actuarial, risk management, and technology solutions. Our consulting and advanced analytics capabilities encompass healthcare, property & casualty insurance, life insurance and financial services, and employee benefits. Founded in 1947, Milliman is an independent firm with offices in major cities around the globe. Visit us at milliman.com.

Contacts

Robert Schmidt

Milliman, Inc.

Tel: 1 208 342 3487

Email: Robert.Schmidt@milliman.com