Energy Transfer and Sunoco Announce Strategic Permian Basin Crude Oil Joint Venture

Energy Transfer and Sunoco Announce Strategic Permian Basin Crude Oil Joint Venture

DALLAS--(BUSINESS WIRE)--Energy Transfer LP (NYSE: ET) (“Energy Transfer”) and Sunoco LP (NYSE: SUN) (“Sunoco”) today announced the formation of a joint venture combining their respective crude oil and produced water gathering assets in the Permian Basin.

Energy Transfer will serve as the operator of the joint venture and contribute its Permian crude oil and produced water gathering assets and operations. Sunoco will contribute all of its Permian crude oil gathering assets and operations to the joint venture. Energy Transfer’s long-haul crude pipeline network that provides transportation of crude oil out of the Permian Basin to Nederland, Houston, and Cushing is excluded from the joint venture.

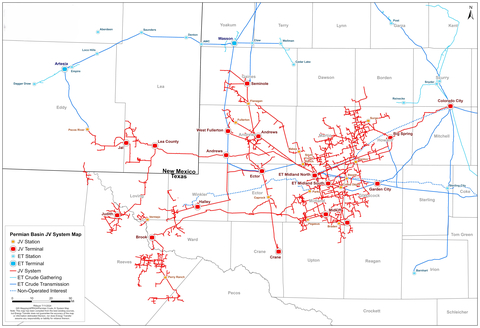

As depicted in the included map, the joint venture will operate more than 5,000 miles of crude oil and water gathering pipelines with crude oil storage capacity in excess of 11 million barrels.

Energy Transfer will hold a 67.5% interest in the joint venture with Sunoco holding a 32.5% interest.

The formation of the joint venture has an effective date of July 1, 2024, and is expected to be immediately accretive to distributable cash flow per LP unit for both Energy Transfer and Sunoco.

Intrepid Partners, LLC served as financial advisor to Energy Transfer’s conflicts committee, while Guggenheim Securities, LLC served as financial advisor to Sunoco’s special committee. Potter Anderson & Corroon LLP acted as Delaware counsel for Energy Transfer’s conflicts committee, and Richards, Layton & Finger, P.A. acted as Delaware counsel for Sunoco’s special committee. Vinson & Elkins LLP and Akin Gump Strauss Hauer & Feld LLP also acted as legal counsel to the partnerships on the transaction.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with more than 130,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 44 states with assets in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and approximately 21% of the outstanding common units of Sunoco LP (NYSE: SUN), and the general partner interests and approximately 39% of the outstanding common units of USA Compression Partners, LP (NYSE: USAC). For more information, visit the Energy Transfer LP website at www.energytransfer.com.

About Sunoco LP

Sunoco LP (NYSE: SUN) is a leading energy infrastructure and fuel distribution master limited partnership operating in over 40 U.S. states, Puerto Rico, Europe, and Mexico. The Partnership’s midstream operations include an extensive network of approximately 14,000 miles of pipeline and over 100 terminals. This critical infrastructure complements the Partnership’s fuel distribution operations, which serve approximately 7,400 Sunoco and partner branded locations and additional independent dealers and commercial customers. SUN's general partner is owned by Energy Transfer LP (NYSE: ET).

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results are discussed in Energy Transfer’s and Sunoco’s Annual Reports on Forms 10-K and other documents filed from time to time with the Securities and Exchange Commission. Energy Transfer and Sunoco undertake no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on Energy Transfer’s website at www.energytransfer.com and Sunoco’s website at www.sunocolp.com.

Contacts

Energy Transfer

Investors:

Bill Baerg, Vice President – Investor Relations

Brent Ratliff, Vice President – Investor Relations

Lyndsay Hannah, Director – Investor Relations

(214) 840-0795, InvestorRelations@energytransfer.com

Media:

Vicki Granado – Vice President, Media & Communications

(214) 981-0761, vicki.granado@energytransfer.com

Sunoco LP

Investors:

Scott Grischow, Treasurer, Senior Vice President – Finance

(214) 840-5660, scott.grischow@sunoco.com

Media:

Chris Cho, Senior Manager – Communications

(210) 918-3953, chris.cho@sunoco.com